Databricks Bets $100M on Game-Changing OpenAI Partnership

Databricks just dropped a nine-figure bomb that could reshape the AI landscape.

The Data Power Play

That $100 million investment isn't just pocket change—it's a strategic move to combine Databricks' data lakehouse architecture with OpenAI's cutting-edge models. We're talking about enterprise AI solutions that could make current implementations look like stone tablets.

Wall Street's Skeptical Glance

While tech teams celebrate, finance bros are already calculating burn rates and questioning when—or if—this massive bet will pay off. Because nothing says 'solid investment' like pouring $100 million into technology that might be obsolete in 18 months.

The partnership signals a new arms race in enterprise AI, where data infrastructure and language models collide to create something potentially revolutionary—or spectacularly expensive.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, he said that the deal could bring in much more than $100 million in revenue down the line. This new collaboration stands out because of how simple it makes things for users. In the past, Databricks customers needed complicated tech setups and legal approvals to use OpenAI’s models. Now, with this partnership, they can start using GPT-5 and other models directly from the Databricks interface with just a click, and at the same price as accessing OpenAI directly.

Interestingly, other tech giants are also integrating AI. For instance, Snowflake (SNOW), which competes with Databricks, recently expanded its partnership with Microsoft to offer OpenAI models. Separately, Oracle (ORCL) will launch a service to run models from OpenAI, Google (GOOGL), and xAI using its own database software.

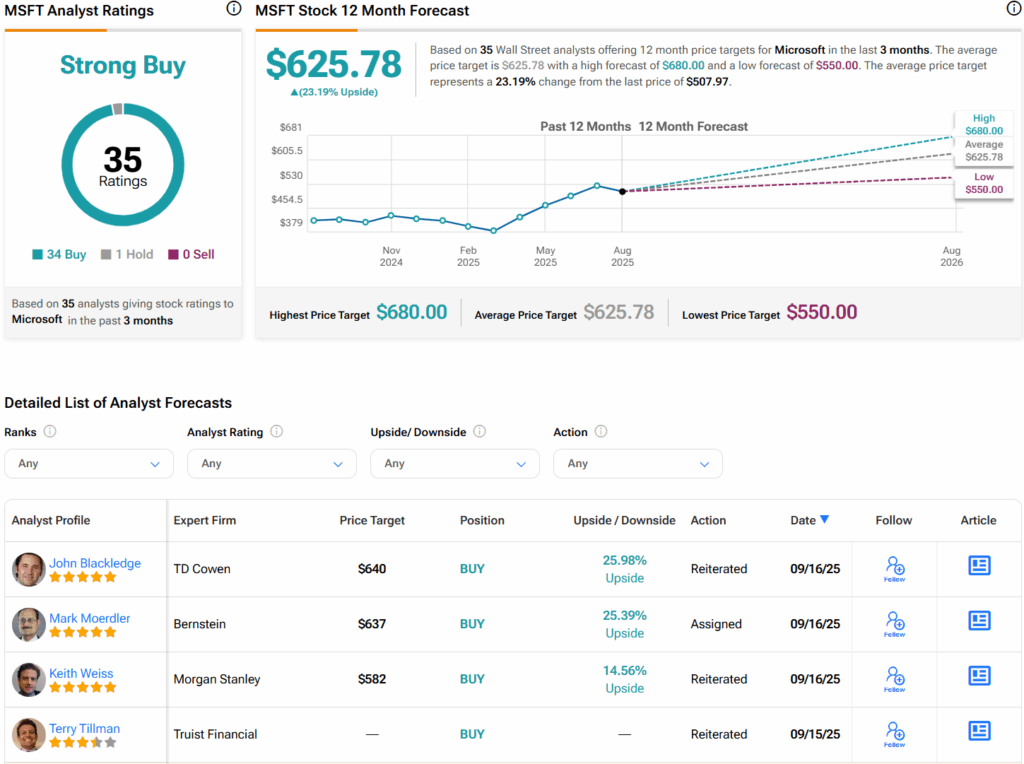

Is MSFT Stock a Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 34 Buys and one Hold assigned in the last three months. In addition, the average MSFT price target of $625.78 per share implies 23.2% upside potential.