XRP Hold or Sell? Expert Reveals 57% vs 43% Critical Decision Point

XRP investors face a classic crypto crossroads—hold through the volatility or cash out while you can.

The Numbers Don't Lie

Market analysts are pointing to a clear 57% versus 43% split in trader sentiment, creating one of the most divided landscapes in recent crypto memory. That near-even split tells you everything about XRP's current identity crisis—too big to ignore but too unpredictable to trust completely.

Timing Is Everything

Seasoned traders know these 50-50 moments often precede major price movements. The question isn't whether XRP will move—it's which direction the dominoes will fall when institutional money finally picks a side. Retail investors are left watching the charts while Wall Street probably already placed their bets yesterday.

Classic Crypto Theater

Another day, another coin keeping everyone guessing while the whales position themselves on both sides of the trade—because why pick one outcome when you can profit from both?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The consortium, which also includes BlackRock’s Global Infrastructure Partners (GIP), Elon Musk’s AI startup xAI, and sovereign wealth fund Mubadala’s AI investment subsidiary, MGX, announced the all-stock deal on Wednesday. The AI infrastructure firm will be purchased from Australian asset management Macquarie (MQBKY) and its co-investors in the company.

‘The Future of AI Infrastructure’

After the acquisition, AIP plans to inject an initial equity capital of $30 billion into Aligned Data Centers, with the possibility of increasing the investment up to $100 billion, plus debt. This is even as AIP sees the U.S. company as “well positioned to anchor [its] vision for the future of AI infrastructure.”

BlackRock’s shares jumped by more than 1% during the first hour of trading on Wednesday, in reaction to the update.

The consortium has been dubbed ‘Artificial Intelligence Infrastructure Partnership (AIP). It also includes key backers such as the Kuwait investment Authority, a sovereign wealth fund, and Temasek, an investment outlet owned by Singapore.

Big Tech and Asset Manager Join Forces

The group in a statement noted that the goal of acquiring the data center infrastructure company is to “fuel the expansion of next-generation cloud and AI infrastructure”.

Align Data Centers designs and builds data centers for AI workloads. It also operates across the U.S. and North and South America, including in Mexico, Colombia, Chile, and Brazil.

According to the announcement, the U.S. company has 50 data center campuses under its belt and manages more than five gigawatts in both operational and planned power capacity. Arrangements to complete the takeover is expected to be completed during the first six months of next year.

Aligned Data Centers is expected to continue to maintain its base in Dallas, Texas, with continued leadership from its chief executive Andrew Schaap.

The deal comes as Big Tech and top asset managers –ignoring worries of an AI bubble — continue to pour billions of dollars in investment into developing massive AI computing power to stay at the forefront of AI innovation.

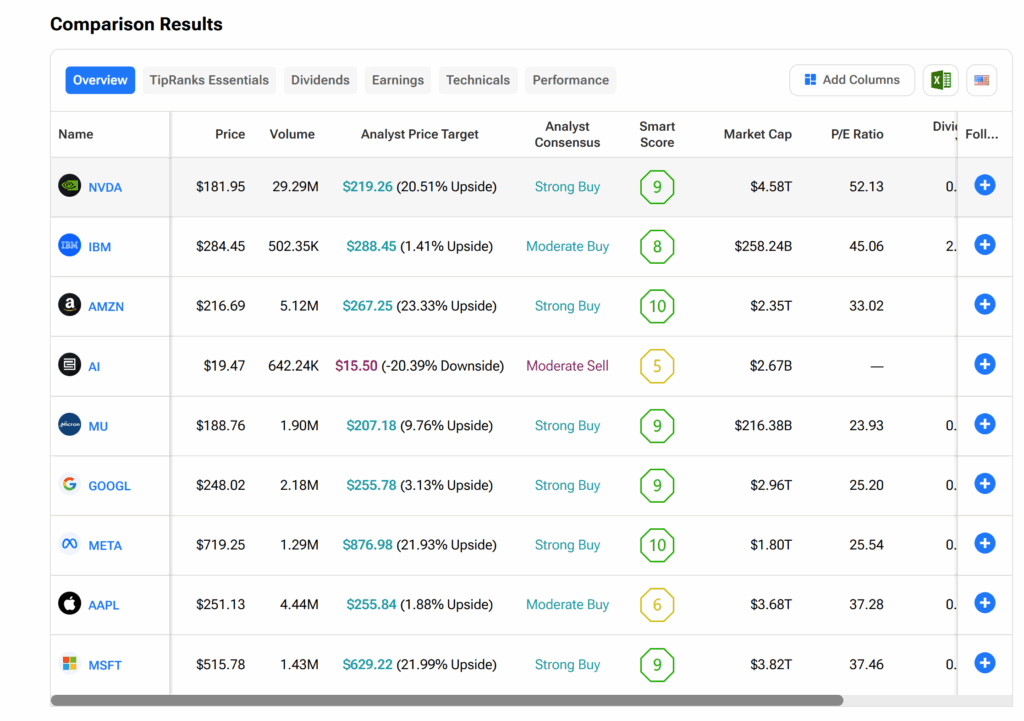

What are the Best AI Stocks to Buy?

With tech companies and asset managers joining forces to pump heavy investments into AI infrastructure, selecting the right stock is increasingly essential for investors. The TipRanks Stock Comparison tool provides direction on which AI stocks Wall Street analysts consider as top investment choices — see the graphics below for details.