Leveraged Bitcoin Longs Surge Back as Traders Bet Big on Crypto Rally

Bitcoin bulls are loading up on leverage again—and this time they're not being subtle about it.

The Comeback Kids

Major trading firms report leveraged long positions flooding back into Bitcoin markets, signaling renewed institutional confidence despite regulatory headwinds. The smart money's positioning suggests they see clear skies ahead for crypto's flagship asset.

Risk-On Returns

After months of cautious positioning, professional traders are piling back into leveraged Bitcoin exposure. The move comes as traditional finance finally admits what crypto natives knew years ago—digital gold isn't going anywhere.

Wall Street's latest 'discovery' of Bitcoin leverage would be charming if it weren't so late to the party. Meanwhile, the rest of us have been earning yield while they were still writing risk assessment reports.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following Wells Fargo analyst Michael Turrin’s upgrade and price target hike, the analyst said investor interest was “still somewhat muted,” although he is of the mind that will likely change soon. The analyst thinks most in software/broader TMT are “still doing fundamental work to better understand the story & investment case.”

“However,” Turrin went on to add, “now with key milestones behind it (incl. IPO lock-up), our sense is those looking for ways to play AI exposure come back to the name more constructive as CoreWeave continues to execute against its strategy (securing debt, power, & GPUs).”

Turrin’s comments come in the wake of investor conversations and a Wells Fargo-hosted management group meeting. The analyst highlights several key themes: demand is still “far outstripping” supply, with contracts now averaging five to six years compared with about four previously, and monetization proving stronger than expected as Nvidia Hopper GPUs are experiencing only 10–15% price erosion after roughly three years. Unit economics remain solid, with management reaffirming its long-term margin framework in the high-20% to low-30% range at scale and maintaining a 2.5-year payback period. Supply, however, is still the main constraint, as powered shell capacity – data center space that is built out with power and cooling infrastructure but not yet fully equipped with servers or GPUs – remains the limiting factor and shortages are expected to persist for years rather than months.

The AI infrastructure player has also announced its third deal with OpenAI in the past six months, with a new five-year, $6.5 billion order under the existing MSA. This brings the total value of its contracts with OpenAI to $22.4 billion, running through May 2031. Given the long procurement and delivery cycle for GPUs, Turrin thinks the latest agreement is likely intended to begin around May 2026. With this addition, OpenAI now accounts for more than 60% of CoreWeave’s roughly $35 billion pro forma RPO (remaining performance obligations).

CoreWeave’s press release said the new agreement with OpenAI is intended “to power the training of its most advanced next-generation models,” without specifically referencing inference. That said, Turrin notes that workloads typically shift over time, so the deal could cover training in the early years or phases and transition to inference later. By contrast, CoreWeave’s earlier agreements with OpenAI used broader wording, referring to both “training and delivering models.”

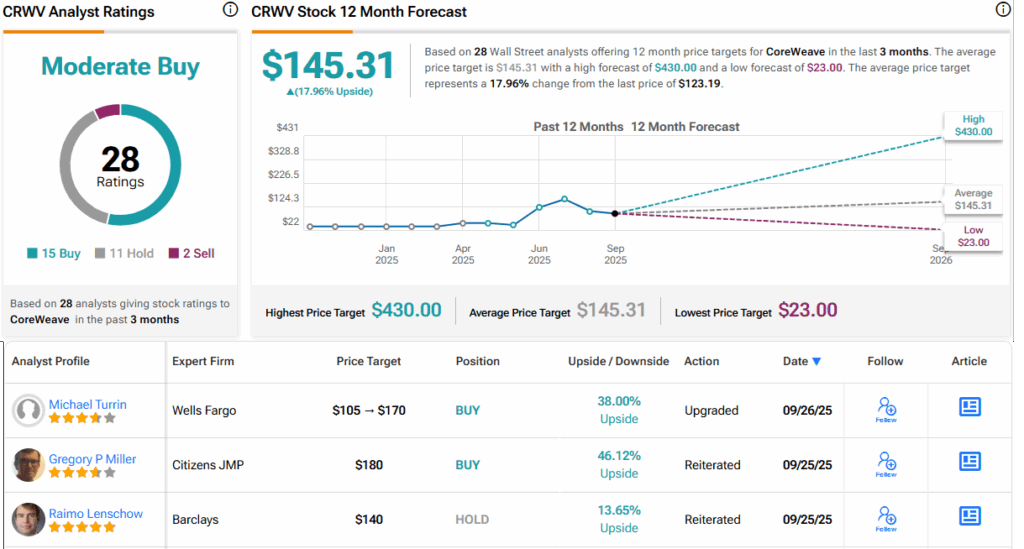

Bottom line, Turrin maintained an Overweight (i.e., Buy) rating on CRWV shares along with a $170 price target, implying the stock will gain 38% in the months ahead. (To watch Turrin’s track record, click here)

Turning now to the rest of the Street, where CRWV stock claims an additional 14 Buys, 11 Holds and 2 Sells, for a Moderate Buy consensus rating. The average target stands at $145.31, a figure that factors in one-year gain of 18%. (See CRWV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.