ZachXBT Tracks $28M Bittensor Hack Through Anime NFT Digital Footprint

Blockchain detective ZachXBT just pulled off the crypto equivalent of finding a needle in a haystack—except the needle was wearing anime-themed digital collectibles.

The $28M Trail

When Bittensor's ecosystem got hit with a massive security breach, the hacker thought they'd covered their tracks. But they left one crucial clue: a trail of anime NFT transactions that cut across multiple wallets and protocols. ZachXBT connected the dots through blockchain forensics, mapping the entire heist from initial exploit to attempted money laundering.

Digital Fingerprints Everywhere

The perpetrator moved stolen funds through decentralized exchanges, mixed currencies, but kept returning to their beloved anime NFT collection—a digital signature that ultimately became their undoing. Every transaction, every swap, every attempt to obscure the money trail still left blockchain breadcrumbs that don't lie.

Security Wake-Up Call

While the crypto community celebrates another ZachXBT victory, the incident exposes how even sophisticated hackers struggle with operational security. They'll spend months planning a complex smart contract exploit but forget that their Pikachu NFT portfolio creates a permanent public record. Nothing says 'arrest me' like leaving your favorite cartoon characters at every crime scene.

Another day, another crypto heist—proving once again that in decentralized finance, the most centralized vulnerability remains human error. At least this time the investigator got paid in clout instead of another worthless governance token.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the lawsuit, Nio allegedly overstated over $600 million in leased battery revenue through a company called Weineng, which GIC described as “superficially independent” but actually controlled by Nio. The complaint claims Nio’s accounting misrepresented earnings, artificially boosting its market value and misleading shareholders.

Shares Drop as Legal Concerns Grow

GIC, which purchased Nio shares between August 11, 2022, and July 11, 2023, said it suffered significant losses due to the alleged misstatements. The lawsuit triggered a broad sell-off in Nio’s stock.

Hong Kong-listed shares fell about 7.9%, while U.S.-listed ADRs slipped more than 8% in pre-market trading on Thursday. The case adds to pressure on Chinese EV makers already struggling with slower demand and rising competition in global markets.

Nio has not yet responded to the allegations. Analysts believe the case could weigh on investor sentiment in the NEAR term, keeping the company’s financial reporting under close scrutiny.

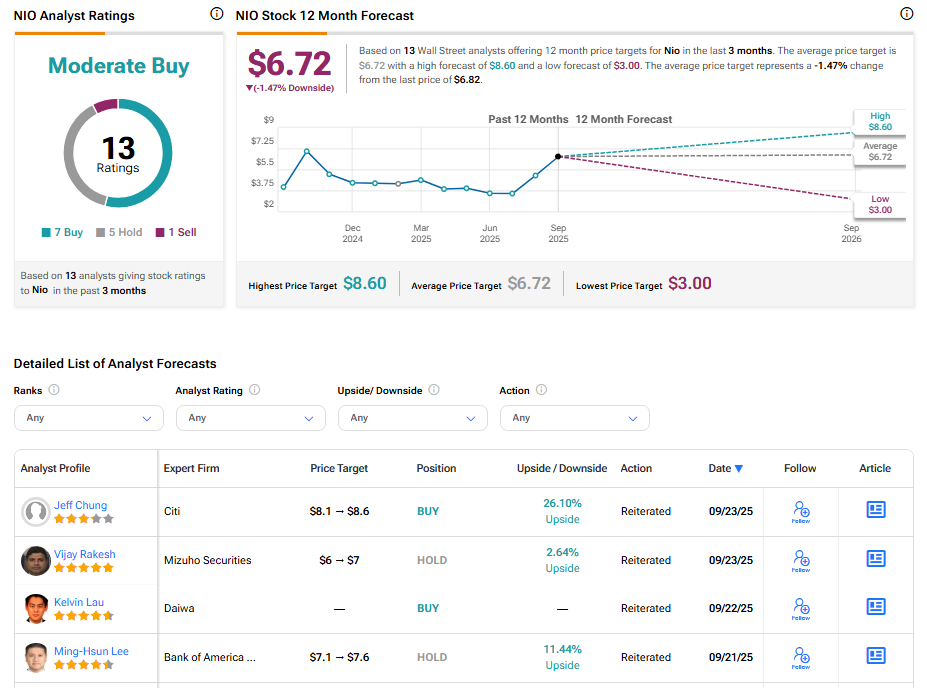

Is NIO a Buy, Sell, or Hold?

Overall, Wall Street has a Moderate Buy consensus rating on NIO stock, based on seven Buys, five Holds, and one Sell assigned in the last three months. The average NIO stock price target of $6.72 implies 1.47% downside potential from current levels.