Alibaba Stock Soars to 4-Year Peak Fueled by Massive $53 Billion AI Investment and Qwen-Max 3 Breakthrough

Alibaba just triggered a market quake with its aggressive AI pivot—sending shares screaming to heights not seen since 2021.

The $53 Billion Gambit

That's not a typo. The Chinese tech giant is deploying fifty-three billion dollars—enough capital to fund several small nations—into artificial intelligence infrastructure. This isn't just dipping toes in the water; it's flooding the entire sector.

Qwen-Max 3: The Catalyst

Their newly launched AI model demonstrates processing capabilities that make competitors look like they're running on dial-up. Early benchmarks show quantum leaps in multilingual processing and real-time decision-making algorithms.

Wall Street's Sudden Affection

Traders who've been ignoring tech stocks for months suddenly remember what growth looks like. The rally demonstrates how quickly institutional money flocks back when there's actual innovation on the table—not just another earnings beat through accounting gymnastics.

This surge proves that even legacy tech giants can still move markets when they stop playing defense and start launching offensive plays. Though let's see how long the love lasts once analysts start questioning the ROI timeline on that $53 billion bet.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of this push, Alibaba announced the launch of its new large-scale AI model, the Qwen3-Max, aimed at strengthening its position in the fast-changing AI race. Alibaba Cloud CTO Zhou Jingren revealed that the model has more than 1 trillion parameters and is designed to excel in code generation and autonomous agent capabilities.

Alibaba Doubles Down on AI Expansion

Wu expects global AI investment to reach about $4 trillion in the next five years. To keep pace, Alibaba plans to increase its spending beyond an earlier commitments and position itself as a “full-stack AI service provider,” building both services and the infrastructure to power them. The company’s cloud division, which already serves regions from the U.S. to Australia, will open new data centers in Brazil, France, and the Netherlands within the next year.

According to Bloomberg Intelligence, the total AI-related capital spending from China’s tech giants, including Alibaba, Baidu (BIDU), Tencent (TCHEY), and JD.com (JD), is expected to exceed $32 billion this year, more than double the $13 billion spent in 2023.

Challenges and Global Competition

Despite the heavy investments, Chinese companies face headwinds due to limited access to Nvidia’s (NVDA) advanced AI chips, pushing them to accelerate the use of in-house semiconductors. Alibaba recently won a major contract from leading wireless carrier, China Unicom, to deploy its own Pingtouge or “T-Head” AI accelerators.

Alibaba’s aggressive AI strategy puts it in direct competition with U.S. tech leaders such as Amazon (AMZN), Alphabet (GOOGL), Meta (META) and Microsoft (MSFT). These companies are reportedly spending a total of up to $320 billion on AI technologies and data center expansion this year.

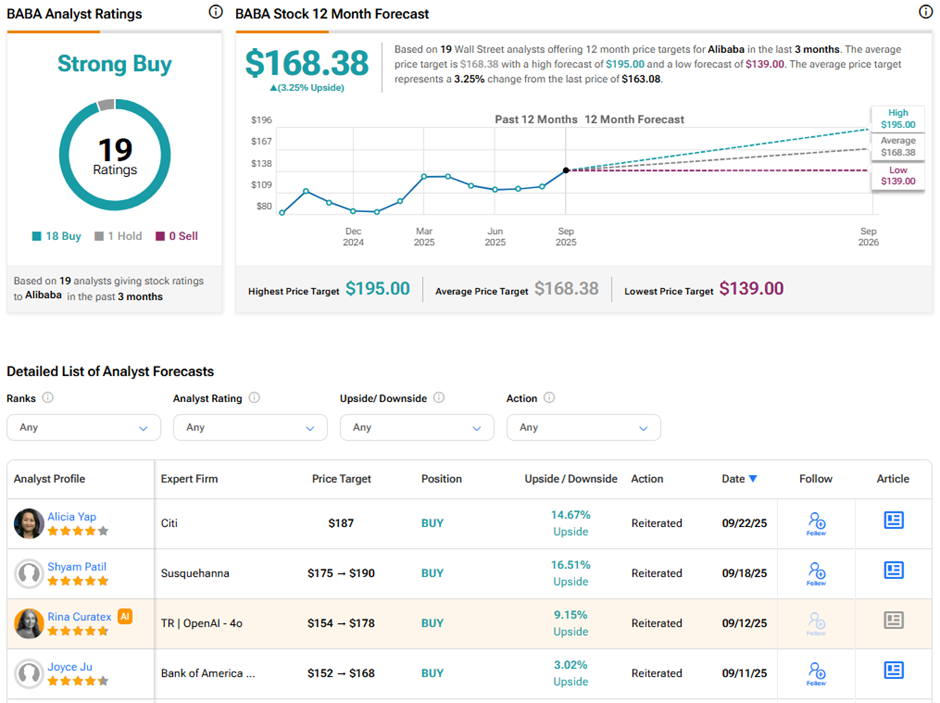

Is BABA Stock a Buy, Hold, or Sell?

On TipRanks, BABA stock has a Strong Buy consensus rating based on 18 Buys and one Hold rating. The average Alibaba price target of $168.38 implies 3.3% upside potential from current levels. Year-to-date, BABA stock has surged nearly 96%.