Palantir Stock (PLTR) Hits ’Fully Priced’ Territory as Mizuho Analyst Sounds Warning Bell After Massive Rally

Palantir's rocket ride hits analyst resistance as Mizuho declares the data giant 'fully priced' following its explosive run-up.

The Valuation Reality Check

Mizuho's top analyst slaps a sobering assessment on Palantir's recent surge, suggesting the stock has exhausted its near-term upside potential. The warning comes as PLTR shares defied broader market trends with a blistering rally that left traditional valuation metrics in the dust.

Institutional Skepticism Mounts

While retail traders continue fueling the momentum, institutional voices grow increasingly cautious. The 'fully priced' designation signals that even bullish analysts see limited runway for additional gains at current levels—a classic case of Wall Street telling you to take profits while the getting's good.

Timing the Top

The analyst affirmation creates a fascinating tension between fundamental valuation concerns and relentless market momentum. When the professionals start waving caution flags during a parabolic move, smart money pays attention—even if it means leaving some hypothetical gains on the table.

Another reminder that in markets, sometimes the most expensive words are 'this time it's different.'

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moskowitz said Palantir is well placed to gain from the growing use of AI across government and commercial markets. Still, he believes the stock’s high valuation already captures most of its growth story, leaving only limited upside in the NEAR term.

Analyst Sees Strong AIP Growth but Notes High Valuation

The analyst said Palantir’s Artificial Intelligence Platform (AIP) remains a key driver of growth, helping the company speed up adoption and close deals faster through its AIP boot camps. These sessions let potential clients test Palantir’s tools directly, boosting its U.S. commercial business and attracting new customers.

He also noted that Palantir has secured several large government contracts this year, further strengthening its position in AI-based data software. However, Moskowitz warned that Palantir’s premium valuation leaves little room for upside in the near term. He added that the company’s products are costly, which could also limit how many new clients can afford them over time.

AIP Agent Studio Seen as a Key Growth Driver

Moskowitz said Palantir is adding new features with AIP Agent Studio, a no-code platform launched in late 2024 that lets users create AI agents using their own data. The platform connects with Palantir’s Ontology system, allowing companies to automate tasks and apply AI directly in daily work.

He believes this MOVE toward “agentic AI” could open new revenue streams in the long run, though the technology is still in its early stages across the industry.

Is Palantir a Good Stock to Buy?

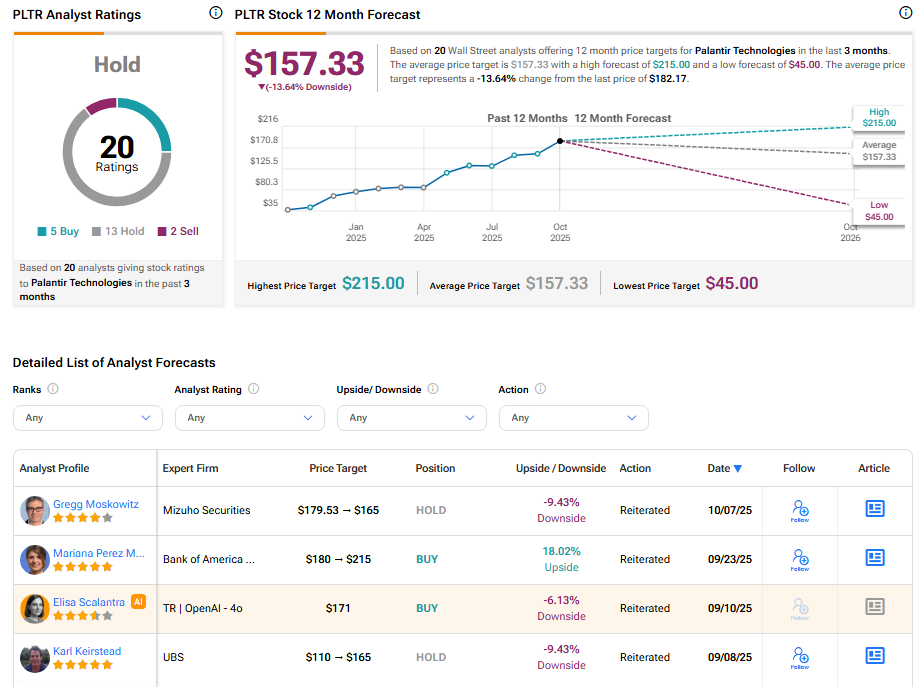

Currently, many analysts are sidelined on Palantir Technologies stock, mainly due to its elevated valuation. Wall Street’s Hold consensus rating on PLTR stock is based on 13 Holds, five Buys, and two Sell recommendations. The average PLTR stock price target of $157.33 indicates a possible downside of 13.64% from current levels.