Warner Bros. Discovery (NASDAQ:WBD) Climbs Higher as Paramount Skydance Bid Remains Absent

WBD shares notch unexpected gains while merger dance stalls

The Streaming Standoff

Warner Bros. Discovery stock defies sector gravity with Paramount's Skydance acquisition bid still missing from the equation. Investors shrug off consolidation fears as the media giant charts its own course.

Market Mechanics

Traders push WBD upward despite the conspicuous absence of industry-shaking M&A activity. The stock's resilience suggests either profound confidence in standalone strategy or temporary market amnesia about streaming's brutal economics.

Because nothing says 'healthy valuation' like rallying on what didn't happen—Wall Street's version of celebrating the dog that didn't bark while ignoring the burning house.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It turns out that Paramount has not offered a bid yet because it fears that Warner CEO David Zaslav will promptly use that bid as a cudgel to other potential bidders. Zaslav is proving worrisome to Paramount and its financial backers. None of them want a hostile takeover, reports note, and they also know that Zaslav wants a bidding war to crank up.

In fact, reports from the New York Post suggest that Paramount is planning to go talk to John Malone, who even we know has been serving as a mentor and confidant to Zaslav. However, this plan might backfire; it turns out that Malone would also benefit from a bidding war. And with new signs that Amazon (AMZN) might take a hand in the bidding war, things just got that much more complicated.

Whither Netflix?

Meanwhile, where is Netflix in all this? Analysts are beginning to wonder just how likely it is that Netflix (NFLX) will buy in after all. Certainly, there are reasons to do so. Warner has a huge content library and an established studio presence as well as theatrical distribution capabilities. This could be big for Warner, but will it fly?

Lightshed Partners analyst Rich Greenfield—who has a four-and-a-half star rating on TipRanks—doubts it, saying, “While WBD investors may hope for competitive bids…we do not believe any are likely to bid.” David Faber on CNBC noted that such a move WOULD “…really hurt their stock price,” as the messaging would be contrary to what it has run on for years. Why buy a company with a huge cable presence when you are basically the anti-cable?

Is WBD Stock a Good Buy?

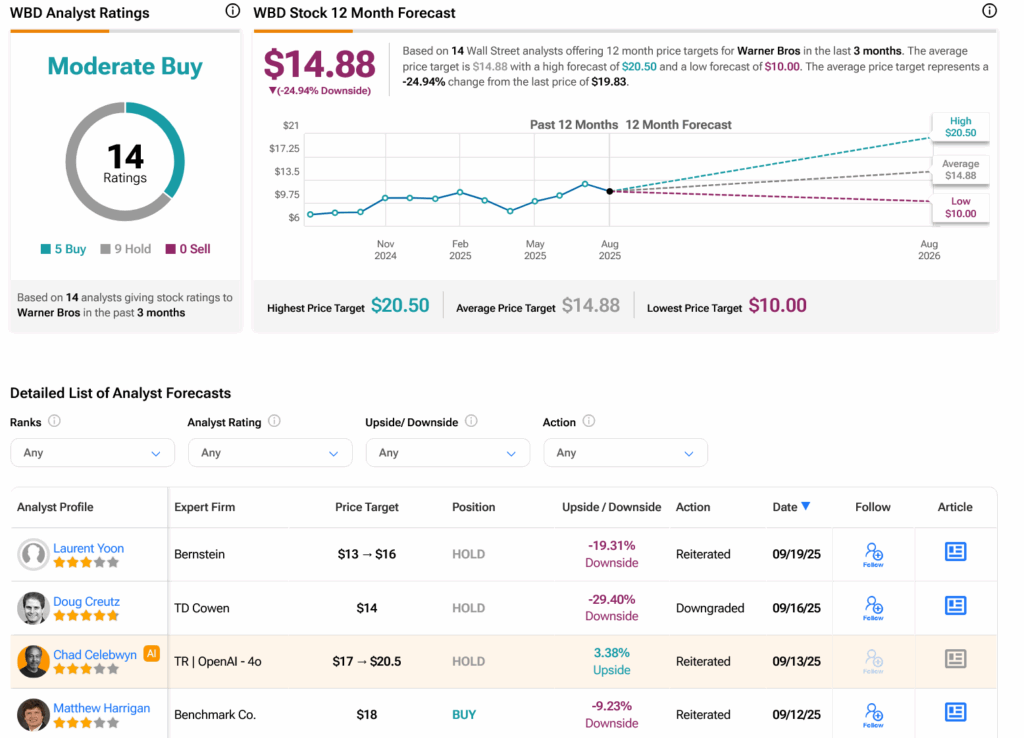

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on five Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 138.83% rally in its share price over the past year, the average WBD price target of $14.88 per share implies 24.94% downside risk.

Disclosure