SEBI Plans Bold Moves to Cool F&O Frenzy - Longer-Tenure Equity Derivatives on the Table

Regulator targets derivatives market overheating with extended contract structures

SEBI's latest power play aims to inject maturity into India's hyperactive derivatives scene. The watchdog eyes longer-tenure equity derivatives as its next weapon against speculative excess.

Market Calibration Strategy

Extended contract durations could force traders to think beyond weekly expiry cycles. The move signals regulatory discomfort with retail's obsession with quick-turnaround bets.

Structural Shift Ahead

Longer-tenure products might actually attract institutional money seeking hedging alternatives. Because nothing says 'sophisticated market' like giving gamblers more time to lose their shirts.

SEBI isn't just watching from the sidelines—it's rewriting the rulebook for India's financial adrenaline junkies.

Also read

SEBI to issue directions on derivatives contracts expiry this month

SEBI whole-time member Ananth Narayan said the industry WOULD be given adequate time to adjust. “We are considering ways to improve the tenor and maturity profile of derivative products so that they better support sustained capital formation and foster all-around trust in the ecosystem,” he said.

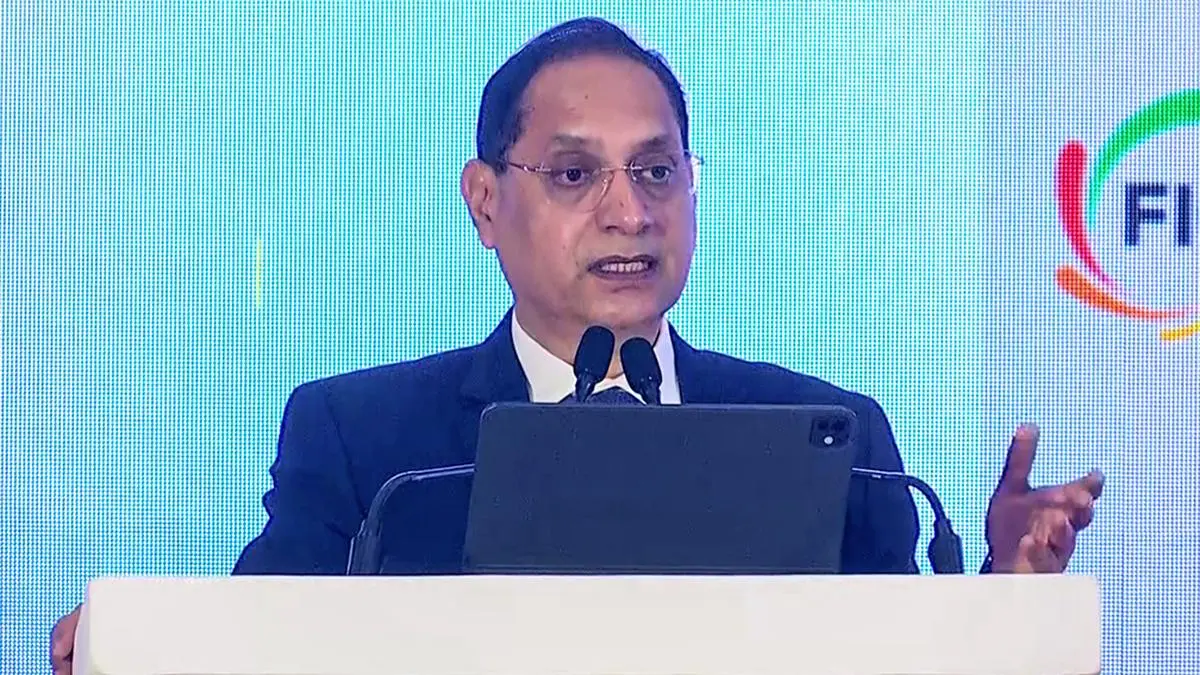

SEBI Chairman Tuhin Kanta Pandey | Photo Credit: SHASHANK PARADE

The regulator’s focus is also on deepening the cash equity market through possible incentives or margin relaxations. Average daily traded volumes in the cash segment have grown over 25 per cent annually in the past five years to more than ₹1 trillion, but short-term derivative volumes have risen even faster.

Framework on cards

SEBI is also examining a product suitability framework for the equity derivatives segment to ensure participation is informed, suitable, and appropriate for investors. “Here again, stakeholder engagement will be key–we are open to all constructive ideas,” Narayan said.

The regulator has also formed a special team inside the surveillance department, along with NSE, to study its surveillance following alleged derivatives manipulation by US-based firm Jane Street, said WTM Kamlesh Varshney.

Retail participation in derivatives has surged sharply in recent years, prompting SEBI to limit the number of weekly expiries, raise lot sizes, and introduce a slew of other curbs. A recent SEBI study showed that retail investors’ losses widened by 41 per cent to ₹1.06 lakh crore in FY25 in equity derivatives, with 91 per cent of individual traders continuing to incur losses.

Published on August 21, 2025