Galaxy Digital’s Bitcoin Warning: The Market Reality Just Shifted Dramatically

Bitcoin's trajectory faces a fundamental rewrite as Galaxy Digital sounds the alarm on new market realities.

The Paradigm Shift

Traditional crypto assumptions get tossed out the window as institutional players signal changing dynamics. Market structures that worked for years suddenly look outdated—another reminder that in finance, yesterday's genius becomes tomorrow's cautionary tale.

New Rules, New Players

Galaxy's analysis suggests the old playbook needs burning. Regulatory pressures, institutional adoption patterns, and macroeconomic factors converge to create what they call a 'market reality rewrite.' The warning comes as no surprise to those watching the institutionalization of digital assets—though Wall Street still treats crypto like a rebellious teenager they're forced to fund.

Adapt or Get Left Behind

The message echoes across trading desks and mining operations: evolve or face extinction. Galaxy's stark assessment serves as both warning and roadmap for navigating what comes next. Because in crypto, the only constant is change—and the occasional reminder that traditional finance still doesn't get it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, a dividend ETF (Exchange-Traded Fund) is a fund that holds a basket of dividend-paying stocks and trades on an exchange like a regular stock.

TipRanks Makes Dividend Investing Easier

TipRanks provides a range of tools to help investors find and track dividend opportunities that fit their goals. The Best Dividend Stocks list highlights top dividend-paying companies along with key comparison metrics. Meanwhile, the Dividend Calendar makes it simple to track upcoming payouts, so investors can plan purchases in time to qualify for the next distribution.

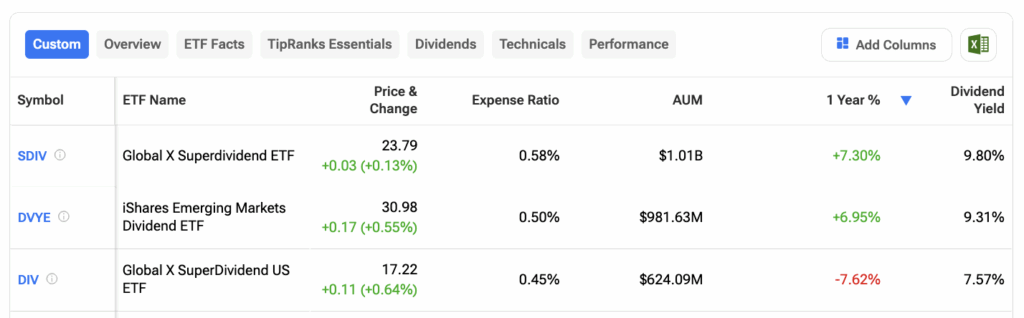

For those interested in ETFs, TipRanks also offers powerful comparison features. TipRanks’ ETF Comparison Tool lets investors compare funds across metrics such as AUM (assets under management), expense ratios, technicals, dividend analysis, etc.

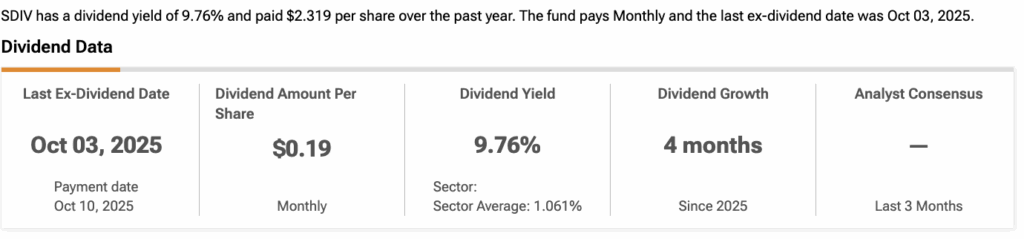

Global X Superdividend ETF (SDIV)

The Global X Superdividend ETF tracks the Stuttgart Solactive AG Global SuperDividend (USD) Index. SDIV aims to deliver strong income by investing in a diversified portfolio of some of the world’s highest-yielding stocks.

Meanwhile, SDIV pays a monthly dividend of $0.19 per share, reflecting a 9.76% yield, and carries an expense ratio of 0.58%. The ETF holds 100 stocks with total assets of $1.01 billion, with its top 10 holdings accounting for 16.91% of the portfolio.

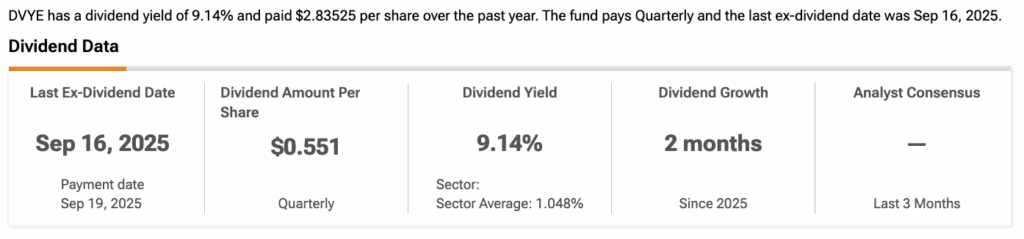

iShares Emerging Markets Dividend ETF (DVYE)

The iShares Emerging Markets Dividend ETF aims to track the Dow Jones Emerging Markets Select Dividend Index. This index follows a dividend-weighted methodology to select roughly 100 stocks from emerging markets. This focus on companies in emerging economies helps the fund deliver attractive dividend yields.

DVYE currently pays a quarterly dividend of $0.551 per share, leading to a 9.14% yield, while maintaining an expense ratio of 0.50%. Meanwhile, DVYE holds 96 stocks with $981.63 million in AUM.

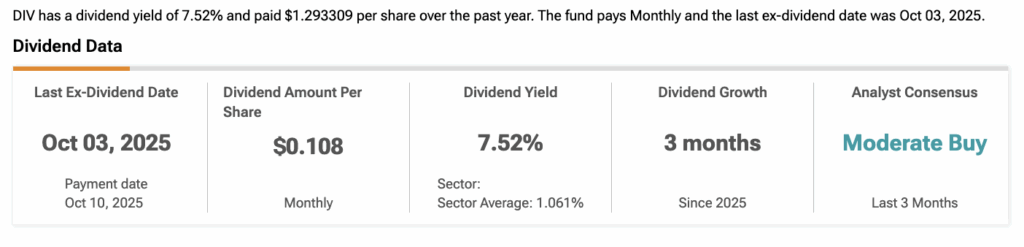

Global X SuperDividend US ETF (DIV)

The Global X SuperDividend US ETF is a solid option for investors seeking steady income from high-dividend U.S. stocks. By following the Indxx SuperDividend U.S. Low Volatility Index, DIV provides exposure to a diversified mix of high-yield, U.S.-based equities.

DIV pays a monthly dividend of $0.108 per share, reflecting a yield of 7.52%. Meanwhile, DIV has an expense ratio of 0.45%. In terms of holdings, it has a total of 51 holdings with total assets of $624.09 million.