비트코인, S&P500과 강력한 동조화...15% 추가 상승 가능성 점쳐져

디지털 금과 전통 시장의 수렴 현상이 투자자들을 사로잡고 있습니다.

비트코인이 S&P500 지수와의 상관관계를 강화하면서 시장 관측통들은 추가 15% 랠리를 전망하고 있습니다—물론 전통 금융권 애널리스트들은 여전히 "일시적 현상"이라고 치부하지만요.

상관관계 심화

두 자산 클래스 간의 움직임이 점점 더 유사해지고 있습니다. 인플레이션 헤지 수단으로서의 매력이 기관 투자자들로 하여금 양쪽 시장에 동시에 베팅하게 만들고 있죠.

기술적 분석 신호

차트 패턴이 추가 상승을 암시합니다. 주요 저항선 돌파와 거래량 증가가 강세 모멘텀을 확인시켜주고 있어요—전통 주식 시장이 보여주지 못하는 역동성을 보여주고 있습니다.

리스크 온 환경

글로벌 유동성 확대가 위험 자산 전반을 밀어올리고 있습니다. 암호화폐가 이 흐름의 선봉장 역할을 하면서 디지털 자산 클래스의 성숙도를 입증하고 있죠.

15% 추가 상승이 현실화된다면, 비트코인은 다시 한번 전통적 금융 "전문가"들의 회의론을 무색하게 만들 겁니다—그들이 아직도 블록체인을 단순한 "유행"으로 치부하는 동안 말이에요.

Image source: Getty Images.

Lululemon's sales have been taking a hit

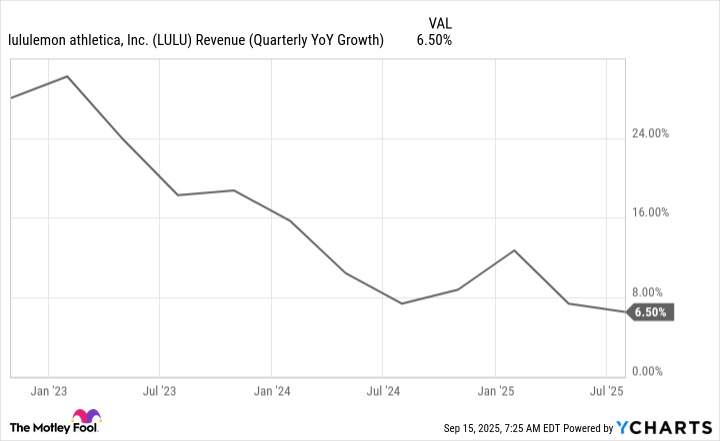

In the past, Lululemon has been a captivating apparel stock to own because of its strong growth prospects. But in recent years, the company's sales growth rate has been slowing down significantly. And that can be a huge problem, particularly when investors are paying a premium for the stock.

LULU Revenue (Quarterly YoY Growth) data by YCharts

For the company's second quarter, which ended Aug. 3, Lululemon's sales ROSE by just 6.5% year over year to $2.5 billion. The company's top line came in just below analyst expectations. And comparable store sales in North America declined by 4%.

It wasn't a bad performance on the bottom line as Lululemon reported earnings per share of $3.10, which was soundly better than Wall Street's estimates of $2.88. But the problem is that earnings will be worse in upcoming periods, with the company projecting a $240 million hit to its bottom line for the current fiscal year due to tariffs. CEO Calvin McDonald said that, "the increased rates and removal of the de minimis provisions have played a large part in our guidance reduction for the year."

Lululemon's valuation looks tempting

As of the end of last week, Lululemon's stock has crashed 58% since the start of the year. It's been a disastrous performance that has easily resulted in the stock hitting a new 52-week low. And the last time it was at these levels (around $160) was in 2020, and that was briefly when the stock market as a whole crashed due to concerns related to the pandemic.

Based on earnings, Lululemon looks like it may be a steal of a deal. Currently, the stock trades at a forward price-to-earnings (P/E) multiple of 12, which is based on how analysts expect the company to perform in the year ahead. That's an incredibly cheap valuation given that the average stock on thetrades at a forward P/E of over 21.

Is Lululemon stock worth taking a chance on today?

Lululemon stock is at multiyear lows right now, but for justifiable reasons. Investors are worried that in light of challenging economic conditions and consumers scaling back on discretionary spending that Lululemon's business may face challenges in future quarters. Tariffs exacerbate those worries.

Given the uncertainty around the business, I'd hold off on investing in Lululemon stock today. It certainly does look cheap but its premium-priced apparel may simply not be in high demand. And whether the company can win customers over in the future is also debatable, given the rising trend of fast fashion and consumers opting to buy cheap products from online retailers, which can explain Lululemon's slowing growth in recent years. The company has been facing adversity for multiple years now and while things have gotten significantly worse this year, the business has already been slowing down.

It's possible the sell-off in Lululemon stock isn't over just yet. And with plenty of uncertainty still around the business, the best option for investors may be to take a wait-and-see approach.