Where Will Target Stock Be in 5 Years? A Bold Forecast for Retail’s Future

Target's five-year trajectory hinges on one brutal truth: adapt or get left behind.

Digital Transformation or Bust

The retail giant either masters e-commerce integration or watches market share evaporate. Physical stores become experience hubs—not just shopping destinations.

Supply Chain Revolution

AI-driven logistics and inventory management separate winners from losers. Target's tech investments today determine tomorrow's profitability margins.

Consumer Behavior Shift

Gen Z spending habits rewrite all retail rules. Brands that nail social commerce and mobile-first experiences capture the next decade's growth.

Target trades at a discount to its potential—if management executes flawlessly. Miss the digital pivot though, and shareholders might wish they'd just bought index funds instead of betting on retail turnaround stories.

Image source: Target.

Target's challenges

Investors have to acknowledge that the reasons for the sell-offs are at least somewhat justified.

The supply chain crisis earlier in the decade left the company with elevated inventories that still plague it today. Also, an embrace of diversity, equity, and inclusion (DEI) and the later abandonment of that policy alienated people on both sides of the political aisle.

Moreover, the company's CEO change caused further disappointment when Target announced COO Michael Fiddelke WOULD become the new CEO in February. Amid its struggles, investors have indicated they preferred an outsider, so Fiddelke will face challenges in winning over investor confidence.

Fiddelke will also have to win over customers. Sales levels have fallen even as competitors likeandcontinue to report positive sales growth. In the first half of fiscal 2025 (ended Aug. 2), Target's net sales of $49 billion fell 2% from year-ago levels.

Unfortunately, its cost of sales did not drop as fast, and depreciation and amortization costs increased. Although Target still earned almost $2 billion in the first half of the year, this represents an 8% yearly decline.

Additionally, Target forecasts a "low single-digit decline in sales" for fiscal 2025, though analysts predict a 2% net sales increase in fiscal 2026. Still, its continued missteps may have some investors wondering whether Target will go the way of failed retailers like Sears and JCPenney.

Why a comeback is possible

However, speculation that Target is the next Sears appears overstated. For one, Target's footprint, which spans nearly 2,000 stores across all 50 states, is a competitive advantage.

More than 75% of Americans live within 10 miles of a Target store, a reach exceeded only by Walmart. This positions Target well for omnichannel retailing, especially since Fiddelke believes the company could add about 300 stores.

Investors should also consider its dividend. Right now, its $4.56 per share annual payout amounts to a dividend yield of 5.1%. That is more than quadruple the S&P 500 average of 1.2%.

Moreover, its 54 years of annual payout hikes give it Dividend King status, which places it among an exclusive group of companies that have hiked their dividend annually for 50 or more years. The abandonment of such streaks tends to lead to stock sell-offs that can persist for years, meaning Target will almost certainly continue the dividend increases if possible.

Fortunately, it looks like Target can still afford its payout. Over the trailing 12 months, the dividend cost the company just over $2 billion. Over the same period, it generated just over $2.9 billion in free cash flow, more than enough to cover the dividend and years of payout hikes.

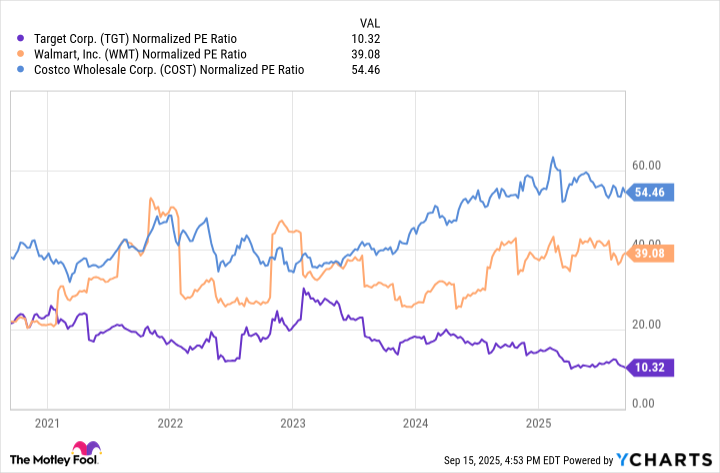

Finally, investors should take heed of its valuation. Its P/E ratio of 10 is far below theaverage of 31. Since its primary competitors' stocks trade at a considerably higher earnings multiple, Target's stock may be too cheap to ignore despite the challenges.

TGT Normalized PE Ratio data by YCharts

Target in five years

Although Target will have to overcome significant obstacles, it is in a strong position to turn itself around and outperform the market over the next five years.

Indeed, Target's immediate path back to positive growth is uncertain. Also, Fiddelke will need to win the confidence of investors, which may take time.

Nonetheless, its massive footprint and planned store additions position it well to benefit from both in-store and online retailing. Also, the company's high, sustainable dividend should be attractive to investors, particularly because its Dividend King status and robust free cash flows make it highly likely that the payout hikes will continue.

Considering that investors can buy such an income stream at just 10 times earnings, any improvement in its business is likely to take its stock higher during that time.