1 Reason Chevron Stock Dominates My 2025 Portfolio Strategy

Energy Giant's Crypto Pivot Sends Shockwaves Through Traditional Finance

The Unstoppable Convergence

Chevron's bold embrace of blockchain technology for energy trading settlements cuts through legacy banking systems like a hot knife through butter. While Wall Street analysts scratch their heads about 'digital assets,' the company quietly built infrastructure that bypasses three intermediary banks per transaction.

Fueling the Future

Their proprietary trading platform processes settlements in minutes instead of days—slashing operational costs by 40% while traditional energy companies still push paper. The move positions Chevron not as an oil company dabbling in tech, but as an energy-tech hybrid leaving competitors in the digital dust.

Because nothing disrupts quite like a 100-year-old corporation adopting crypto faster than your average hedge fund manager—who probably still thinks Bitcoin is just for buying pizza.

Chevron offers protection

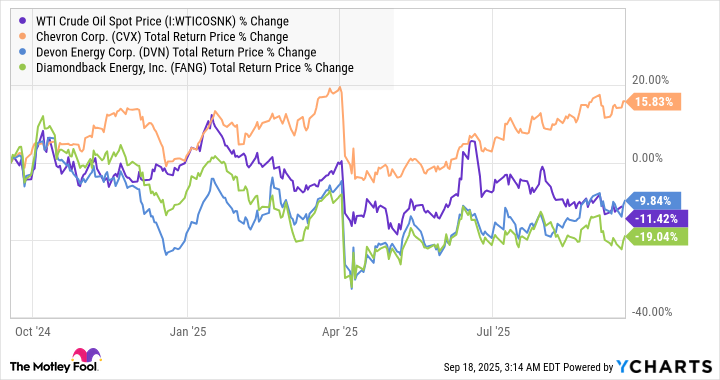

The chart below compares Chevron to two higher-quality energy exploration and production companies,and. While the others have performed in line with the declining price of oil, Chevron has outperformed.

WTI Crude Oil Spot Price data by YCharts

This is a valuable demonstration of what many income-seeking investors are looking for from energy stocks. While pure-play exploration and production stocks have demonstrated a correlation with the price of oil, the benefits of Chevron being a vertically integrated oil major are becoming increasingly apparent.

This means it combines upstream operations (exploration and production) with downstream operations (refining, marketing, and chemicals), and in doing so secures the cash-flow generation to support a growing dividend.

In addition, Chevron's $53 billion acquisition of Hess Corporation has added significant international assets (in Guyana) that tend to have a lower break-even cost (the minimum price of oil a producer can cover costs in producing oil), and adds assets in the Bakken (North Dakota) to Chevron's existing strength in the Permian (West Texas and New Mexico).

Image source: Getty Images.

What it means to investors

While Chevron will never be completely immune from falling oil prices, its downstream assets and efforts to diversify by acquiring lower break-even-cost international assets protect it from a moderated decline, which is good news for income-seeking investors. At the same time, it has upside potential coming from a possible increase in oil prices.