Prediction: The S&P 500 Won’t Return Anything Close to 10% in 2026

Wall Street's favorite benchmark faces a reality check—traditional markets are showing cracks while digital assets surge ahead.

The 10% fantasy meets crypto's hard truth

Forget those rosy projections—the S&P's glory days look numbered. Institutional money keeps flooding into Bitcoin and Ethereum while traditional equities struggle with inflation and regulatory fatigue.

Digital gold vs. paper promises

While traditional analysts cling to outdated models, crypto's transparent ledgers and 24/7 trading cycles are rewriting the rules of ROI. No waiting for market opens—just relentless global momentum.

Smart money's already moving

Hedge funds and family offices aren't betting on mediocre returns—they're stacking satoshis and diversifying into DeFi yields that make 10% look like pocket change. Another case of legacy finance playing catch-up.

Image source: Getty Images.

The average isn't normal

Over the 50 years from 1975 to 2024, the S&P 500 produced an average annual return (without dividends) of 10.6%, a median return of 13.1%, and a standard deviation of 16%. This means that over that period, there was a 68% chance the S&P 500 returned between a loss of 5.4% and a gain of 26.6% and a 95% chance that it lost between 21.4% and gained 42.6%. The last decade encapsulates this variance well.

|

2024 |

23.31% |

|

2023 |

24.23% |

|

2022 |

(19.44%) |

|

2021 |

26.89% |

|

2020 |

16.26% |

|

2019 |

28.88% |

|

2018 |

(6.24%) |

|

2017 |

19.42% |

|

2016 |

9.54% |

|

2015 |

(0.73%) |

Data source: Macrotrends.

As you can see in the table, just one year was close to the average -- 2016. And more often than not, the index was producing much more or much less than 10%, with epic gains more than offsetting big down years like in 2022.

A high-risk, higher-potential-reward index

I WOULD expect the S&P 500's returns going forward to have even more variance than the 50-year average due to the index's composition.

39% of the S&P 500 is in the "Ten Titans" stocks --,,,,,,,,, and. And over half of the S&P 500 is invested in just 25 companies, meaning that just 5% of components control half the influence.

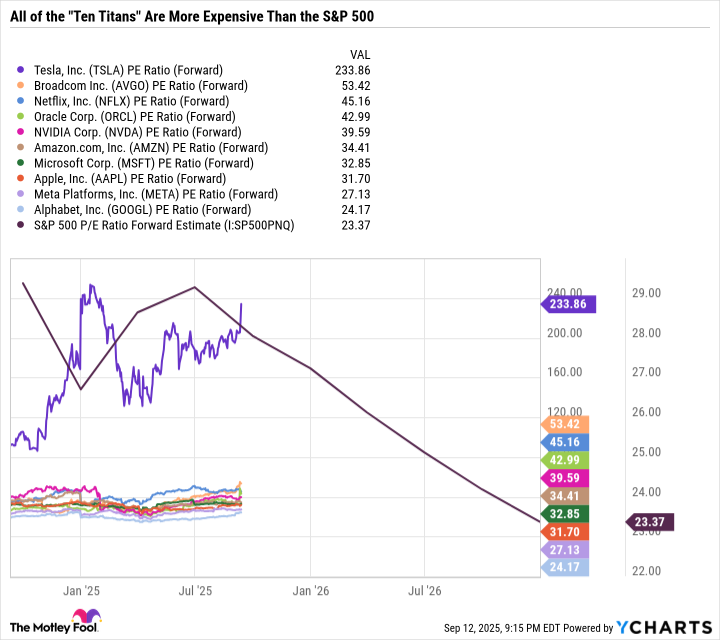

While large and established companies can be less volatile than smaller, unproven ones, the issue is that many of the top S&P 500 growth stocks are valued based on earnings expectations years from now. Just look at the forward price-to-earnings (P/E) ratios of the Ten Titans.

Data by YCharts.

The forward P/E ratio tells you what the P/E would be if the stock price didn't MOVE and earnings came in line with consensus analyst estimates over the next 12 months. As you can see in the chart, all the Ten Titans have higher forward P/E ratios than the S&P 500. And many of them are much higher.

Investors in Tesla, Broadcom, Netflix, Oracle, and Nvidia are betting big on where those companies will be several years from now rather than where they are today. And there's reason to believe at least some will deliver.

On Sept. 9, Oracle released an incredible five-year forecast that implies a more than 14-fold increase in its cloud infrastructure revenue. If Oracle hits that target, the stock will justify its lofty valuation.

Similarly, Broadcom is winning business as hyperscalers increasingly turn to its custom AI chips for AI workloads. Broadcom and Nvidia should continue to benefit from sustained big tech AI spending. So, although both stocks look expensive now, they certainly could grow into their valuations over time.

The S&P 500 is still a good long-term buy

Even after outsized gains in 2023, 2024, and so far this year, it wouldn't surprise me one bit if the S&P 500 returned much more than 10% in 2026. The simplest path to more gains would be AI investments paying off, justifying more spending from hyperscalers. Lower interest rates could help struggling consumer-facing companies. The Ten Titans have propped up and otherwise faltering S&P 500, which is showing a lot of weakness in stocks from the consumer discretionary, consumer staples, and healthcare sectors. If interest rates fall, it could jolt the housing market can consumer spending.

However, I also wouldn't be surprised if the S&P 500 had a down year if growth rates cool and earnings don't come in as expected. The market can be ruthless if there's uncertainty. Just look at how trade policy took a sledgehammer to the S&P 500 in April. So a combination of heightened geopolitical tensions and a cooldown in the AI industry could induce a sell-off even if the fundamentals remain intact.

The solution for long-term investors is to avoid becoming overly confident or panicky. Now is a good time to conduct a portfolio review and ensure you are invested in companies you believe in for the long term and can stick with even during a prolonged downturn. For some investors, those high conviction holdings may include some of the Ten Titans. For more risk-averse investors, the best course of action may be to shift away from high-flying growth stocks toward more balanced, dividend-paying companies that are valued for their existing results rather than the investment thesis depending largely on potential.