Nvidia CEO Jensen Huang Just Delivered Fantastic News for Intel Investors

Nvidia's Jensen Huang drops bullish bombshell for Intel holders—tech's power shift accelerates.

Semiconductor Supremacy Shift

Huang's latest announcement sends Intel's prospects soaring as AI demand reshapes the entire chip ecosystem. Nvidia's dominance in AI processors creates ripple effects that benefit legacy players too—Intel catches the wave.

Market Momentum Builds

Supply chain synergies and manufacturing partnerships drive unprecedented value creation. While Wall Street analysts scramble to upgrade price targets, retail investors finally get a win in the volatile tech sector—proving even broken clocks are right twice a decade.

Future-Proof Positioning

Intel's infrastructure capabilities align perfectly with Nvidia's next-gen architecture requirements. This isn't just cooperation—it's strategic symbiosis that could redefine computing for the next generation. The real question isn't if this momentum continues, but how long until hedge funds overleverage and ruin it for everyone.

Image source: Intel.

Let's break down the mechanics of the deal and explore why this partnership is meaningful for each side.

What does the Nvidia-Intel deal include?

Nvidia and Intel's collaboration focuses on uniting their strengths in two domains: data centers and personal computing (PC). In the data center segment, Intel will design custom x86 CPUs tailored for Nvidia's AI infrastructure platforms. On the PC side, Intel will introduce x86 system-on-chips (SOCs) that incorporate Nvidia's RTX GPU chiplets -- a hybrid solution that marries industry-leading CPUs with world-class GPUs.

At a strategic level, the significance of this deal is that it links Intel's historical dominance in the CPU market with Nvidia's leadership in accelerated AI workloads. Notably, the agreement does not grant Intel exclusivity as a foundry partner -- an area where the company remains overshadowed by.

While this is not an outright acquisition, the partnership is highly additive for both Nvidia and Intel. For Nvidia, the deal extends its reach deeper into the CPU ecosystem -- underscoring its position in end-to-end AI infrastructure. For Intel, the $5 billion investment delivers both capital and much-needed strategic validation at a time when the company is searching for momentum.

Put simply, the deal represents a pragmatic alignment between a market leader driving the future of computing with a legacy incumbent eager to regain relevance in the rapidly changing AI market.

Is Nvidia's deal with Intel a game-changer?

AI infrastructure is no longer defined by stand-alone hardware. The future of computing lies in integrated ecosystems that combine silicon, software, and systems into seamless platforms capable of delivering both scale and performance. Nvidia's deal with Intel lays the foundation for the direction of a more unified computing stack.

By joining forces, the two companies are blending their respective strengths into what could evolve as a new category-defining standard for the AI era. For Nvidia, the partnership secures broader market compatibility. Meanwhile, Intel gains a tangible growth roadmap at a moment when competitive pressures are rising -- which helps Intel's efforts to restore its credibility.

This collaboration is more than just a splashy headline -- it symbolizes a reshaping of the competitive landscape. At its core, Nvidia and Intel joining forces highlights a reflection that AI infrastructure will not be won as a zero-sum game, but instead, requires ongoing alignment across complementary strengths.

If executed successfully, the partnership could accelerate AI adoption across both enterprise and consumer markets -- lending weight to Huang's vision that the next industrial revolution has arrived.

How should investors play the news?

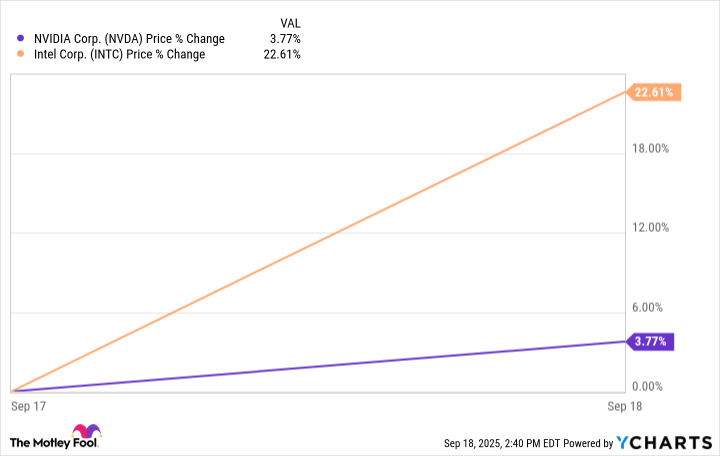

Unsurprisingly, shares of both Intel and Nvidia rallied on news of the partnership. While I typically avoid investing in momentum stocks, this is a case where I'd consider making an exception.

Data by YCharts.

Intel stock has gained just 5% over the past three years and remains roughly 40% below its highs -- even after the recent double-digit bump from the Nvidia announcement. Against that backdrop, Intel looks interesting as a complementary position to existing semiconductor or AI holdings. For now, however, I WOULD treat Intel as a smaller allocation until execution from this deal gains more visibility.

As for Nvidia, this collaboration represents yet another catalyst in an already-long line of reasons to own the stock as a long-term, CORE holding. While the headlines sparked short-term day trading activity, I think the real value lies in the potential synergies that could play out over time.

In my view, both Intel and Nvidia still have their best days ahead -- making them compelling buy-and-hold opportunities for investors with a long-term horizon.