Rich Dad Author Backs Trump’s 401(k) Bitcoin Revolution - Claims Everyone Gets Wealthy

Financial guru Robert Kiyosaki throws weight behind presidential push for retirement fund diversification into digital gold and real assets.

The Bitcoin Retirement Gamble

Traditional 401(k) plans face potential disruption as political momentum builds for alternative asset inclusion. Gold, real estate, and cryptocurrency could soon become mainstream retirement options.

Wealth Redistribution or Wall Street Nightmare?

Proponents argue diversification beyond stocks and bonds protects against inflation. Critics warn about volatility risks in retirement portfolios - because nothing says 'secure retirement' like watching your life savings swing 20% before breakfast.

The final verdict? Either financial liberation awaits millions, or financial advisors are about to get very rich explaining why your Bitcoin retirement vanished.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fund Flows and Sentiment

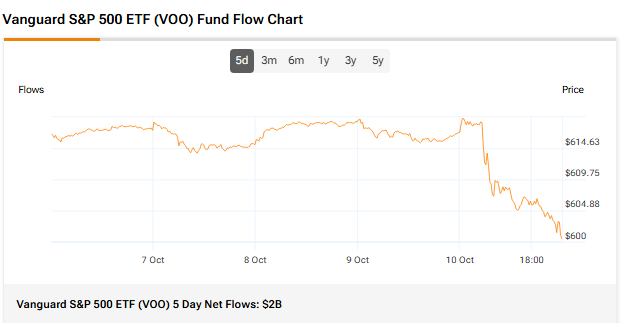

The VOO ETF, which tracks the S&P 500 (SPX), continues to draw investor interest. According to TipRanks data, VOO recorded 5-day net inflows of about $2 billion, showing steady investor demand for large-cap U.S. exposure.

Today’s VOO ETF Performance

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VOO is a Moderate Buy. The Street’s average price target of $687.85 implies an upside of 14.54%.

Currently, VOO’s five holdings with the highest upside potential are Dexcom (DXCM), Fiserv, Inc. (FI), Caesars Entertainment (CZR), MGM Resorts (MGM), and Moderna (MRNA).

Meanwhile, its five holdings with the greatest downside potential are Garmin (GRMN), Paramount Skydance (PSKY), Intel (INTC), Super Micro Computer (SMCI), and Tesla (TSLA).

Revealingly, VOO ETF’s Smart Score is seven, implying that this ETF will likely perform in line with the market.

Does VOO Pay Dividends?

Yes, VOO pays dividends, offering investors a source of regular income. The ETF distributes these payments every quarter to shareholders. They come from the dividends paid by the companies in the S&P 500 (). Since company payouts change over time, the dividend amount from VOO also varies each quarter.

VOO’s yield as of today is 1.17%.