Gold’s Worst Day in 12 Years: Can Bitcoin Capitalize on the Precious Metal’s Collapse?

As gold tumbles to its lowest point in over a decade, Bitcoin stands poised to absorb the fleeing capital from traditional safe havens.

The Great Divergence

While gold experiences its most brutal sell-off since 2013, Bitcoin continues its steady ascent—proving digital assets aren't just speculative toys but legitimate alternatives to ancient stores of value.

Flight to Digital

Investors who once piled into gold during economic uncertainty now recognize Bitcoin's superior characteristics: borderless transactions, predictable issuance, and resistance to central bank manipulation that's been gold's Achilles heel.

The New Safe Haven

Gold's 12-year low isn't just a bad day—it's a symptom of outdated financial infrastructure meeting modern monetary reality. Meanwhile, Bitcoin's network grows stronger with each passing block.

When traditional hedges fail and central banks keep printing, maybe the real safe haven was the digital currency we built along the way—proving once again that in finance, sometimes the best insurance is disrupting the entire concept of insurance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company said the MOVE is part of its plan to simplify operations and cut costs as growth in the cable industry slows. In fact, other major players like Comcast (CMCSA) and Paramount (PARA) have also announced layoffs recently, as more viewers move away from traditional TV.

Subscriber Numbers Continue to Decline

Like other cable providers, Charter is losing customers as more people switch to streaming. In the last reported second quarter, broadband subscribers fell by 117,000 to 29.9 million. Meanwhile, video subscribers also dropped 5% to 12.6 million, down from 13.3 million a year ago.

Although the drop in customers has slowed, Charter still faces a tough market. More homes are giving up cable TV for cheaper streaming services, hurting its main source of income. At the same time, new internet providers are offering faster speeds and lower prices, making it harder for Charter to keep and win back customers.

Charter Looks to Expand Reach with Cox Deal

To tackle growing competition, Charter is preparing to buy Cox Cable for $21.9 billion. The deal will combine Charter’s 31.4 million customers with Cox’s 6.3 million, giving the company a stronger base to compete.

By joining forces, Charter aims to cut costs, strengthen its position with content providers, and expand its broadband and wireless services. However, the merger will also bring integration risks and upfront expenses.

Is Charter Communications Stock a Good Buy Right Now?

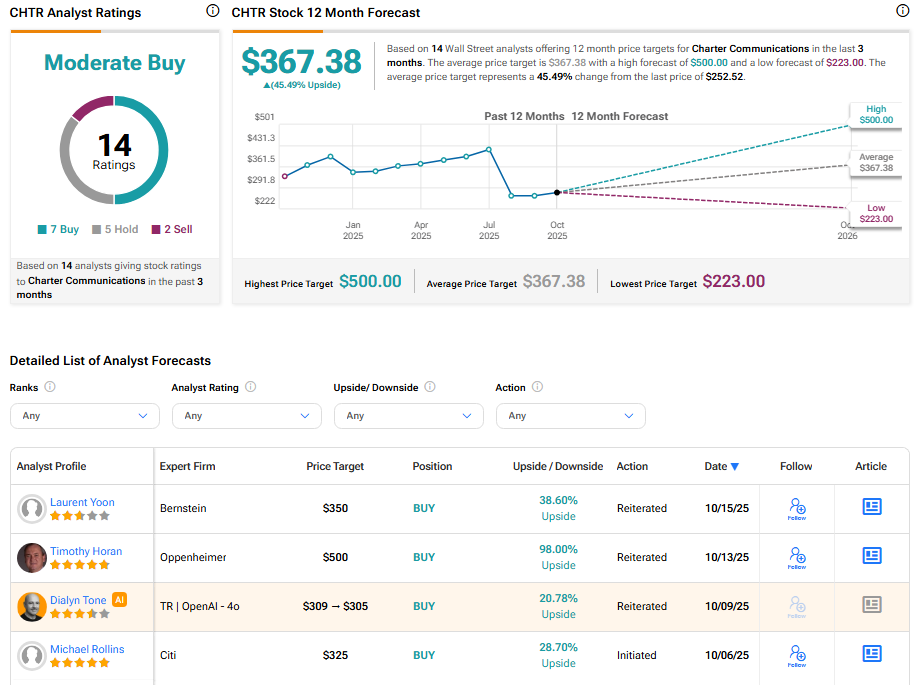

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Charter Communications stock based on seven Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 23.4% loss in its share price over the past year, the average CHTR price target of $367.38 per share implies 45.49% upside potential.