Airbnb (ABNB) Q3 Earnings Showdown: Options Traders Bet on a Wild 7.95% Move

Markets are bracing for turbulence as Airbnb's Q3 earnings loom—options pricing screams volatility ahead.

Will ABNB deliver or disappoint? The smart money's hedging for a nearly 8% swing either way.

Earnings season's favorite casino game is back—place your bets before the house reveals its hand.

Bonus jab: Another round of 'beat or miss' theater where Wall Street pretends short-term results matter more than rigged fundamentals.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street is expecting ABNB to report a Q3 earnings of $2.31 per share, compared with $2.13 in the same period last year. Also, analysts project revenues of $4.08 million, up from $3.73 million in the year-ago quarter.

Airbnb’s previous quarter also showed strong momentum, with revenue and earnings up 12.7% and 19.8%, respectively. The company also reported 134.4 million nights booked, up 7.4% year over year.

What to Watch in Today’s Report

At the upcoming earnings report, investors are looking for clues about Airbnb’s ability to navigate rising competition, regulatory challenges, and shifting consumer behavior. With the stock down about 8.5% year-to-date and lagging broader market indices, some investors are worried about whether the company can maintain its competitive edge.

In addition, key areas in focus today include gross booking value (GBV) trends, the number of nights and experiences booked, forward-looking guidance for Q4 and Fiscal 2025, and any updates on new product initiatives or geographic expansion.

These metrics will give insight into Airbnb’s growth strategy and its ability to adapt in a changing travel demand scenario.

Is Airbnb a Buy or Sell?

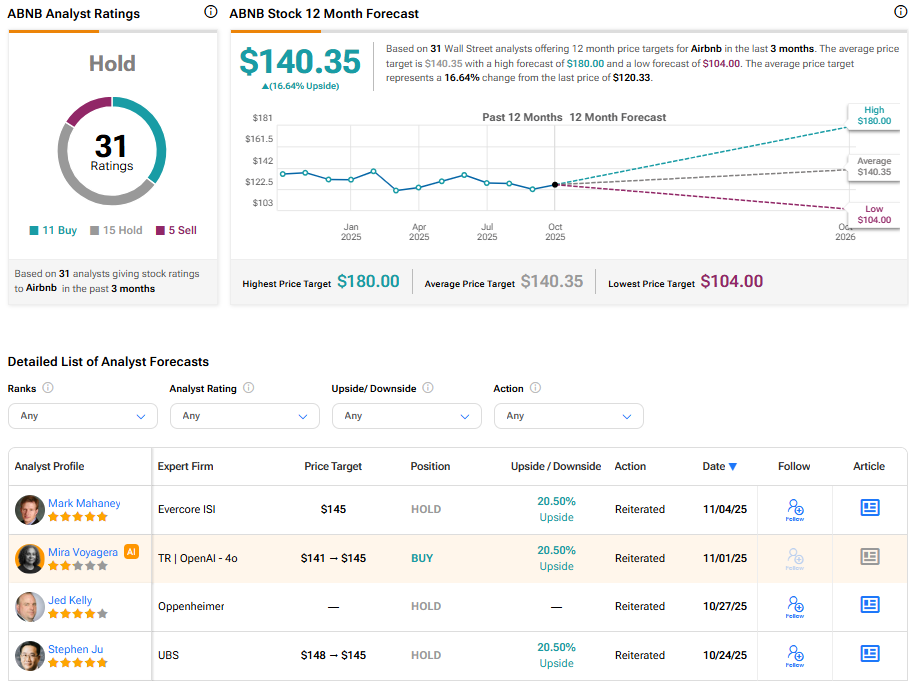

Turning to Wall Street, ABNB stock has a Hold consensus rating based on 11 Buys, 15 Holds, and five Sells assigned in the last three months. At $140.35, the average Airbnb stock price target implies a 16.64% upside potential.