Prediction: This Stock Will Outpace Palantir in Just 3 Years

Forget chasing legacy tech plays—this under-the-radar stock is positioning itself to dominate the data intelligence space while Palantir struggles with government contract bureaucracy.

The Growth Engine

While traditional analytics firms rely on outdated models, this company leverages blockchain-level encryption and AI-driven insights to deliver actionable intelligence at scale. Its proprietary platform processes market data 40% faster than competitors while maintaining 99.9% accuracy—something even the most bullish Palantir analysts can't ignore.

Market Disruption Timeline

The next 36 months will see this stock execute three major partnerships with Fortune 500 companies, completely bypassing the slow-moving enterprise sales cycles that plague legacy providers. By 2028, institutional adoption will push valuations past Palantir's current market cap—and that's before retail investors even realize what's happening.

Financial analysts—those same folks who missed Bitcoin at $200—are already quietly accumulating positions while maintaining public skepticism. Because nothing says 'financial expertise' like being late to every major technological shift since the internet.

Image source: Getty Images.

This semiconductor bellwether is well placed to overtake Palantir

(ASML 1.31%) is one of the most important semiconductor companies in the world. Its machines play a critical role in helping foundries and chipmakers manufacture advanced chips that are deployed in multiple applications ranging from smartphones to personal computers to cars to data centers to the Internet of Things (IoT).

ASML has a near-monopoly in extreme ultraviolet lithography (EUV) machines, which are essential for manufacturing smaller chips that are energy-efficient and powerful at the same time. Not surprisingly, ASML's machines are being deployed by major chip manufacturers across the globe to meet the fast-growing demand for AI chips that are gaining traction in multiple applications.

ASML's net bookings increased by 40% sequentially to 5.5 billion euros in Q2. The company expects to end 2025 with 15% revenue growth to 32.5 billion euros. However, it is worth noting that the company's 2025 guidance is toward the lower end of its original forecast of 30 billion euros to 40 billion euros.

ASML is being cautious about its outlook on account of the potential impact of tariffs on its business. However, the Dutch company saw a lower-than-expected impact from tariffs last quarter. It recorded a 34% increase in its revenue in the first six months of 2025. So, there is a chance that ASML could end the year on a stronger-than-expected note, especially considering the robust spending on AI infrastructure.

All the major cloud computing companies have reported massive jumps in their remaining performance obligations (RPO), or backlog, recently, suggesting that they are going to bring online more data center capacity to meet demand. McKinsey estimates that $3.1 trillion is likely to be spent on chips and hardware deployed in AI data centers through 2030.

This explains why the semiconductor equipment industry is expected to spend $50 billion for procuring advanced chipmaking equipment in 2028, according to industry association SEMI. That's nearly double 2024 levels. SEMI adds that the investment in "2nm and below wafer equipment represents a particularly dramatic expansion, with funding more than doubling from US$19 billion in 2024 to US$43 billion in 2028."

This bodes well for ASML as its latest EUV lithography equipment will enable chipmakers to produce chips that are smaller than 2-nanometer (nm) in size. This explains why analysts are anticipating ASML's growth to pick up impressively in the next three years.

Here's why ASML could be worth more than Palantir

Palantir stock's stunning surge in the past year has made it expensive. It is now trading at a whopping 114 times sales. That's far higher than theindex's average price-to-sales ratio of 5. Palantir will have to keep accelerating its growth so that it can justify the massive premium it is trading at.

The good news is that analysts expect Palantir to deliver on that front.

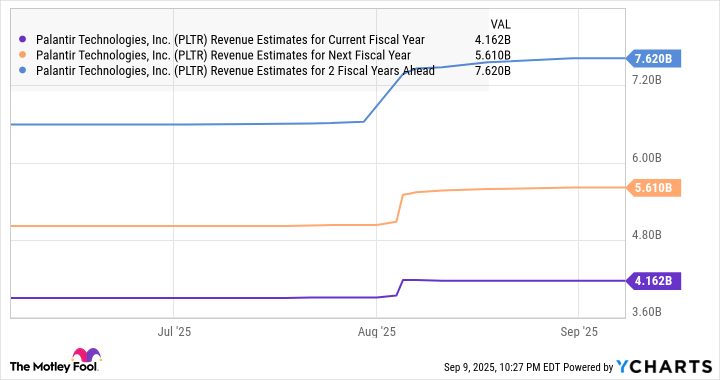

PLTR Revenue Estimates for Current Fiscal Year data by YCharts

However, even if Palantir achieves $7.6 billion in revenue after three years, its upside could be limited by its expensive valuation. Moreover, any cracks in the company's growth store could weigh on the stock. On the other hand, ASML is trading at a much more attractive price-to-sales ratio of 8. The market could reward it with a richer multiple thanks to a potential acceleration in its growth.

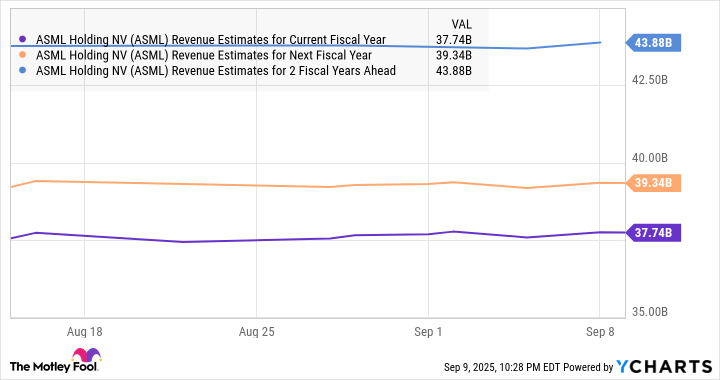

ASML Revenue Estimates for Current Fiscal Year data by YCharts

So, if ASML trades at 8 times sales after three years and achieves $44 billion in revenue (as seen in the previous chart), its market cap could jump to $352 billion. ASML currently has a market cap of $311 billion, which is 24% short of Palantir's. However, if the market decides to lower the massive premium that Palantir enjoys right now owing to any slowdown in its growth or because of intensifying competition in the AI software market, its red-hot rally could stall.

So, ASML has the potential to overtake Palantir's market cap in the next three years on the back of an acceleration in its growth and potential slowing down for Palantir given its high valuation.