Could Buying United Parcel Service Today Set You Up for Life?

UPS Stock: Your Ticket to Financial Freedom or Just Another Delivery?

Logistics Giant Disrupts Traditional Investing

United Parcel Service isn't just moving packages—it's moving markets. The shipping behemoth's infrastructure spans continents, handling everything from critical medical supplies to that impulse Amazon buy you definitely didn't need.

Why Wall Street Can't Ignore the Brown Trucks

While crypto bros chase the next meme coin, UPS quietly dominates global supply chains. Their fleet of aircraft and vehicles forms a physical network that makes blockchain look like child's play. No flashy NFTs here—just cold, hard logistics supremacy.

The Boring Investment That Outperforms Flashy Alternatives

Forget timing the market—UPS delivers consistent returns while other investors chase get-rich-quick schemes. The stock's dividend history reads like a love letter to patient capital, proving sometimes the best investments are the ones you can actually touch.

Final Take: In a world obsessed with digital assets, UPS remains the physical backbone of global commerce—because apparently, someone still needs to actually deliver all those crypto mining rigs.

What does UPS do?

For most people, the quick summary of UPS' business WOULD start and stop with the words "package delivery." However, the background behind those two words is very important. What this industrial giant really excels at is logistics, a fact helped along by UPS' vast scale as a business.

Image source: Getty Images.

Essentially, UPS allows customers to easily MOVE a package from one place to another. That effort includes package pickup, package routing, and package delivery. Each step is a huge effort in its own right. Pickup, for example, can happen at a customer's business (as other packages are being delivered), in a local drop-off box, or in one of the company's many stores. Routing is the magic moment, as UPS uses its trucks, airplanes, and sorting facilities to make sure each item gets to where it needs to go quickly, efficiently, and cost effectively. And delivery, the part that most people are seeing when they watch those brown trucks around town, is the end of the process (and sometimes the start of a new process, if packages are being picked up).

UPS' business is simple in some regards, but massively complex in others. In fact, it would be hard to replicate what UPS does. Even(AMZN 0.23%), after years of capital investments in its own package delivery service, still uses UPS. That shows the value of the network that UPS has developed over the decades. And it is important to keep in mind that packages will need to be delivered for as long as people live in different locations. This is not a fly-by-night business, which suggests that buying it could help set you up for life as an investor.

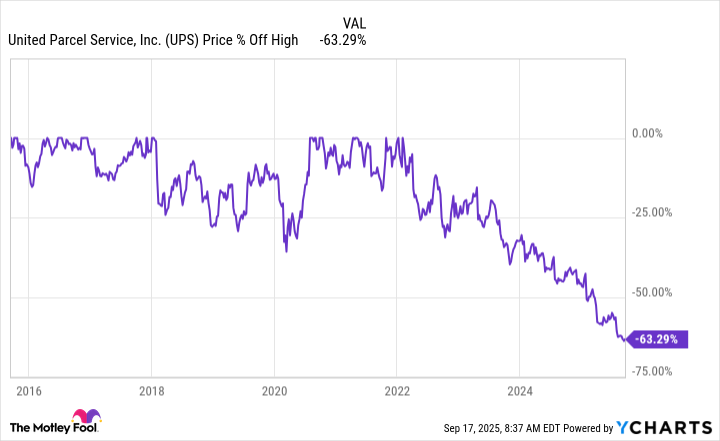

UPS data by YCharts

What's wrong with UPS?

That said, UPS' stock has fallen 60% from the highs it reached in 2022. The price is now below where it was prior to the coronavirus pandemic. These are both important facts to consider before buying UPS.

The steep drop is partly related to a massive price spike during the pandemic. Wall Street extrapolated the short-term demand boost for package delivery during the pandemic far into the future. When the world learned to live with COVID and package delivery demand cooled, so did UPS' stock price.

The company isn't sitting around and hoping for the best, however, it is actively working to upgrade its business. That includes spending on technology, closing older distribution centers, and shifting its customer focus to its most profitable business. For example, it recently announced that it would be materially reducing its relationship with e-commerce giant Amazon because the deliveries it makes for the company are low-margin.

The results of the company's efforts to upgrade its business have included lower revenue and rising costs. It was unavoidable and financial results got hit not just by the receding of the pandemic, but also by management's strategic plans for the future. Investors are worried even though the company's attempts to upgrade its operations appear appropriate from a business perspective. If you think in decades, the downbeat view of UPS' shares today could be a buying opportunity.

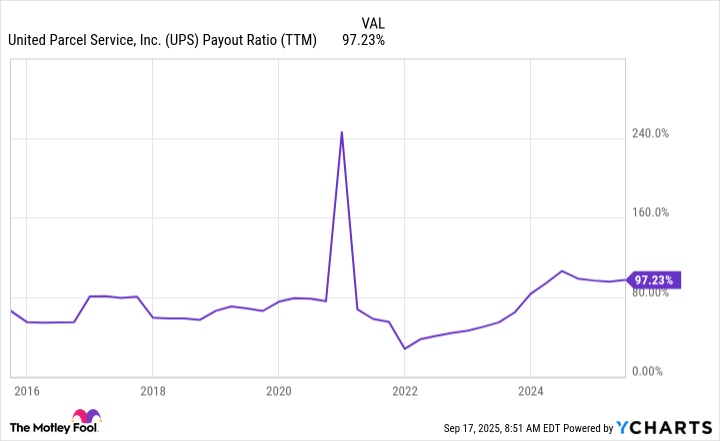

The problem comes in when you consider the dividend, noting that the dividend yield is a very enticing 7.7%. That's high enough that it suggests dividend investors are worried about a dividend cut. That's not an unfounded concern, despite the fact that UPS has increased its dividend annually for 16 years.

UPS Payout Ratio (TTM) data by YCharts

The dividend payout ratio is currently closing in on 100%. To be fair, it has long been in the 70% to 80% range, so the payout ratio was never low. But given the overhaul of the business, there is a very real possibility that the dividend also gets a reset. However, even if the dividend were cut by 50%, the yield would still be fairly attractive relative to the tiny 1.2% yield of the(^GSPC 0.49%).

Could UPS set you up for life?

If you are looking for a reliable business that is likely to be a long-term survivor, UPS is a solid option. And once it works through its current modernization effort the business is likely to be a more profitable operation. But if you are looking for a SAFE dividend you might want to tread with caution. The overhaul that is in the works has pushed the payout ratio to a worrying level and a dividend reset could be in the cards. If that doesn't bother you, noting that it seems unlikely that the dividend will be eliminated, UPS could be an attractive turnaround story to add to your portfolio.