Top Analyst Doubles Down on Bullish Salesforce (NYSE:CRM) Rating as AI Momentum Accelerates

Wall Street's brightest aren't backing down from their Salesforce bet—even as the AI frenzy reaches fever pitch.

The AI Engine Revs Up

CRM's artificial intelligence integrations are hitting their stride, transforming customer relationship platforms into predictive powerhouses. The company's Einstein AI platform now handles everything from automated lead scoring to sentiment analysis—cutting through data noise faster than a trader spotting a bull flag.

Street Confidence Defies Skeptics

Analysts maintain their outperform ratings despite valuation concerns, betting that Salesforce's enterprise foothold will outperform flashier AI pure-plays. They're essentially wagering that corporate clients would rather trust their CRM to an established vendor than gamble on unproven startups—because nothing says 'responsible investing' like paying 50 times revenue for software that tells you when to call customers.

Ultimately, this isn't just about AI hype—it's about whether Salesforce can actually monetize the technology before Wall Street's attention span shifts to the next shiny object.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tackling Agentforce Issues

Hubbl shared several examples showing that Salesforce’s Agentforce platform can be much more effective if companies first fix basic issues in their system.

Rob Acker, Hubbl’s CEO and a former Salesforce executive, and Mike Bogan, Hubbl’s Chief Strategy Officer, noted that while many companies are planning for AI, few are truly ready.

They believe that Agentforce will work better if Salesforce’s internal systems are clean and well-structured, and free of technical debt. Importantly, Hubbl helps fix these issues by combining AI-driven system optimization with process mining tools built directly on Salesforce.

Path to Stronger Agentforce Adoption

A case study from Barracuda Networks showed a 10-fold increase in Salesforce usage after implementing Hubbl, and a notable rise in license spending, including Agentforce.

Further, Walravens mentioned that Salesforce sales teams are now asking for Hubbl diagnostic scans before meeting major clients.

From an investor’s viewpoint, these insights suggest that Salesforce could drive Agentforce adoption by first focusing on the structural readiness of its customer base.

Walravens hinted that Salesforce’s “Well Architected Program” may return at Dreamforce, scheduled from October 14 to October 16, to support this strategy. The program helps companies build clean, efficient systems on its platform. It offers solutions to make setups more secure, scalable, and ready for AI tools such as Agentforce.

Is CRM a Buy, Sell, or Hold?

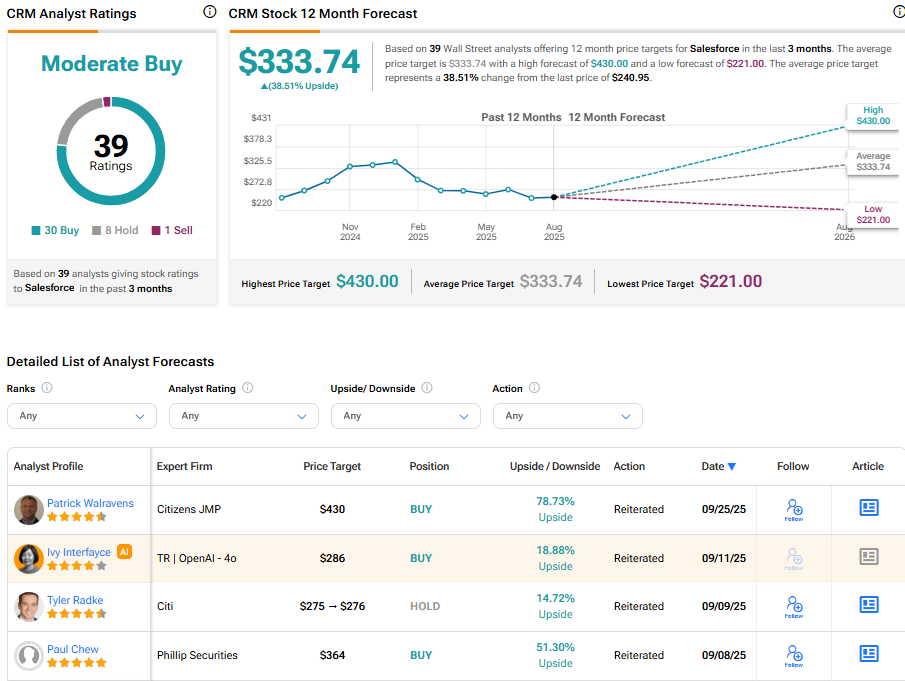

Turning to Wall Street, CRM stock has a Moderate Buy consensus rating based on 30 Buys, eight Holds, and one Sell assigned in the last three months. At $333.74, the average Salesforce stock price target implies a 38.51% upside potential.