Western Digital Stock (WDC) Soars 155% - Morgan Stanley Still Bullish, Raises Price Target

Morgan Stanley doubles down on Western Digital despite massive gains—because why let pesky things like valuation get in the way of a good story?

The Unstoppable Rally

Western Digital shares skyrocket 155% from recent lows, defying gravity and basic financial logic. The storage giant's stock refuses to cool off, leaving bears scrambling and analysts reaching for new superlatives.

Institutional Confidence Unshaken

Morgan Stanley boosts its price target, betting the explosive run has more fuel in the tank. The upgrade signals Wall Street's belief that data storage demand will keep driving growth—or that momentum trading works until it doesn't.

Storage Sector Heats Up

As cloud computing and AI workloads explode, storage providers become the picks and shovels of the digital gold rush. Western Digital positions itself at the center of the data revolution, though whether the fundamentals justify the euphoria remains Wall Street's favorite guessing game.

Another reminder that in today's market, traditional valuation metrics are about as useful as a floppy disk—sometimes the tape just keeps running until it doesn't.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

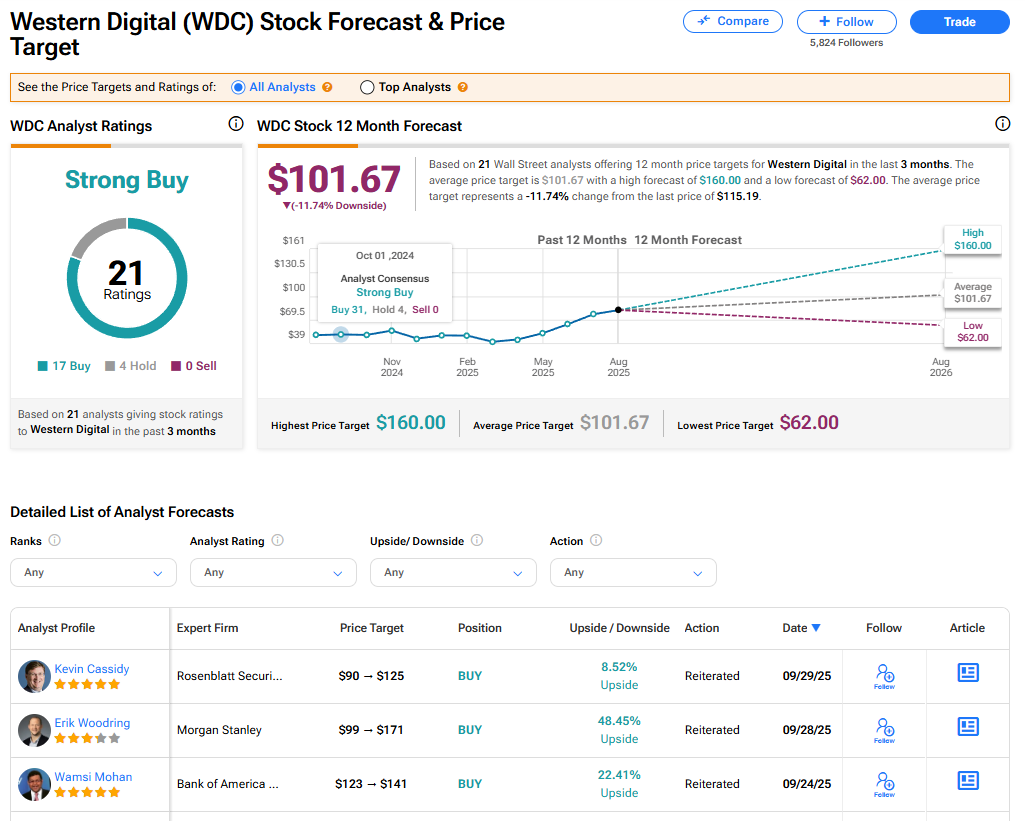

The investment bank has named data-storage company Western Digital a “top pick,” reiterated a Buy-equivalent overweight rating on the stock, and nearly doubled its price target to $171 from $99, which is the highest forecast on Wall Street.

Despite the massive bull run in WDC stock, the market has yet to fully price in demand for the company’s Core products, said Morgan Stanley in a note to clients. Western Digital’s stock is up 8% on Sept. 29 and on pace to close at an all-time high. The stock has gained 45% in September alone.

Room to Run

Morgan Stanley adds in its bullish note that demand for Western Digital’s hard disk drive (HDD) products have started to pick up over the past year due to growing cloud-infrastructure and artificial intelligence (AI) spending. That growth cycle is unlikely to peak until 2028, says the investment bank.

From this year through 2028, Western Digital could have annual per-share earnings growth of 37%, says Morgan Stanley, putting it among the top cloud hardware, semiconductor, and networking names. “Data is the oil that will keep AI running and it’s become increasingly clear that HDD’s are the oligopoly that will benefit from the vast amounts of data storage needed to power AI,” wrote the bank.

Is WDC Stock a Buy?

The stock of Western Digital has a consensus Strong Buy rating among 21 Wall Street analysts. That rating is based on 17 Buy and four Hold recommendations issued in the last three months. The average WDC price target of $101.67 implies 11.74% downside from current levels.