Intel Stock (NASDAQ:INTC) Surges as Crescent Island Inference Testing Accelerates for 2026

Intel's strategic pivot toward inference computing sparks investor frenzy as Crescent Island testing timeline gets confirmed.

The Inference Revolution Heats Up

Semiconductor giant Intel is betting big on inference technology—the computational backbone powering real-time AI applications. With Crescent Island testing scheduled for next year, the company positions itself at the forefront of the AI infrastructure race.

Wall Street Takes Notice

NASDAQ traders sent Intel shares soaring as the inference-focused roadmap gained clarity. The move signals Intel's determination to capture market share in the rapidly expanding AI chip sector—though whether this justifies the hype remains Wall Street's favorite guessing game.

Another tech stock riding the AI wave—because apparently, adding 'inference' to your vocabulary is worth billions in market cap these days.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Crescent Island, geared to be a data center GPU with a particular focus on inference workloads, is set to start testing in the closing half of 2026, reports note. This is actually the second time that Intel is looking to break into the AI accelerator market, since the Gaudi chips failed to catch on in their first go-round.

Intel missed out on the first wave of AI infrastructure expansion, which started up in earnest back in November 2022. But Intel is not planning to cede the market to competitors who got first-mover advantage. This is actually part of a larger plan at Intel to launch new AI data chips annually, and build the roadmap to “…more predictable yearly updates,” reports noted. Sachin Katti, Intel’s chief technology officer, noted “Instead of trying to build for every workload out there, our focus is increasingly going to be on inference.”

“Of Course”

Meanwhile, former Intel CEO Pat Gelsinger came out in a big way on the entire AI marketplace. When asked during an interview on CNBC if we were in an AI bubble, Gelsinger simply said, “Of course.” Gelsinger even compared the rise of AI, which was largely missed during his tenure, to past technology cycles. The key difference, though, is that this particular cycle is much better and faster than those seen previously.

This bubble, however, is likely to have legs. Gelsinger noted, “I don’t see it ending for several years.” Indeed, there is a lot of potential to artificial intelligence, and that makes for a market in which the whole sector is, paradoxically “…overextended but underdeveloped.”

Is Intel a Buy, Hold or Sell?

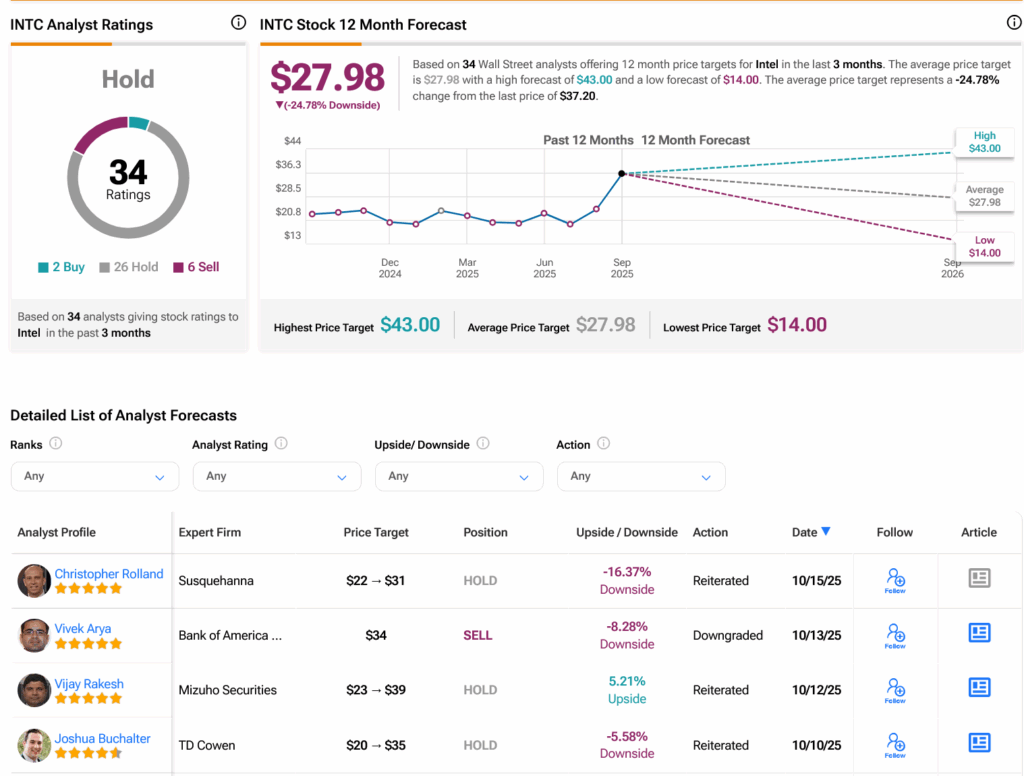

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 26 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 59.7% rally in its share price over the past year, the average INTC price target of $27.98 per share implies 24.78% downside risk.

Disclosure