Silver’s Clean-Tech Revolution: How Green Demand Is Reshaping Markets in 2025

Solar panels and EV factories are swallowing silver at unprecedented rates—and traditional investors barely saw it coming.

The Green Metal Squeeze

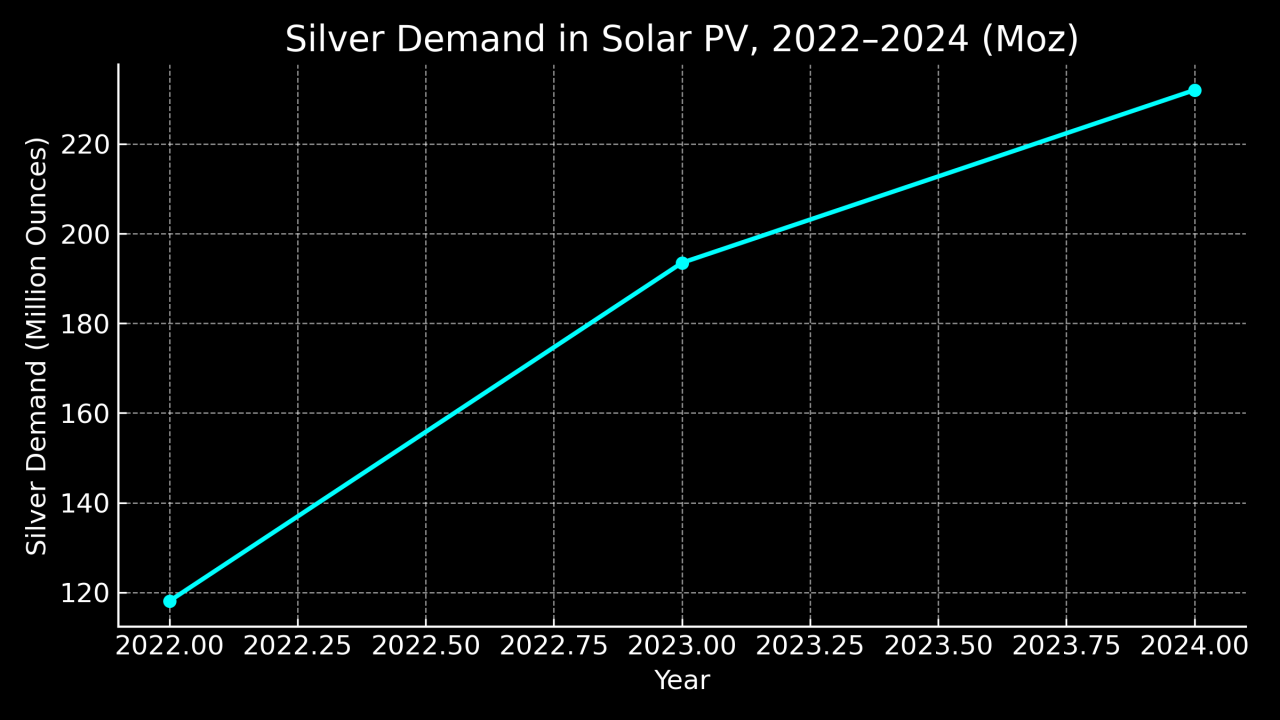

Silver's industrial demand now outpaces jewelry and silverware combined. Photovoltaic installations alone consumed over 180 million ounces last year—enough to line every rooftop from California to Tokyo.

Price Volatility Meets Climate Goals

While silver spot prices swung 34% this quarter, mining output stagnates. Primary silver mines can't keep up with solar's insatiable appetite—secondary sources and recycling can't fill the gap.

Investment Implications

Traders who dismissed silver as 'gold's boring cousin' now chase contracts like tech stocks. Physical ETF holdings hit record highs while industrial users hedge future supply—creating a perfect bullish storm.

As decarbonization targets clash with finite supply, silver's role evolves from monetary relic to essential energy transition metal. Wall Street analysts still price it like a commodity—but clean-tech demand treats it like a strategic resource.

Solar PV: The Immediate, Quantifiable Demand Shock

Solar cells use silver paste with very high silver content, and the PV sector accounted for about 19% of global silver demand in 2024.

That share translates into hundreds of millions of ounces used for solar applications, so each uptick in deployment adds concrete metal demand that the market must source.

Substitutes exist but moving away from silver at scale adds cost or efficiency trade-offs for manufacturers.

RECOMMENDED: Silver’s Surge: Outshining Gold in 2025

Broader Clean-Tech and Industrial Demand For Silver

Beyond PV, electrification and electronics raised industrial consumption to a record level, 680.5 Moz in 2024, which is a steady, recurring draw on supply.

As industry takes a larger and structural share of demand, silver behaves less like a pure monetary or speculative asset and more like a strategic industrial input. That change raises price sensitivity when industrial production grows.

ALSO READ: Will The Silver Price Ever Rise To $100?

Supply Constraints and Investment Amplification For Silver

The market recorded a large deficit in 2024, tightening available inventories. At the same time investors put substantial metal into silver ETPs, with net inflows of about 95 Moz in the first half of 2025.

Because most silver comes as a by-product of other mines, mine output cannot quickly expand to close the gap. The result is a feedback loop where industrial demand and investor flows remove mobile metal and push prices higher.

RECOMMENDED: Is Silver A Good Investment Right Now?

Conclusion

Clean-tech adoption creates a structural reason to expect firmer silver prices in 2025, but the rally’s path depends on three numbers: PV deployment, ETP flows, and mine output. Track those metrics to judge whether prices run higher or stabilize.

When is The Best Time To Buy Gold & Silver?

To receive key alerts and analysis on the best times to buy Gold and Silver, you should consider Joining the original market-timing research service — delivering premium insights since 2017.

InvestingHaven alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience.

This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Here’s how we’re guiding our premium members (log in required):

- Silver Rally Fueled by Absent Speculators (Sept 20)

- What Happens When Silver Hits 50 USD/oz? (Sept 13)

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean? (Aug 16)