CoreWeave Stock (CRWV) Skyrockets as It Challenges Amazon’s Storage Empire

Another David vs Goliath story unfolds in cloud storage—except this David comes armed with specialized GPU infrastructure and investor enthusiasm.

The Underdog's Advantage

CoreWeave isn't just entering the storage arena—it's carving out a niche Amazon can't easily replicate. While AWS offers everything to everyone, CRWV focuses on high-performance computing storage that makes AI and machine learning workflows actually work. Investors clearly see the differentiation, sending shares climbing as institutional money bets on specialization over scale.

Storage Wars Get Interesting

The market's reacting like someone finally discovered Amazon has blind spots. CoreWeave's approach targets the exact workloads where AWS struggles—compute-intensive operations requiring massive parallel processing. It's not about being bigger; it's about being better where it counts. The stock movement suggests Wall Street might finally understand that sometimes the tortoise wins because the hare took the wrong route.

Another reminder that in tech, being the biggest just means you have the most territory to defend—and the most startups aiming at your weak spots.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CoreWeave’s new offering comes with no egress charges — the cost of moving data out of cloud storage services — as well as no request and transaction charges.

Future Competitor to Amazon and Google?

The new storage offering, called the AI Object Storage, makes CoreWeave a possible future competitor to object storage providers such as Amazon Web Services (AMZN) and Google Cloud (GOOGL), both of which charge egress fees.

CoreWeave observed that the service is fully managed, meaning that it handles all activities, such as setup and maintenance, required for the storage service to function properly. In terms of pricing, CoreWeave noted that its charges are automatically determined in three tiers based on usage level.

The offering also comes with features that help to maintain the accuracy of data while being transferred between cloud service providers, the neocloud company added.

CoreWeave Strengthens Product Portfolio

Traditional object storage systems commonly tie data to a specific server, data center, or cloud provider, thereby limiting access to them. However, CoreWeave has said that its new service will remove this constraint by making a single dataset accessible across regions, on-premises, or varying cloud service providers.

The firm further pointed out that adding more resources to the storage does not slow it down as the storage “scales” to match demand.

The new offering comes as CoreWeave is building out its base to compete in the emerging AI infrastructure market. The company is one of several rising data center infrastructure companies such as Nebius (NBIS), and IREN Limited (IREN) vying to provide Big Tech with tools they need for AI cloud computing.

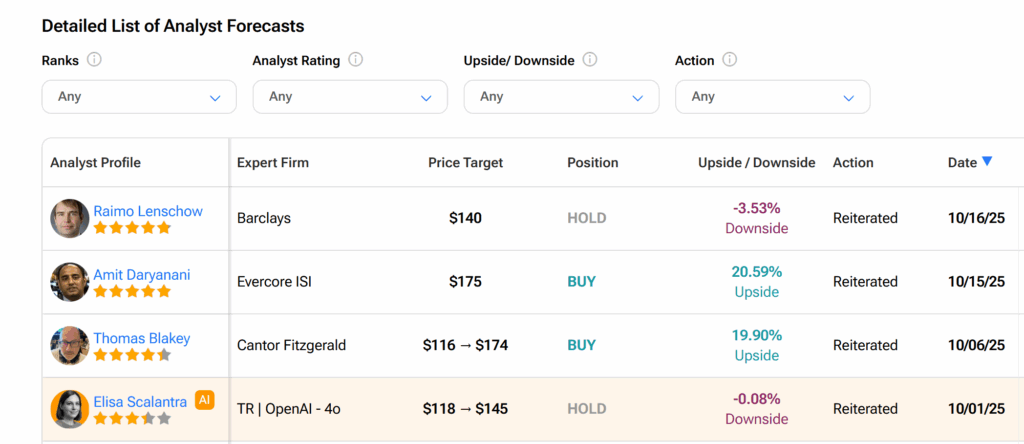

The launch of the object storage service comes as CoreWeave just secured a deal with Poolside, an AI startup also backed by Nvidia, to build a massive data center complex in West Texas. It has started to earn price target boosts from Wall Street analysts as a result.

Is CoreWeave a Good Buy?

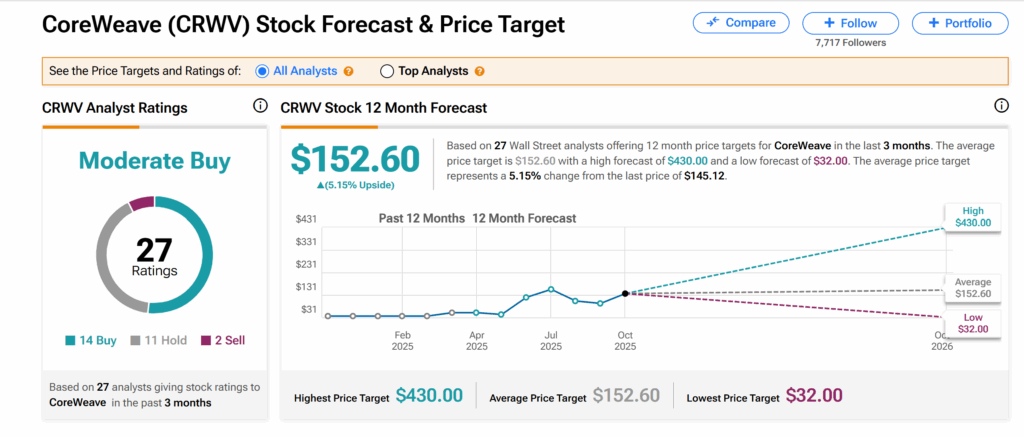

However, across Wall Street, CoreWeave’s shares currently have a Moderate Buy consensus rating. This is based on 14 Buys, 11 Holds, and two Sells assigned by 27 Wall Street analysts over the past three months.

Moreover, the average CRWV price target of $152.60 indicates a 5% growth possibility from the current level.