Opendoor Stock (OPEN) Plummets After Hedge Fund Manager Torches Business Model as ’Total Garbage’

Another day, another tech disruptor gets its wings clipped by Wall Street reality.

The House That Algorithms Built Crumbles

Opendoor's digital-first home flipping model hit a brick wall when a prominent hedge fund manager eviscerated its entire operational premise. The blistering critique sent OPEN shares into freefall as investors questioned whether algorithm-driven real estate could withstand actual market pressures.

When Disruption Meets Due Diligence

The fund manager's scathing assessment exposed fundamental flaws in the iBuying model's economics—questioning everything from acquisition strategies to margin sustainability. Turns out houses aren't exactly NFTs you can flip with a few lines of code.

Tech's Real Estate Gambit Hits Reality Check

As interest rates bite and housing markets cool, Opendoor's data-driven approach faces its toughest stress test yet. The company now must prove its algorithms can navigate actual market turbulence rather than just bull market conditions.

Another reminder that while tech can optimize everything, some industries—like real estate—still require good old-fashioned fundamentals. But hey, at least they tried to blockchain the housing market before the crash.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hedge Fund Manager Warns Investors About Opendoor Stock

Noble, who has founded two billion-dollar hedge funds and was an assistant to popular investor Peter Lynch, pointed out that Opendoor has lost money every single year since it was founded. He added that OPEN’s business model doesn’t work and had “atrocious” unit economics. Noble also believes that the company’s cost reduction efforts “will not MOVE the needle.”

Noble cautioned investors about OPEN stock’s lofty valuation despite weak fundamentals. He noted that OPEN stock trades at 22x EV/revenue (enterprise value/revenue), with a “lousy balance sheet and is perennially loss-making.” In contrast, the hedge fund manager highlighted that rival Compass (COMP) trades at 0.9x EV/revenue, has a strong balance sheet, and is profitable.

“Go ahead and speculate if you wish, but don’t DARE pretend that there is a fundamental case,” said Noble.

Despite yesterday’s selloff, Opendoor stock is still up about 424% year-to-date. The bullish comments about Opendoor by Eric Jackson, the founder and president of EMJ Capital, in July sparked a meme stock rally. Interestingly, on Monday, the hedge fund manager triggered a massive rally in Better Home & Finance Holding (BETR) stock.

What Is the Price Target for Opendoor Stock?

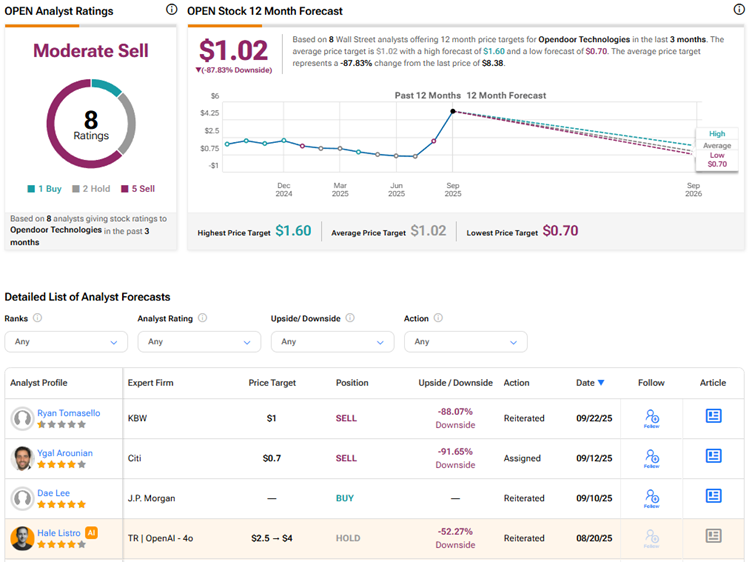

Wall Street has a Moderate Sell consensus rating on Opendoor Technologies stock based on one Buy, two Holds, and five Sell recommendations. The average OPEN stock price target of $1.02 indicates about 88% downside from current levels.