Meta Axes 600 Superintelligence Lab Jobs - Tech Giant’s AI Ambitions Face Major Restructuring

Meta's artificial intelligence division takes massive hit as company cuts 600 positions from its superintelligence labs.

The Reality Check

While Zuckerberg's metaverse dreams keep burning cash, these cuts reveal where the real financial pressure points lie. The superintelligence team—once hailed as the future of AI—now joins the growing list of tech casualties.

Digital assets continue demonstrating their resilience while traditional tech giants struggle to maintain their innovation pace. Another reminder that in today's market, being 'too big to fail' just means you're too big to adapt quickly.

Wall Street analysts will probably call this 'strategic realignment'—because nothing says strategic like firing the people building your supposed competitive advantage.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The news follows Meta’s $27 billion financing deal with Blue Owl Capital (OWL), the biggest private funding agreement in the company’s history, which will be used to build Meta’s largest data center project yet. Interestingly, some analysts believe that the deal gives Meta the ability to pursue its large-scale AI goals while shifting much of the upfront cost and risk to outside investors. In return, Meta will maintain a smaller ownership stake in the project while reducing its financial burden.

It is also worth noting that Meta CEO Mark Zuckerberg has been investing heavily in AI this year, especially when it comes to attracting talent. Indeed, the firm has been offering compensation packages as high as $100 million in order to poach key employees from competitors after receiving poor feedback on its open-source Llama 4 model.

Is Meta a Buy, Sell, or Hold?

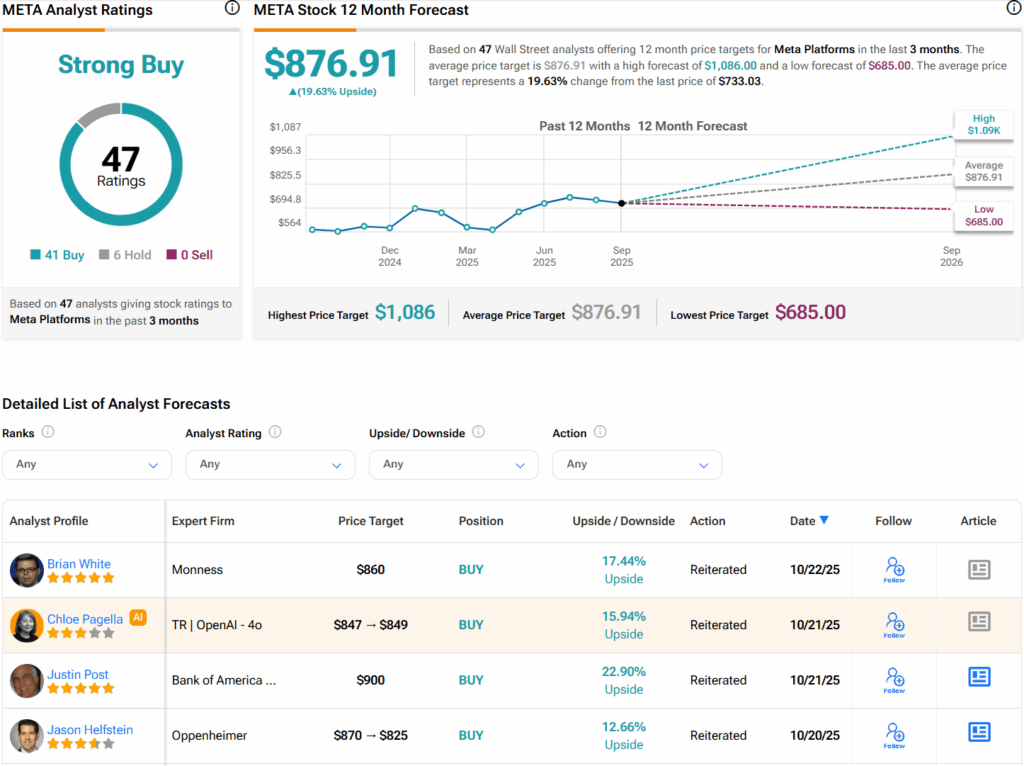

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 41 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $876.91 per share implies 19.6% upside potential.