Cathie Wood’s Bold Portfolio Shift: Dumping Tempus AI and Roku Shares Signals Strategic Pivot

ARK Invest's visionary CEO makes another controversial move—liquidating positions in two former darlings as the market watches every trade.

Strategic Reallocation or Profit-Taking?

Cathie Wood's investment arm continues trimming exposure to Tempus AI and Roku, executing trades that ripple through growth stock portfolios. The sales follow Wood's pattern of actively managing positions despite public conviction in disruptive technologies.

Market analysts track these transactions like hawkish Fed watchers—because when Cathie moves, retail often follows. The latest filings show consistent selling pressure on both positions throughout September.

Tech Sector Rotation Intensifies

While Wood maintains bullish rhetoric on innovation stocks, the实际行动 speaks volumes about portfolio rebalancing priorities. The moves come as interest rate uncertainty continues punishing growth valuations.

Another quarter, another round of 'strategic repositioning'—because nothing says conviction like consistently dumping your flagship holdings when the going gets tough.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wood Trims Tempus and Roku Stakes

The largest trade of the day was the sale of 62,352 shares of Tempus AI through the ARK Innovation ETF (ARKK), totaling $5.35 million. TEM shares have rallied nearly 150% so far this year. Wood is likely reducing exposure to TEM stock due to concerns over the stock’s high valuation and uncertain growth prospects, especially following the Ambry acquisition.

Meanwhile, the ARKK ETF also sold 46,876 shares of Roku, consistent with Wood’s recent selling activity. Wood appears to be booking profits from Roku’s recent price surge, with the stock up 33% so far this year. Following these sales, ROKU has dropped to the fourth-largest holding across ARK’s combined portfolios, down from third place, with a 4.67% weighting.

Wood Accumulates Shares of AACT and ARCT

On the buy side, Wood added to her position in special purpose acquisition company (SPAC) Ares Acquisition Corporation II (AACT). The ARKQ ETF bought 85,142 shares, adding to the prior day’s purchase. AACT shares jumped 6.4% in extended trading yesterday after shareholders approved its merger with Kodiak Robotics, Inc. Following the merger, AACT will shift to Delaware from Cayman Islands and change its name to Kodiak AI, Inc. The shares are expected to trade on Nasdaq from September 25, 2025, under the ticker symbol “KDK.”

Additionally, the ARK Genomic Revolution ETF (ARKG) added 28,272 shares of biotech firm Arcturus Therapeutics Holdings (ARCT). This MOVE shows ARK’s growing interest in the biotech field, where Arcturus is advancing with its innovative RNA-based treatments for rare liver and respiratory diseases.

Wood also added to her position in Chinese autonomous mobility company Pony AI (PONY), buying 85,142 shares through the ARK Autonomous Technology and Robotics ETF (ARKQ).

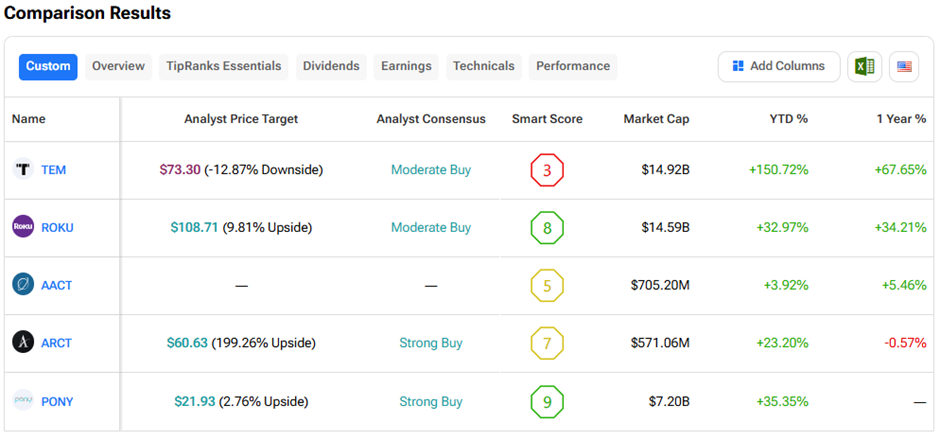

Here’s how these stocks perform on TipRanks’ Stock Comparison Tool: