Eli Lilly (LLY) Plows $6.5 Billion Into Massive Texas Manufacturing Hub

Pharma giant makes Texas-sized bet on production capacity

Eli Lilly just dropped a staggering $6.5 billion on a new manufacturing plant in Texas—because when you're printing money from weight-loss drugs, you might as well build monuments to metabolic capitalism.

The Scale Play

This isn't just expansion—it's a full-scale industrial invasion. Lilly's deploying more capital than some small nations' GDP to cement its manufacturing dominance. They're building fortress-like production capacity while competitors scramble to catch up.

Strategic Ground

Texas offers more than just barbecue and low taxes—it's becoming America's biotech heartland. The state's throwing incentives at pharma companies like confetti, and Lilly just caught the whole bag.

Market Calculus

While traditional investors cheer this 'prudent capital allocation,' crypto natives watch with amusement—wondering when pharma will discover blockchain for supply chain tracking. Until then, they'll keep building brick-and-mortar empires with 20th-century efficiency.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Texas facility will manufacture other medications besides the obesity pill that the company plans to launch worldwide in 2026, pending regulatory approval. However, analysts and investors are mostly fixated on the weight-loss pill that is expected to be a global bestseller for Eli Lilly.

The Texas plant is the latest in a series of U.S. investments from Eli Lilly. The company announced earlier this year that it plans to spend $27 billion to build four new U.S. manufacturing plants, adding to $23 billion of investments made since 2020.

More to Come

Eli Lilly said it will announce two remaining U.S. manufacturing sites by year’s end. Analysts say that production capacity for Eli Lilly’s new weight-loss pill, called Orforglipron, is critically important as the company races to bring it to market and maintain its dominant market position.

Eli Lilly and other drug makers have been scrambling to boost their production in the U.S. as President Donald TRUMP threatens to impose tariffs on pharmaceuticals imported into America. President Trump is encouraging companies to re-shore production and manufacturing to the U.S.

The new manufacturing plant is expected to create 615 jobs in the Houston area, including highly skilled engineers, scientists, operations personnel, and lab technicians. It will also create 4,000 construction jobs.

Is LLY Stock a Buy?

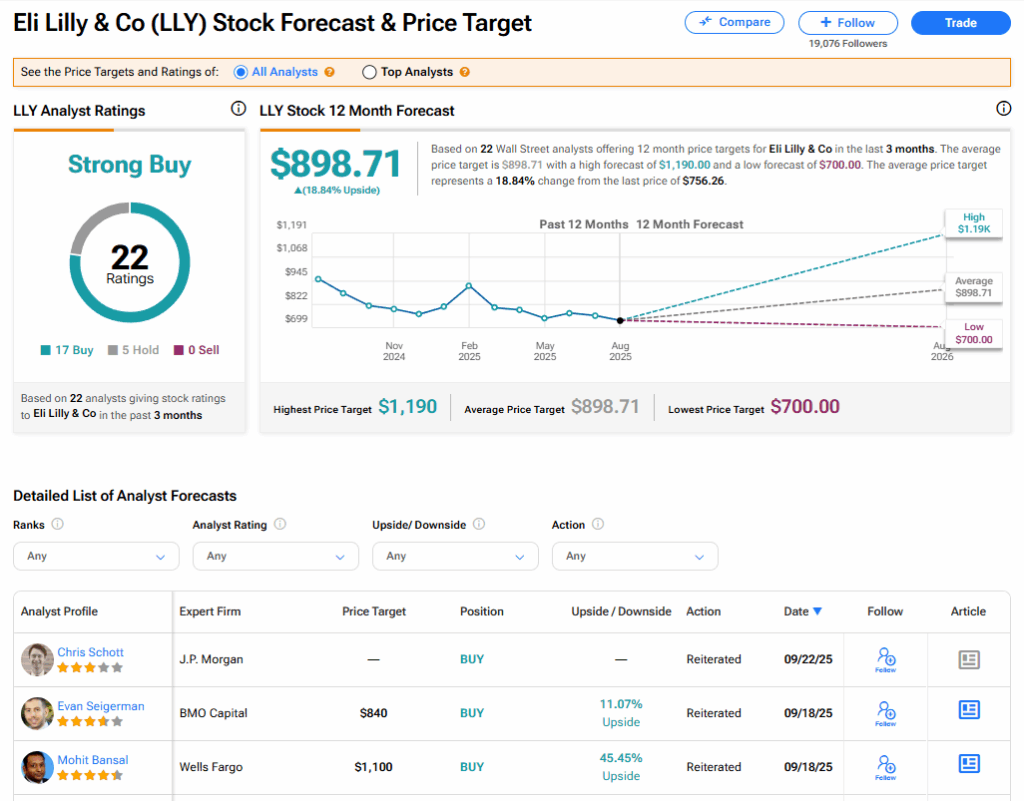

The stock of Eli Lilly has a consensus Strong Buy rating among 22 Wall Street analysts. That rating is based on 17 Buy and five Hold recommendations issued in the last three months. The average LLY price target of $898.71 implies 18.84% upside from current levels.