BNB Coin Price Alert: How Low Could It Drop? Poppe’s Critical Warning - Ethereum’s Fate in Next 1-2 Weeks Revealed

Crypto analyst Poppe sounds the alarm bells as BNB faces potential turbulence. The countdown begins for Ethereum's crucial 1-2 week window that could redefine market trajectories.

The Warning Signs

BNB's recent volatility has traders scrambling for cover. Poppe's analysis suggests we're entering make-or-break territory for the exchange token. Market sentiment shifts like Wall Street's conscience - conveniently when profits are at stake.

Ethereum's Critical Juncture

All eyes turn to ETH as we approach the decisive 1-2 week period. Will it break through resistance or succumb to selling pressure? The charts don't lie - but your crypto broker might.

Perfect storm or buying opportunity? Only time will tell if this is another dip to buy or the beginning of a longer correction. Remember: in crypto, today's panic often becomes tomorrow's FOMO.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

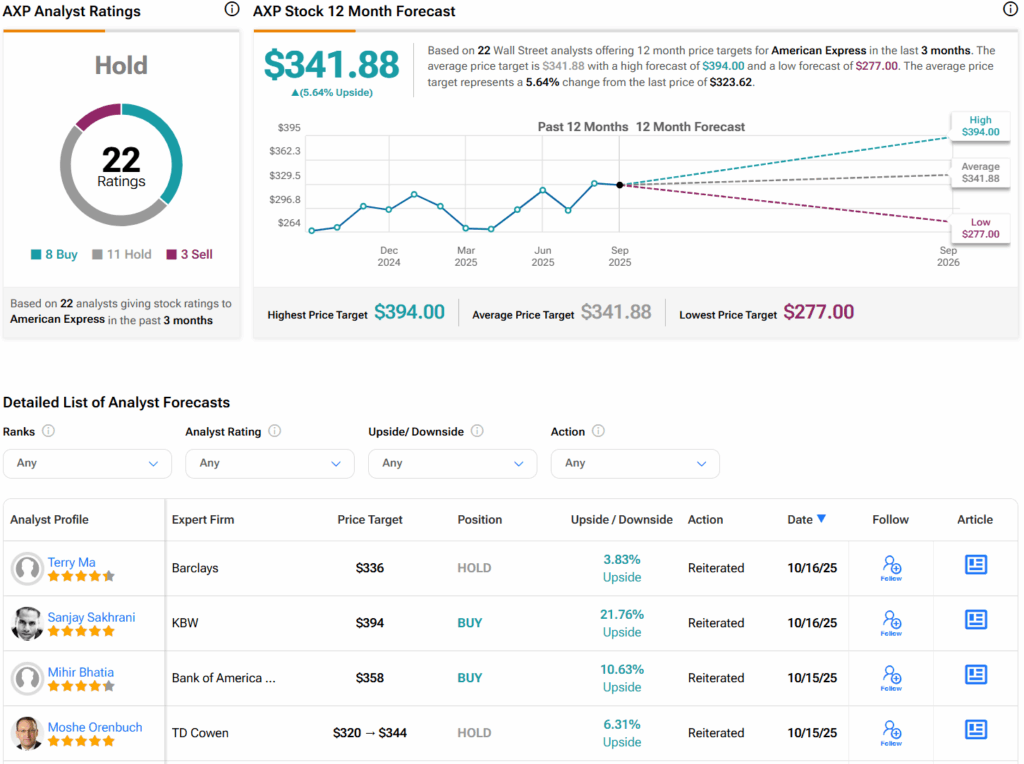

Interestingly, Barclays (BCS) has raised its price target for American Express (AXP) from $297 to $336, but kept its Hold rating. In fact, the firm said that investors are cautious about consumer health and whether credit trends are worsening. Nevertheless, Barclays believes that credit performance is still solid, as demonstrated by the chart below, even after more than two years of tighter financial conditions. And while falling interest rates boosted the mortgage market earlier in the quarter, that Optimism has faded, as Barclays expects interest rates to stay high through 2026.

Separately, JPMorgan (JPM) also raised its price target for American Express, increasing it from $343 to $355, while keeping a Hold rating. In its Q3 earnings preview, JPMorgan pointed out that there is a growing gap between high-income and low-income consumers. The firm is especially cautious about risks facing low-income consumers and says that these issues make it more selective about which financial companies it recommends.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 4.1% price MOVE in either direction. This estimate is derived from the $322.50 strike price, with call options priced at $6.30 and put options at $7.10.

Is AXP Stock a Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AXP stock based on eight Buys, 11 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AXP price target of $341.88 per share implies 5.6% upside potential. At the same time, TipRanks’ AI analyst has an Outperform rating with a $391 price target.