FalconX Rewrites Crypto Fund Management Playbook with Strategic 21Shares Move

Institutional crypto just got a major upgrade as FalconX makes power play for 21Shares dominance.

The Infrastructure Revolution

Forget traditional finance's glacial pace—FalconX's latest maneuver positions them as the prime architect for institutional crypto exposure. They're building the plumbing while Wall Street still debates whether digital assets belong in portfolios.

Strategic Masterstroke or Desperate Gambit?

The 21Shares partnership represents more than just another business deal—it's a direct challenge to legacy financial institutions still treating crypto like a niche experiment. While traditional fund managers debate allocation percentages, FalconX is constructing the entire ecosystem.

Execution Over Theory

No more theoretical discussions about blockchain potential. This move puts real infrastructure behind crypto fund management, creating operational efficiency that makes traditional settlement systems look like medieval accounting.

The New Institutional Standard

FalconX isn't just participating in digital asset evolution—they're actively rewriting the rulebook while traditional finance remains obsessed with quarterly earnings calls and dividend adjustments.

Because nothing says financial innovation like watching hedge fund managers finally understand blockchain while missing the entire revolution.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street expects IBM to post $16.1 billion in revenue and $2.45 per share in adjusted earnings for the September quarter. Looking ahead, consensus calls for $19.2 billion in revenue and $4.33 EPS for the December period.

A clean beat and upbeat tone on recurring software growth could extend the rally. However, a miss or vague commentary might remind investors how quickly expectations can shift when sentiment runs hot.

Analysts Highlight Software and Red Hat Growth

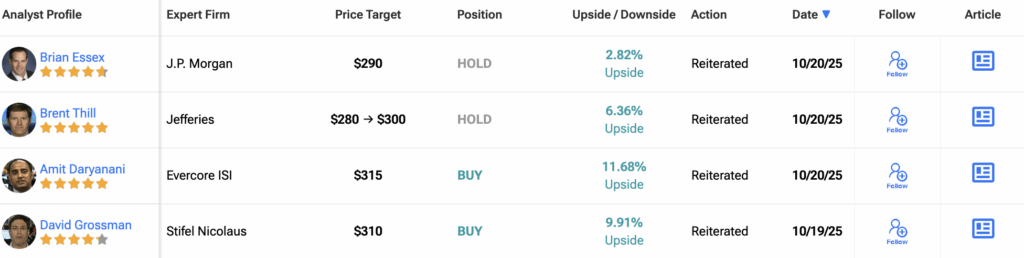

Jefferies analyst Brent Thill reaffirmed a Hold rating and lifted his price target to $300 from $280, citing software momentum and execution strength.

“While some of the software upside is priced in with the recent stock rally, we think IBM can grind higher if fundamentals strengthen in 2H,” Thill wrote.

IBM’s Red Hat business remains a key driver, powering hybrid cloud adoption through its OpenShift platform. Meanwhile, automation services are helping enterprise clients modernize workloads and improve efficiency.

If IBM offers solid data on customer retention and subscription growth, investors are likely to reward that transparency.

Guidance and Cash Flow Remain in Focus

IBM’s full-year outlook calls for at least 5% revenue growth in constant currency and over $13.5 billion in free cash flow. Investors will be looking for either a raise in guidance or confirmation that these targets remain firmly intact.

Additionally, strong cash generation continues to be IBM’s safety net. It allows management to fund buybacks, dividends, and targeted acquisitions that strengthen the software portfolio. Even steady guidance could reassure markets that IBM’s rally is grounded in fundamentals, not just enthusiasm.

What to Watch after the Print

After such a sharp rally, IBM’s valuation now demands proof. The key questions all point back to execution. Can software growth remain steady and broad-based? Are Red Hat and automation scaling fast enough to justify the premium investors are paying? And will improving mix and efficiency finally show up as operating leverage in 2026? A clean set of answers WOULD reinforce confidence that IBM’s turnaround is real and durable. But if progress looks uneven, the stock could pause while fundamentals catch up to expectations.

Is IBM a Good Stock to Buy?

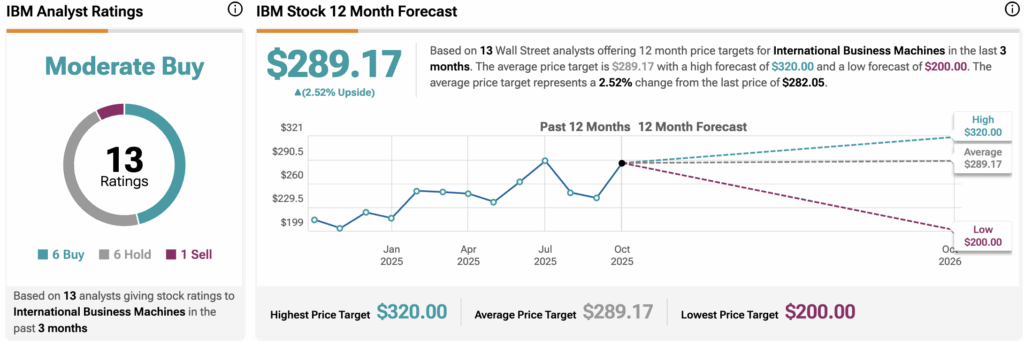

Currently, Wall Street maintains a Moderate Buy consensus on IBM stock, based on 13 analyst ratings over the past three months. The breakdown includes six Buy calls, six Holds, and one Sell recommendation.

The average 12-month IBM stock price target sits at $289.17, implying a modest 2.5% upside from current levels.