Gold Surges Toward $4,000 as Russian Jet Threats and Rate Cut Hopes Fuel Rally

Gold's unstoppable bull run just hit another gear—pushing toward the psychological $4,000 barrier as geopolitical tensions and monetary policy shifts create the perfect storm.

Geopolitical Firestorm Ignites Safe-Haven Demand

Escalating threats to Russian aircraft have traders scrambling for traditional safe havens. Gold's historic role as a crisis hedge kicks into overdrive while digital assets watch from the sidelines.

Interest Rate Speculation Adds Rocket Fuel

Growing consensus that central banks will pivot to easing policies undermines fiat currencies—making non-yielding assets like gold suddenly more attractive. Because nothing says 'stable monetary policy' like emergency rate cuts every six months.

The $4,000 threshold now looms as both technical resistance and psychological benchmark. Gold's relentless climb exposes the deep structural anxieties in traditional finance—while proving some old-school assets still pack a punch in turbulent times.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

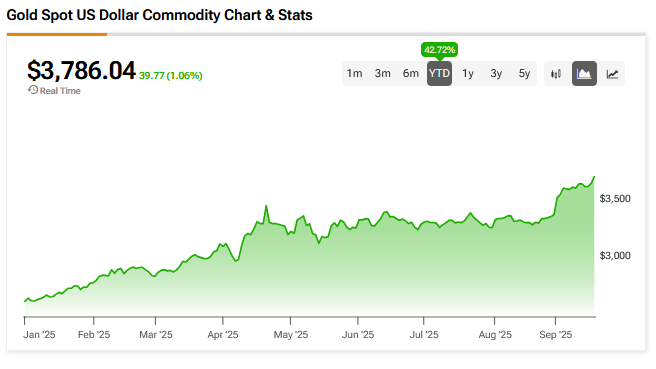

Gold futures gained 0.3% hitting $3,787.80 per ounce in early trading, while the spot price ROSE to a new high of $3,789.

Gold Surge

Gold has been on quite the surge already this year gaining 40% since the start of January, and nearly 10% alone in the last month – see below:

That’s because it is being increasingly seen by investors as a SAFE haven at a time of deep uncertainty in global economics and politics.

Indeed, it seems that the latest fillip in the gold price was as a result of growing geopolitical tensions in Ukraine, the Middle East and warnings from Nato countries such as the U.K. and Poland that they WOULD shoot down any Russian jets making further excursions into members’ airspace.

“Tense geopolitical risks in Ukraine and Gaza” are among the key drivers of gold’s momentum, said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank. “For Gaza, an increasing number of developed nations are recognising the state of Palestine, straining relations with Israel and the US – the latest being France,” she said.

Gold Hopes

The gold price is also being buoyed by growing expectations of further U.S interest rate cuts and even mounting concerns that stock market are surging just a little too fast for some investors liking. Gold tends to look more attractive to investors when interest rates are lower.

Another driving factor is central banks scooping up gold as they look to diversify their reserves, reduce dependence on the U.S. dollar and protect themselves against that global uncertainty.

“I think it’s predominantly a factor of monetary policy expectations, potentially lower interest rates, and upside risks to inflation,” said capital.com analyst Kyle Rodda.

Leading bank Goldman Sachs (GS) has forecast that these drivers, in addition to geopolitical uncertainty, could see the gold price zoom past $4,500 an ounce next year and even hit $5,000 if investors keep piling into the precious metal.

It forecasted that gold could hit $3,700 by the end of 2025 and $4,000 by mid-2026.

Deutsche Bank (DB) has forecast that the gold price will race to $4,000 in 2026 buoyed by strong demand from central banks given global uncertainty and interest rate cuts.

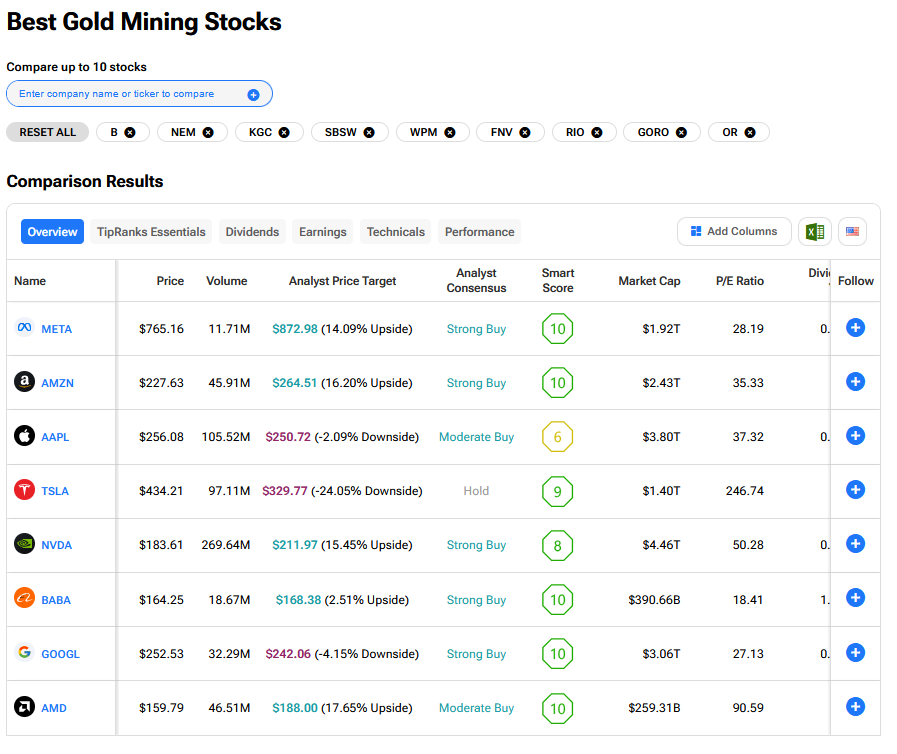

What are the Best Gold Mining Stocks to Buy Now?

We have rounded up the best gold mining stocks to buy now using our TipRanks comparison tool.