Ethereum Shatters Records: Soars Past $4880 Milestone

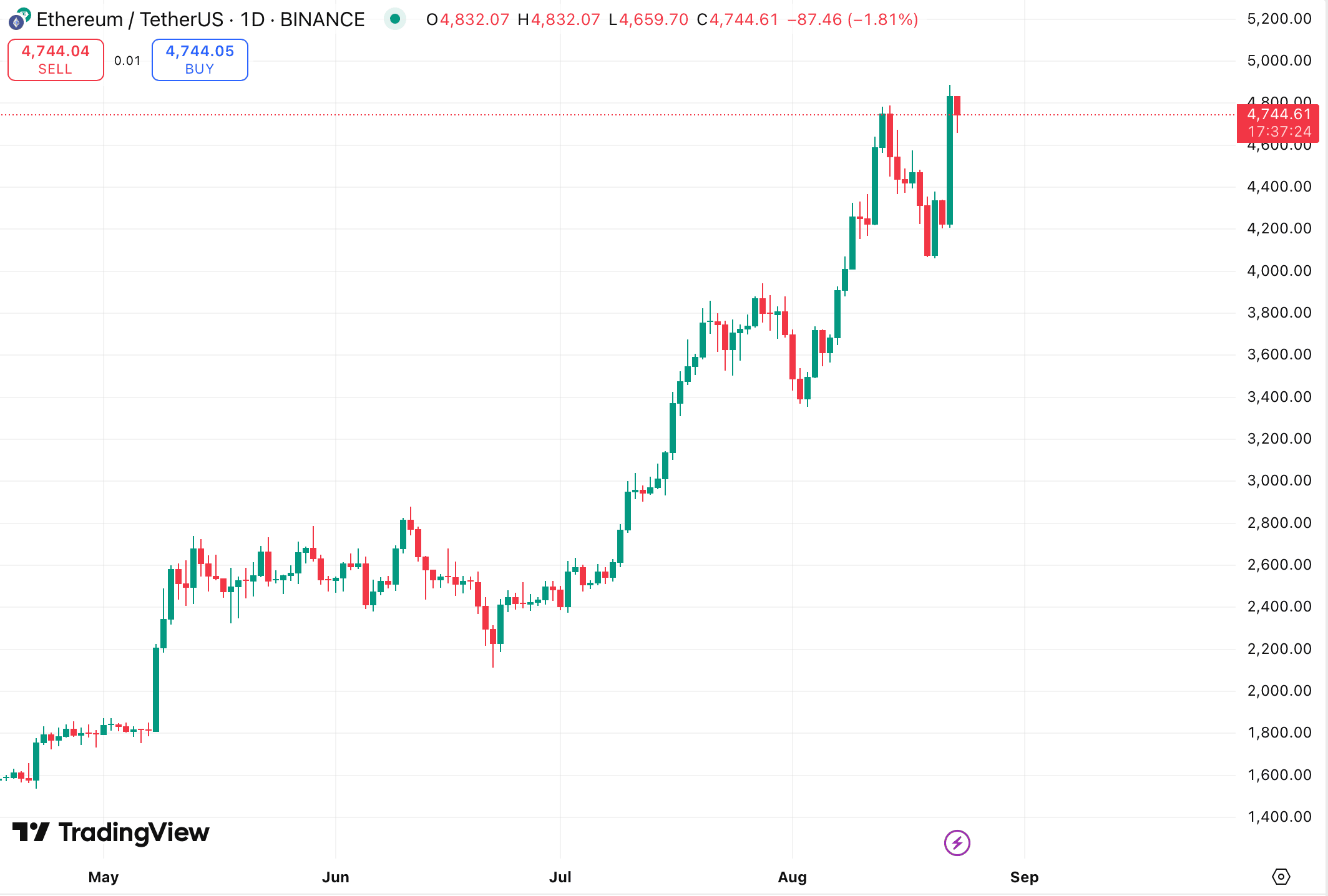

Ethereum just blasted through another psychological barrier—touching $4880 in a stunning display of market momentum.

Market Dynamics Unleashed

Traders are piling in as institutional interest surges and DeFi activity hits unprecedented levels. The rally isn't slowing down—liquidity floods major exchanges while options volume spikes.

Technical Breakout Confirmed

Key resistance levels vaporized in hours. Chart analysts point to clean bullish continuation patterns with no significant pullbacks in sight.

Macro Tailwinds Fueling Fire

While traditional markets grapple with inflation concerns, digital assets continue attracting capital seeking asymmetric returns. Another reminder that legacy finance moves at glacial speed compared to crypto markets.

Where's the ceiling? Nobody knows—but today's action proves Ethereum's momentum remains utterly unstoppable. Sometimes the market does what it wants, regardless of what Wall Street analysts scribble in their quarterly reports.

Daily chart of ETH/USDT on Binance. Source: TradingView.

Daily chart of ETH/USDT on Binance. Source: TradingView.

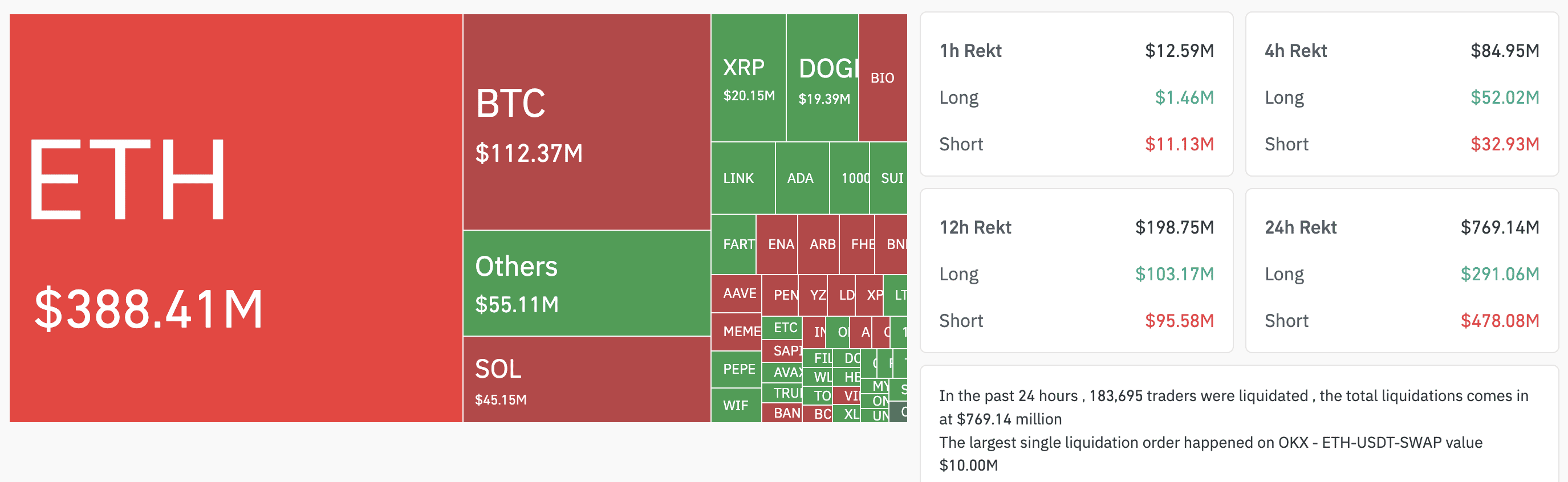

The growth in the crypto market led to liquidations on futures contracts worth $769.14 million. Holders of short positions in Ethereum suffered losses of $388.41 million (or 50%). A total of 183,695 traders recorded losses. The share of liquidations among bitcoin traders was $112.37 million.

Earlier, we wrote that crypto analyst Alessandro Ottaviani called Ethereum a “falling knife” in the crypto market due to its prolonged downward trend.

However, since May of this year, the situation has begun to change, as you can read in a separate article:

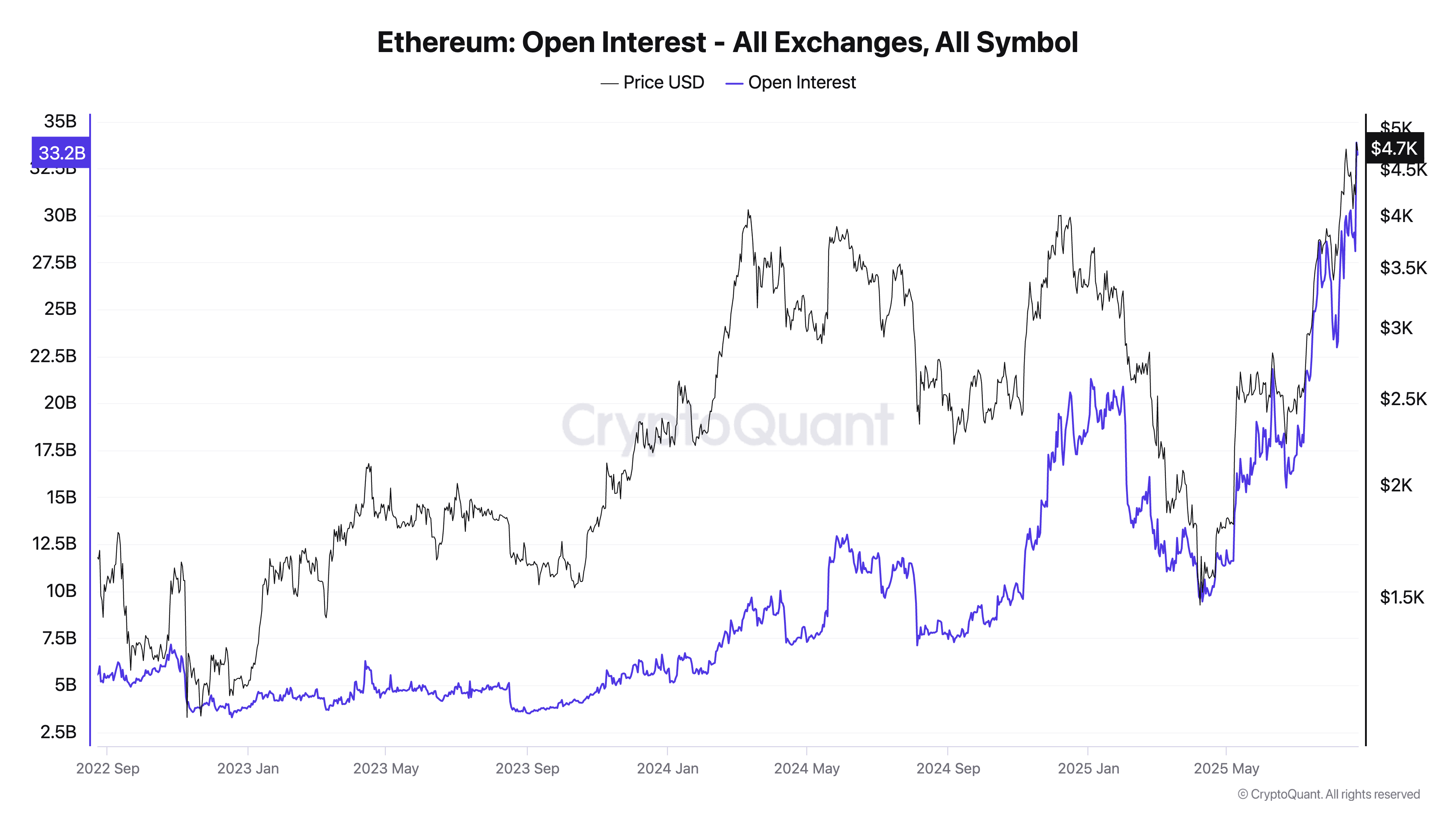

As the value of the analyzed cryptocurrency grew, traders’ activity on futures positions increased. The level of open interest stood at $33.2 billion as of 23 August:

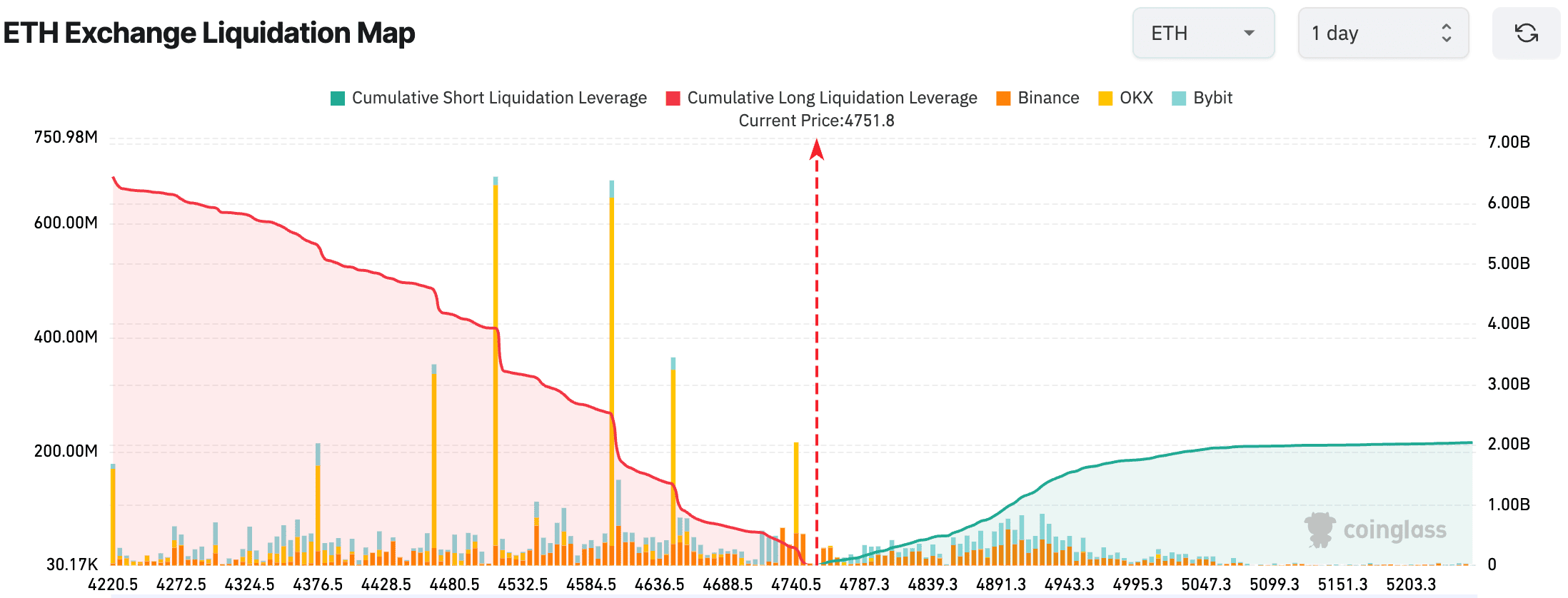

If the price drops to $4,220, the volume of liquidations on long positions will amount to $6.45 billion:

At the same time, Ethereum’s capitalization reached $573.46 trillion with an increase of 10.7%, according to CoinMarketCap.

As a reminder, from August 11 to 15, 2025, spot Ethereum ETFs received a record investment of $2.85 billion, and on August 21, the positive dynamics in the segment resumed after four consecutive trading days in the red. Ethereum-based exchange-traded funds raised $287.61 million.

Arthur Hayes, co-founder of BitMEX predicted that the price of Ethereum will rise to $20,000 in the current market cycle.

Сообщение Ethereum set new high above $4880 появились сначала на INCRYPTED.