J.P. Morgan Urges Investors: Buy Apple Stock Now as iPhone 17 Launch Approaches

Wall Street giant breaks out the bull horn for tech's favorite fruit.

Timing the Tech Wave

J.P. Morgan analysts just issued a rare buy recommendation that's turning heads across trading floors. Their thesis? Apple's upcoming iPhone 17 represents a generational leap that mainstream investors haven't fully priced in yet.

The institutional memo cites supply chain intelligence suggesting production timelines are accelerating beyond expectations. While competitors chase incremental updates, Apple's rumored AI integration and hardware redesign could create another product cycle supernova.

Market Psychology Play

Street sentiment often underestimates Apple's ability to reinvent mature product categories—remember when analysts wrote off the smartphone market as saturated right before the iPhone X supercycle? This time, institutional skepticism creates the perfect contrarian setup.

The recommendation comes with typical investment bank hedging, of course. Because nothing says conviction like appending seventeen pages of risk factors to a 'strong buy' rating.

Positioning for the September Catalyst

With launch events historically driving 8-12% pre-announcement rallies, J.P. Morgan's call essentially front-runs the seasonal pattern. It's the financial equivalent of recommending umbrellas right before monsoon season—technically correct, but timing is everything.

Whether this becomes another legendary trade or just another footnote in quarterly earnings reports depends entirely on whether Apple delivers magic or marginal improvements. The smart money's betting on the former.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s particularly disappointing for one of the world’s largest publicly-traded companies, especially one that operates in the white-hot tech space. The pressures on Apple’s stock price this year have come from a litany of sources, ranging from worries over tariffs that could inflate iPhone manufacturing costs to frustration with the company’s slow progress in AI.

Against that backdrop, the company’s management is pinning its hopes on a turnaround with the launch of the iPhone 17. Though the initial reactions weren’t exactly ecstatic, customers were nevertheless lining up when the new models hit the shelves last Friday.

That potential resurgence hasn’t gone unnoticed on Wall Street. J.P. Morgan analyst Samik Chatterjee is feeling quite positive about AAPL as the iPhone 17 wave reaches stores around the world.

“Following on from favorable demand indications in the early days of the launch of the iPhone 17 series, we are raising our volume expectations for FY26,” explains the 5-star analyst, who is among the top 1% of Wall Street pros.

It’s not just the iPhone 17 numbers that Chatterjee finds encouraging, but also the company’s future plans for introducing a foldable iPhone in the fall of next year. This should create a healthy stream of revenues both this year and next.

“For both FY26 and FY27, we expect price/mix tailwinds to remain a significant contributor to revenue growth,” adds Chatterjee.

Beyond the iPhone revenues, the analyst cites improved gross margins thanks to an improving tariff climate, services growth that is “resilient and robust” and lower risks coming from regulatory and legal issues.

In particular, the lessening tariff fears and increased iPhone revenues have convinced Chatterjee to increase his EPS forecast for FY26/27 to $8.20/$9.50, up from previous projections of $7.55/$8.45, respectively.

The analyst is therefore assigning AAPL an Overweight (i.e. Buy) rating. He is raising his price target from $255 to $280, which WOULD translate into gains approaching 10%. (To watch Samik Chatterjee’s track record, click here)

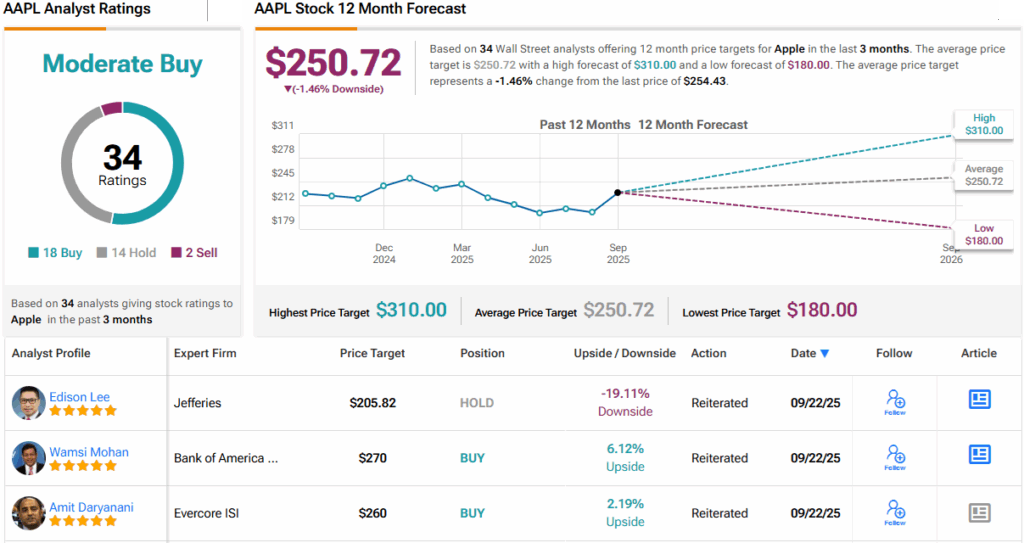

Looking beyond his call, the broader analyst community presents a more nuanced picture. AAPL garners 18 Buys, 14 Holds, and 2 Sells, resulting in a Moderate Buy consensus rating. The average 12-month price target sits at $250.72, suggesting the shares may remain range-bound for the foreseeable future. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.