Is This the Next Stock the U.S. Government Takes a Stake In?

Government Intervention Looms—Which Stock Gets the Golden Handcuffs Next?

Market Speculation Heats Up

Rumors swirl through trading desks as analysts scramble to predict Washington's next move. The pattern's clear—when Uncle Sam wants in, he doesn't knock. He buys.

Strategic Targets Emerge

Sector leaders in energy, defense, and fintech top the watchlists. Any company touching critical infrastructure becomes instant speculation fuel. The playbook's simple: identify systemic importance, then watch for unusual volume spikes.

Wall Street's Ironic Dilemma

Free-market capitalists now scour SEC filings for government fingerprints—because nothing says 'private enterprise' like waiting for bureaucratic approval to make real moves. The ultimate irony: traders praying for state intervention to pump their portfolios.

Image source: Getty Images.

Why the U.S. government might invest in Lockheed Martin

Lockheed Martin is a large defense company, known for making aircraft such as the F-35 fighter jet. It plays an important role in the country's defense strategy, and it generates a lot of revenue from the government. Of the $18.2 billion in revenue it generated last quarter (which ended on June 29), $13.1 billion, or 73%, was from the U.S. government.

Given its close relationship with the U.S. government, Lockheed Martin could be the next company that the government takes a stake in. Commerce Secretary Howard Lutnick admitted in an interview last month that there has been "a monstrous discussion about defense" and even referred to Lockheed Martin as "basically an arm of the U.S. government."

Nothing has been announced at this stage, but it appears clear that Lockheed Martin is a company that the U.S. government is considering investing in, among other defense stocks.

Is Lockheed Martin due for more growth?

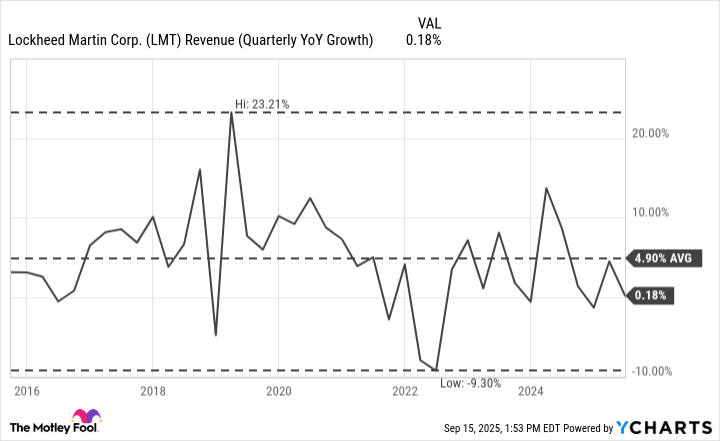

Lockheed Martin has a solid business that is profitable, but its growth rate hasn't been all that impressive in recent years. Its sales last quarter were flat, and historically, this has been a slow-growing business.

LMT Revenue (Quarterly YoY Growth) data by YCharts

What is notable, however, is that during President Trump's first term in office, which began back in 2017, Lockheed Martin did see an acceleration of its growth rate. Republican administrations are known for investing heavily into defense, and that trend could continue under Trump's second term. If that happens, Lockheed Martin could become a more attractive stock to own.

Between 2017 and 2021 (which coincides roughly with Trump's first term), shares of Lockheed Martin ROSE by 42%.

Is Lockheed Martin stock an underrated buy right now?

Shares of Lockheed Martin are down around 3% this year, and over the past 12 months, they have declined by 17%. But it's trading at a forward price-to-earnings multiple of only 16 (based on analyst projections); it's a cheap stock to own, given that thetrades at more than 21 times its estimated profits. It could be overdue for a rally. It also offers an above-average yield of 2.8%, which can give investors some extra incentive to buy and hold the stock.

Whether the government invests in Lockheed Martin or not shouldn't be the determining factor in assessing whether it's a good investment or not. Government policies can change from one administration to the next. What matters most are fundamentals. And with solid earnings numbers and consistent profitability, Lockheed Martin is an attractive stock to invest in for the long haul, especially when factoring in the potential to collect a lot of dividend income from it. It may not be a high-powered growth stock, but Lockheed Martin can be a dependable investment to hang on to for the long haul.