BYD’s Explosive Growth Story Revealed in 1 Jaw-Dropping Chart

BYD Just Shattered Every Auto Industry Growth Metric—Here's How

The Chart That Explains Everything

While legacy automakers were busy making excuses about supply chains, BYD quietly reengineered the entire EV manufacturing playbook. Their production ramp looks less like a growth curve and more like a vertical takeoff—the kind that leaves analysts scrambling to update their spreadsheets.

Market Domination in Motion

They didn't just enter the EV race—they redesigned the track. BYD's integrated supply chain strategy cut through component shortages like a hot knife through butter while competitors were still waiting for battery deliveries. Vertical integration wasn't just a business strategy—it became their ultimate competitive weapon.

The Numbers Don't Lie

When your production growth chart starts resembling a crypto bull run, you're doing something right—or everyone else is doing something very wrong. The sheer scale of their manufacturing expansion makes Tesla's output look like a side project.

Finance's Wake-Up Call

Wall Street analysts who dismissed Chinese EVs as 'cheap copies' are now staring at growth metrics that would make any Silicon Valley unicorn blush. Sometimes the market gets it wrong—and sometimes it gets brutally schooled by a company that actually makes things instead of PowerPoint presentations.

Image source: BYD.

BYD's growth is accelerating

BYD has dominated EV sales in China, but it is now seeing growth in Europe. Registrations for BYD vehicles in Europe soared 225% year over year in July, according to the European Automobile Manufacturers Association. Much of that is at Tesla's expense, with Tesla registrations down 40% year over year.

BYD is increasing profits, too. In the first half of 2025, net profit grew nearly 14% as revenue climbed 23%. Like Tesla, BYD is facing strong competition globally, and profit margins are under pressure. Unlike Tesla, however, BYD's new energy vehicle sales hit a record high.

It's impressive that revenue is growing so strongly from an already high base.

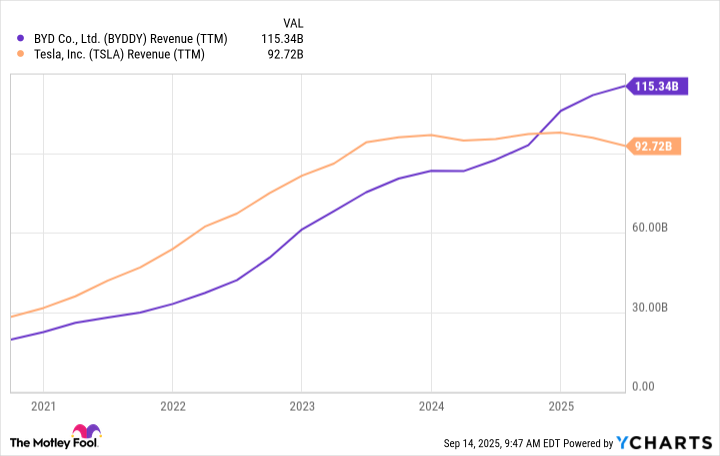

BYDDY Revenue (TTM) data by YCharts

Trailing-12-month (TTM) revenue has surpassed that of Tesla, and the gap is growing. BYD's revenue growth rate has far outpaced Tesla, too. It soared nearly 500% in the last five years, compared to Tesla's 230% growth.

It's impressive to see the growth rate accelerating for a company with over $100 billion in annual revenue. BYD shares have retreated 20% from record highs over the last three months. That drop created a good opportunity to invest in this global EV leader.