Want Palantir (PLTR) Exposure Without the Risk? Here’s Your 2025 Playbook

Wall Street's favorite surveillance stock just got a backdoor entry.

Bypassing the PLTR Volatility Trap

Forget buying shares outright—crypto derivatives now let you mirror Palantir's movement without owning the underlying asset. Synthetic assets track PLTR's price action while keeping your capital in decentralized protocols.

The DeFi Hedge Play

Structured products on-chain create automatic stop-loss positions that traditional brokers would charge 2% management fees for. These smart contract-based instruments execute limit orders even when you're offline—something legacy finance still can't manage efficiently.

Why 2025 Changes Everything

With regulatory clarity finally emerging, institutional-grade protocols now offer exposure to public equities through tokenized wrappers. The irony? Traditional finance spent decades building walls that code just bypassed in 18 months.

Sometimes the safest way to play a risky stock is to never actually touch it—a concept that would give your financial advisor night sweats.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors seeking exposure to PLTR stock may consider the iShares Evolved US Technology ETF (IETC) and the iShares Expanded Tech-Software Sector ETF (IGV). Let’s take a deeper look at these two ETFs.

iShares Evolved US Technology ETF

The IETC ETF provides exposure to U.S. tech companies with strong domestic operations, revenues, and production. It uses a proprietary classification system to focus on firms driving digital transformation, including software, semiconductors, and data analytics. Importantly, PLTR accounts for 11.26% of IETC’s total holdings.

Some of the top holdings in the IETC ETF include Broadcom (AVGO), Nvidia (NVDA), and Amazon (AMZN). Overall, the ETF has $916.20 million in assets under management (AUM) and an expense ratio of 0.18%. Over the past six months, the IETC ETF has generated a return of 29.89%.

On TipRanks, IETC has a Strong Buy consensus rating based on 85 Buys and 17 Holds assigned in the last three months. At $114.60, the average IETC ETF price target implies 11.59% upside potential.

iShares Expanded Tech-Software Sector ETF

The IGV ETF invests in U.S. software and services companies, aiming for growth and income generation. It allows investors to tap into the growth of cloud computing, cybersecurity, enterprise software, and digital platforms. PLTR stock constitutes 10.53% of the ETF’s holdings.

Apart from PLTR, some of the top stocks in the IGV ETF are Oracle (ORCL), Microsoft (MSFT), and Salesforce (CRM). Overall, the ETF has $10.32 billion in AUM. Also, it has an expense ratio of 0.39%. The IGV ETF has returned 22.8% in the past six months.

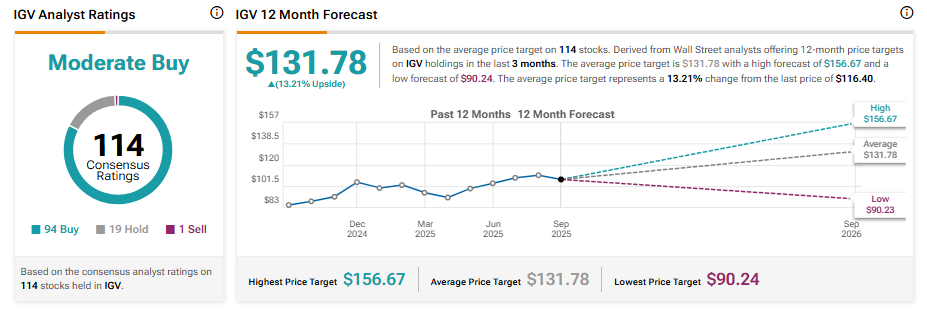

Turning to Wall Street, the ETF has a Moderate Buy consensus rating. Of the 114 stocks held, 94 have Buy ratings, 19 have Hold ratings, and one has a Sell rating. At $131.78, the average IGV ETF price target implies a 13.21% upside potential.

Concluding Thoughts

ETFs provide indirect exposure to PLTR, reducing risk compared to investing directly in the stock. Furthermore, ETFs are a liquid and transparent way to participate in the market. Investors seeking ETF recommendations might consider IETC and IGV, as these ETFs offer exposure to Palantir stock.