CoreWeave (CRWV) & Nvidia-Backed Poolside Forge Massive Data Center Partnership

Tech Titans Collide in Infrastructure Power Move

The Cloud Computing Arms Race Heats Up

CoreWeave just locked arms with Nvidia-funded Poolside—building what insiders call a 'monster' data facility. We're talking server farms that could power half of Silicon Valley's AI dreams. This isn't just another cloud project—it's a statement piece in the infrastructure wars.

Why This Partnership Changes Everything

Nvidia's fingerprints are all over this deal. Their backing gives Poolside the hardware cred while CoreWeave brings the distributed computing muscle. Together they're building what amounts to a digital fortress for next-gen applications—from AI training to blockchain validation.

The Financial Angle Wall Street Missed

While traditional investors obsess over quarterly earnings, these players are building the literal foundation for Web3's future. Another case of tech innovators eating finance's lunch while bankers debate P/E ratios. The real money isn't in trading assets—it's in owning the infrastructure they run on.

Bottom line: When the titans of tech start building fortresses, smart money pays attention. The future's being constructed in server racks, not boardrooms.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of the partnership, CoreWeave will supply over 40,000 Nvidia GPUs for AI computing and act as both the lead tenant and operations partner for the first 250MW phase, with an option to expand capacity by another 500MW. The complex will also use an existing on-site gas plant built by Occidental Petroleum (OXY) and nearby pipelines, which will allow it to generate its own electricity.

This move is part of the current race to build AI-ready infrastructure. For example, OpenAI (PC:OPAIQ) has been making deals with companies like Advanced Micro Devices (AMD), Broadcom (AVGO), and Nvidia to boost its computing power, while Nscale recently signed a huge deal with Microsoft (MSFT) for 200,000 Nvidia GPUs across the U.S. and Europe. Meanwhile, a group including BlackRock (BLK), Nvidia, Microsoft, and Elon Musk’s xAI (PC:XAIIQ) is reportedly considering a $40 billion takeover of a major global data center operator.

Is CRWV Stock a Good Buy?

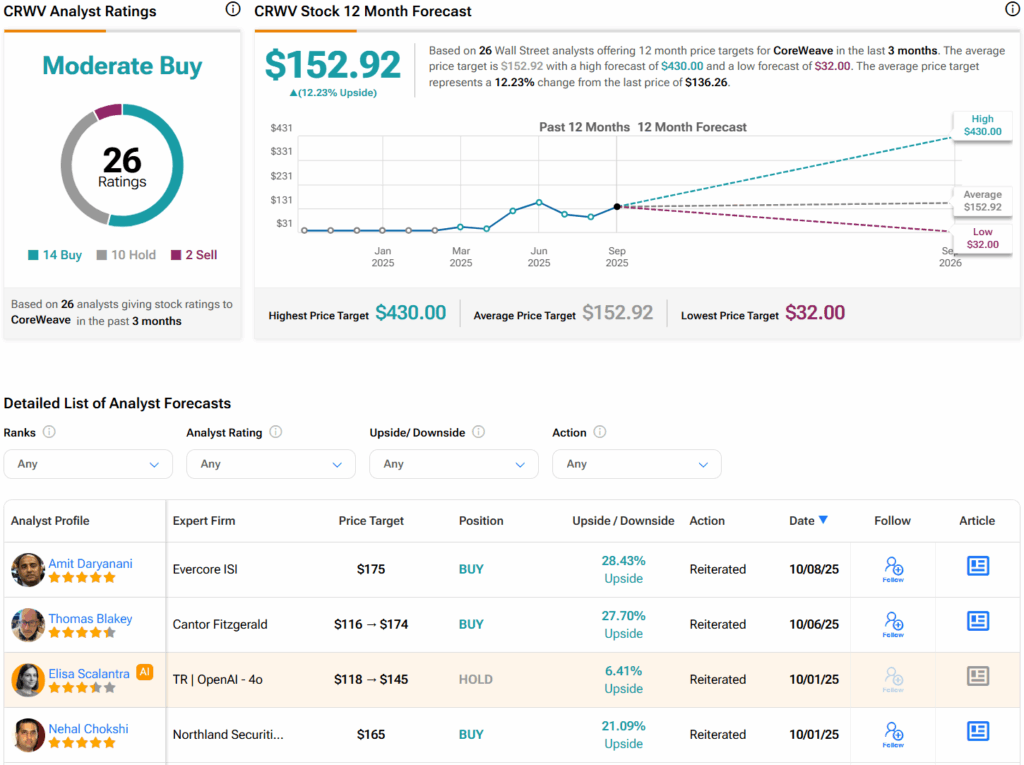

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on 14 Buys, 10 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average CRWV price target of $152.92 per share implies 12.2% upside potential.