Coinbase’s Strategic CoinDCX Investment: Betting Big on India and Middle East Crypto Expansion

Crypto giant makes power move in emerging markets

The Global Gambit

Coinbase just placed its chips on the fastest-growing crypto markets. Their strategic investment in CoinDCX signals a massive bet on India's tech-savvy population and the Middle East's regulatory evolution.

Emerging Market Gold Rush

While Wall Street analysts debate traditional stock picks, crypto players are bypassing conventional markets entirely. Coinbase's move targets regions where adoption curves are steepest and regulatory barriers are crumbling faster than a Bitcoin maximalist's arguments against altcoins.

The Institutional Endgame

This isn't just expansion—it's colonization. Coinbase positions itself at the intersection of two demographic powerhouses while traditional finance still debates whether crypto is a 'real asset class.' Sometimes the highest upside potential isn't in choosing between chip stocks, but in recognizing that the entire casino is being rebuilt.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Advanced Micro Devices (NASDAQ:AMD) Stock

Advanced Micro Devices stock has rallied 48% over the past month and is up 97.5% year-to-date. The surge in the shares of the Lisa Su-led chipmaker comes as the launch of new graphics processing units (GPUs) and massive deals have revived hopes about AMD capturing AI-led demand, addressing concerns about the company lagging rival Nvidia in the AI chips race.

Notably, AMD’s deal with ChatGPT Maker OpenAI () for deploying up to 6 gigawatts (GW) of its AI GPUs over multiple years sparked a rally in the stock, reinforcing confidence in the company’s capability to capture AI-induced demand. Additionally, on October 14, Oracle (ORCL) announced that beginning in the third quarter of 2026, Oracle Cloud Infrastructure will be the first hyperscaler to offer a publicly available AI supercluster powered by 50,000 AMD Instinct MI450 Series GPUs.

Is AMD Stock a Buy or Sell?

On Wednesday, Wedbush analyst Matt Bryson lifted his price target for AMD stock to $270 from $190 and reiterated a Buy rating ahead of Q3 results. The 5-star analyst noted that over the last quarter, AMD has provided certainty around GPU demand by signing new agreements that WOULD substantially boost its GPU revenues. In this regard, Bryson noted the deals with OpenAI and Oracle.

For 2026, Bryson raised his data center GPU/AI estimates for Q3 and Q4. While the analyst increased his H2 2026 expectations, he highlighted that his estimate for AMD’s total AI data center revenues in 2026 remains close to $10 billion as he expects it to take “somewhat longer” for the company to boost its revenues. That said, for 2027, Bryson expects the chipmaker to deliver a notable portion of a gigawatt of capacity to OpenAI, with AI-related revenues expanding to $20 billion. Even after considering higher operating expenses in the out years, Bryson significantly increased his EPS estimate for calendar year 2027 to $9.

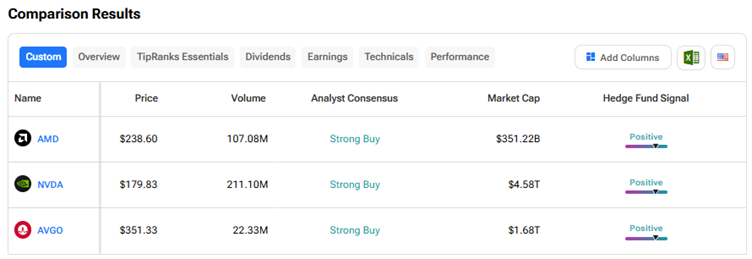

Given the growing optimism, Wall Street has a Strong Buy consensus rating on Advanced Micro Devices stock based on 30 Buys and 10 Holds. The average AMD stock price target of $248.83 indicates 4.3% upside potential from current levels.

Nvidia (NASDAQ:NVDA) Stock

Nvidia stock has risen 34% year-to-date despite growing concerns about mounting competition in the AI chips space from AMD and Broadcom, as well as the adverse impact of the China chip export restrictions. Even amid the ongoing challenges, most analysts remain confident about Nvidia’s growth story based on the company’s dominance in the AI GPU space and continued demand for its innovative products, which are required to support the rapidly growing computing needs.

Moreover, Nvidia continues to bolster its position with strategic deals, including its $5 billion investment in the troubled chipmaker Intel (INTC) and a $100 billion commitment to OpenAI. The company’s opportunities in sovereign AI are also expected to boost its business.

Is NVDA a Good Stock to Buy Now?

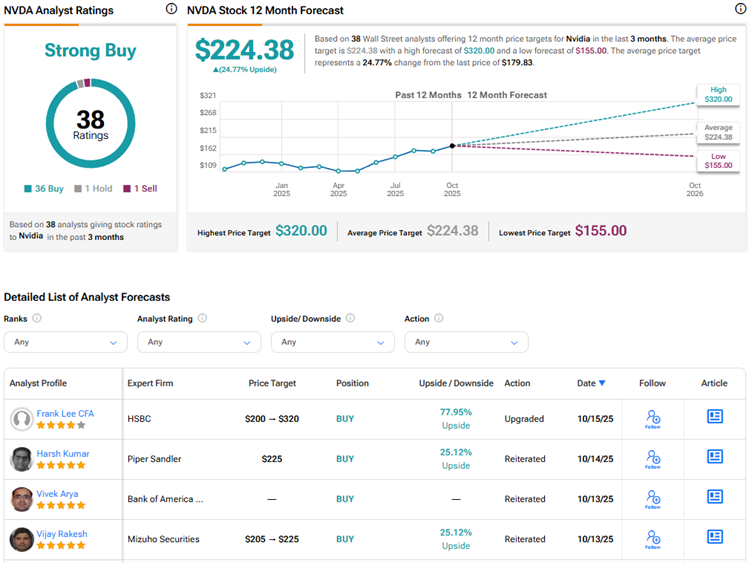

On Monday, Piper Sandler analyst Harsh Kumar reiterated a Buy rating on NVDA stock with a price target of $225 following a discussion with the company regarding the current business environment and recent investment implications.

The 5-star analyst believes that business conditions for Nvidia remain robust, with demand still surpassing manufacturing capacity and supply. Kumar thinks that funding provided by Nvidia to various customers, such as OpenAI and CoreWeave (CRWV), is “insulated from circular financing concerns.”

While Kumar acknowledged risks related to China restrictions and noted that Nvidia’s Q3 guidance did not include any revenue from the H20 chips, he believes that the company is well-positioned to meet the Street’s expectations.

Overall, Nvidia scores a Strong Buy consensus rating based on 36 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $224.38 indicates 25% upside potential from current levels.

Broadcom (NASDAQ:AVGO) Stock

Broadcom stock has risen about 52% year-to-date, driven by Optimism about demand for its high-end application-specific integrated circuits (ASICs)/custom AI chips. On Monday, Broadcom and OpenAI announced a strategic partnership to deploy 10 GW of custom AI accelerators, marking a landmark deal for the company. Deployment will begin in the second half of 2026 and will continue through 2029.

The deal is expected to be game-changing for Broadcom, significantly boosting its revenue and expanding its total addressable market. Overall, Wall Street is optimistic about Broadcom’s long-term prospects, backed by its solid position in custom AI chips and networking products.

Is Broadcom Stock a Buy, Sell, or Hold?

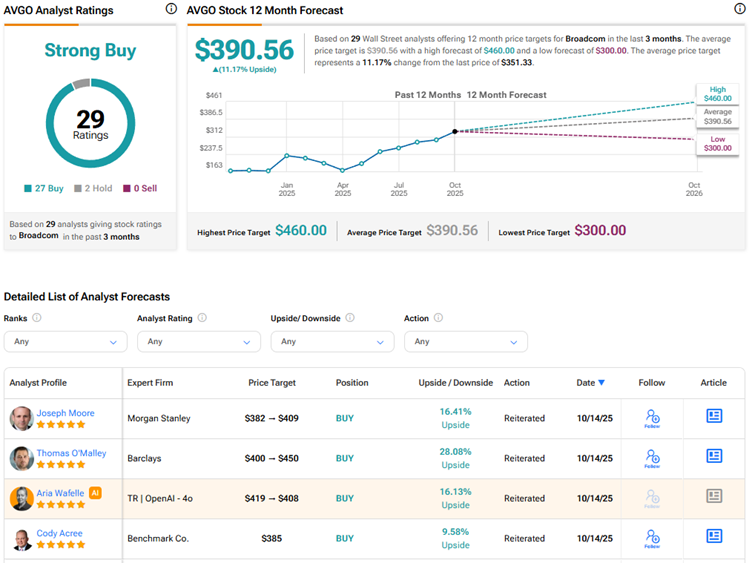

Following the announcement of the OpenAI deal, Oppenheimer analyst Rick Schafer reiterated a Buy rating on Broadcom stock with a price target of $360. Schafer highlighted that management did not share any details on revenue per GW. The analyst estimates AVGO content per GW to exceed $15 billion.

Meanwhile, Schafer highlighted that Broadcom’s President of Semiconductor Solutions, Charlie Kawwas, stated on CNBC that the $10 billion custom AI XPU win announced on September 9 is not OpenAI. He added that Broadcom is the long-time builder of Alphabet’s (GOOGL) TPU (Tensor Processing Units) chips. Schafer believes that AVGO’s additional project partners/customers include ByteDance, Meta Platforms’ (META) Meta Training and Inference Accelerators (MTIA), OpenAI, and a fifth XPU (custom AI chip) customer, which he believes could be xAI, given Broadcom’s focus on serving hyperscalers developing frontier large language models (LLMs).

While Schafer sees the OpenAI deal as incremental to Broadcom’s revenue and EPS, he is holding off from updating his model until more details are available.

Currently, Wall Street has a Strong Buy consensus rating on Broadcom stock based on 27 Buys and two Holds. The average AVGO stock price target of $390.56 indicates 11.2% upside potential from current levels.

Conclusion

Wall Street is highly bullish on Nvidia, Broadcom, and Advanced Micro Devices stocks amid robust demand for AI chips. Currently, analysts see higher upside potential in Nvidia stock than in the other two chip stocks. Despite growing competition, most analysts remain optimistic about Nvidia and expect it to maintain its dominance in the AI GPU market, backed by innovation and solid execution.