Why OpenAI’s Potential Nvidia (NVDA) Chip Lease Strategy Makes Financial Sense

OpenAI considers bypassing massive capital expenditures by leasing Nvidia's cutting-edge processors instead of buying them outright.

Strategic Flexibility

Leasing provides immediate access to top-tier computing power without the upfront costs of ownership. This approach lets OpenAI scale resources dynamically as AI model demands fluctuate.

Financial Engineering

The move reflects savvy financial management in an era where chip prices rival Manhattan real estate. Tech giants now treat compute capacity as a variable cost rather than fixed asset.

Market Implications

Nvidia maintains revenue streams while OpenAI preserves capital for other innovations. The arrangement demonstrates how AI leaders optimize resources in a capital-intensive landscape.

This leasing model could redefine how tech companies approach infrastructure—proving sometimes the smartest move isn't owning the gold mine, but paying by the shovel-load.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This comes after Nvidia pledged up to $100 billion to support OpenAI’s new data centers, with its chips and networking equipment expected to make up $350–450 billion of the overall $500–600 billion price tag. If finalized, the lease WOULD likely run for around five years, similar to OpenAI’s existing rental agreements with Oracle (ORCL). By renting instead of buying, OpenAI could spread out costs while still getting the cutting-edge hardware it needs to handle the explosive demand for AI models.

The structure of the deal would also protect Nvidia. In fact, one idea being discussed is for Nvidia to set up a separate entity that borrows money to buy the chips, with the chips serving as collateral and OpenAI’s lease payments covering the loan. Additionally, Nvidia is investing $10 billion in OpenAI at a $500 billion valuation. This will give it a small equity stake while helping OpenAI cover the costs of networking and related systems.

What Is a Good Price for NVDA?

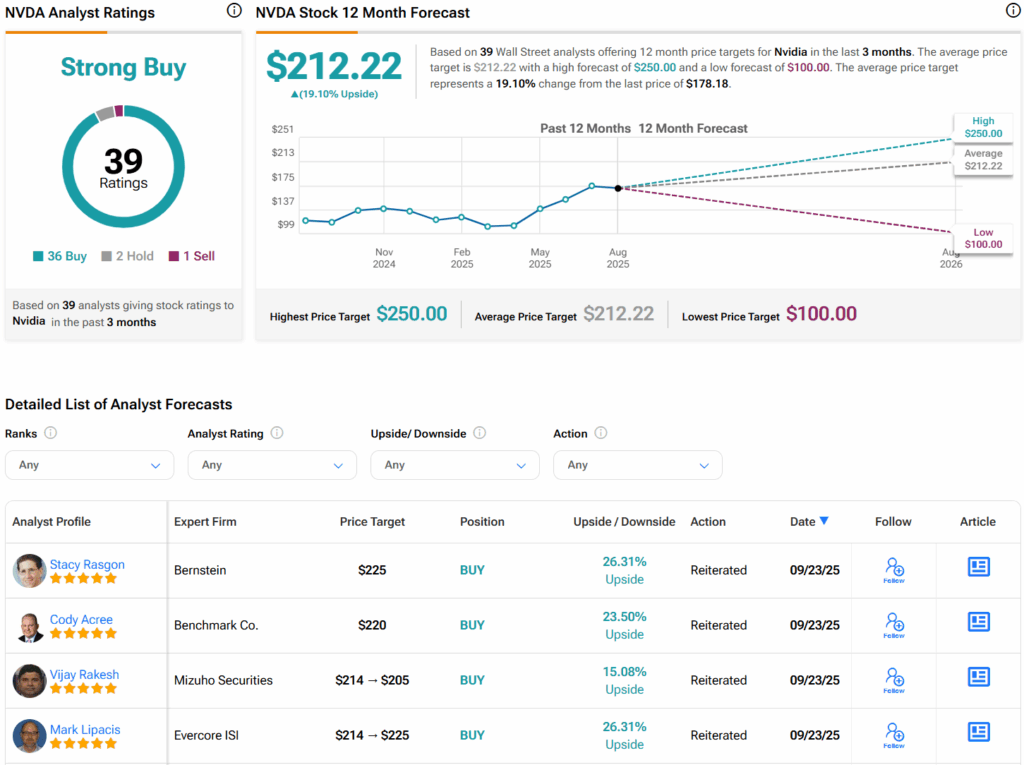

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 36 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $212.22 per share implies 19.1% upside potential.