If You’d Invested $1,000 in Amazon 5 Years Ago, Here’s How Much You’d Have Today

Amazon's stock just delivered another masterclass in compounding—while traditional finance was busy overcomplicating things with fees and paperwork.

Five years back, dropping a grand into Bezos' brainchild would've looked like just another bet. Fast forward to today, and that same investment has multiplied like digital rabbits—proving yet again that sometimes the simplest plays crush the fanciest hedge fund strategies.

No fancy derivatives, no complex options—just pure equity growth doing what it does best: printing returns while Wall Street analysts were still debating P/E ratios.

So next time your financial advisor suggests 'diversifying' into three different mutual funds with expense ratios higher than your coffee budget—maybe just remember the Amazon play. Simple. Clean. Profitable. Almost like they don't want you to figure it out.

Image source: Getty Images.

Why did Amazon underperform?

Let's be clear: It isn't that Amazon is performing poorly. And before you judge the last five years of performance, it's important to put that time frame into context.

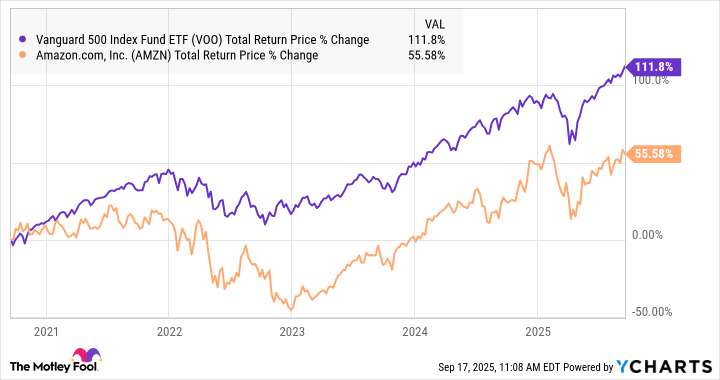

VOO Total Return Price data by YCharts

Specifically, five years ago, in mid-September 2020, the world was essentially still locked down due to the COVID-19 pandemic. As a result, e-commerce demand was incredibly strong. In fact, from the start of 2020 through mid-September, Amazon had already risen by 63% versus just a 5% total return from the S&P 500. In other words, when looking at the past five years, Amazon was already starting from a place of strong performance.

As a matter of fact, if we look at Amazon versus the S&P 500 from the beginning of 2020 through today, Amazon is actually ahead by about 26 percentage points.