Billions Pour Into Stablecoins Ahead of Fed Decision—Binance Reports Massive Inflows

Billions flood stablecoins as traders brace for Fed volatility.

Hedging Against Uncertainty

With the Federal Reserve's rate decision looming, crypto markets see unprecedented stablecoin movements. Binance reports massive capital repositioning—investors clearly seeking shelter from potential market turbulence.

The Safety Play

Traders aren't exiting crypto—they're parking funds in stable assets while waiting for clarity. This isn't fear; it's sophisticated risk management in a market that's finally growing up.

Timing The Re-entry

Smart money knows rate decisions create opportunities. These inflows represent dry powder ready to deploy once the Fed's move shakes out—watch for the snap-back into risk assets post-announcement.

Because nothing says 'stable' like parking billions in unregulated digital IOUs before a central bank meeting—the irony writes itself.

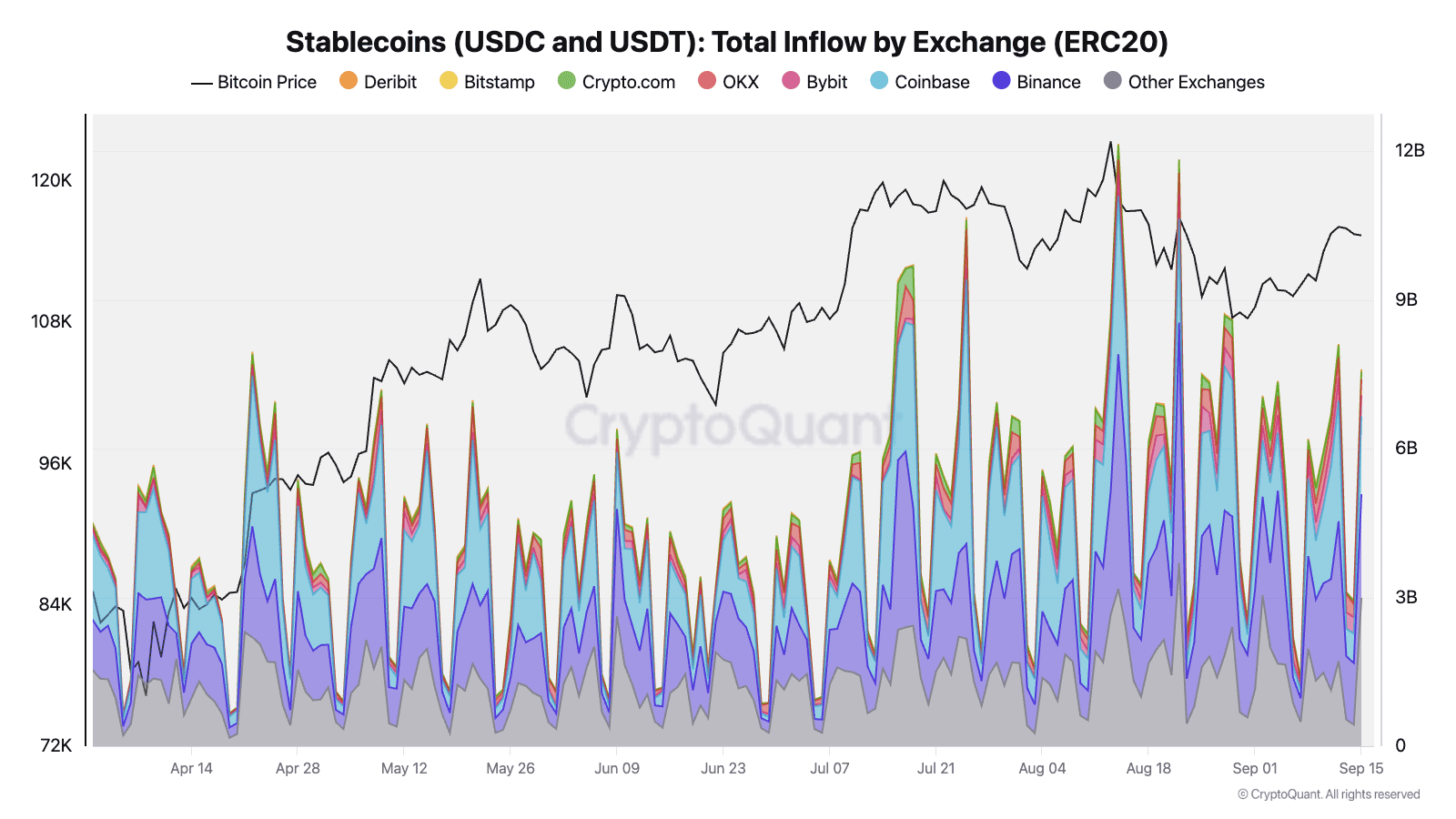

Stablecoin inflows to different platforms. Source: CryptoQuant.

Stablecoin inflows to different platforms. Source: CryptoQuant.

A significant role in the growth was played by large holders. The average USDT deposit on Binance reached $214,000, almost double the July figure, the company noted.

Analysts attribute this to the Fed’s recent decision, which is likely to have an impact on the macroeconomic situation and digital asset markets.

In addition, the number of altcoin deposits on centralised platforms has risen to 55,000 in the last week, well above the early 2025 levels (20,000-30,000). Almost half of this volume — 25,000 deposits — came from Binance.

The exchange is also leading in terms of the number of unique addresses, the release emphasises. This indicates high liquidity and activity on the platform, making it easier for traders to quickly access altcoins and favourable transactions, Binance said.

Сообщение Binance says billions of dollars in stablecoin inflows ahead of Fed rate decision появились сначала на INCRYPTED.