🚀 This AI Stock Is Predicted to Hit $10 Trillion in Just 5 Years

Forget moonshots—this AI play is targeting galaxy-level returns.

Why Wall Street Can't Look Away

Artificial intelligence isn't just transforming industries—it's minting trillion-dollar valuations. One stock stands poised to capture the entire AI value chain, from chips to cloud infrastructure. Analysts project a staggering $10 trillion market cap within five years, dwarfing current tech giants.

The Domino Effect

Every automated decision, every optimized supply chain, every generative model fuels this company's ascent. They're not just riding the wave—they're building the ocean. While traditional investors chase quarterly earnings, this firm operates on exponential time.

Reality Check

Sure, $10 trillion sounds like fantasy—until you remember Amazon was once just a bookstore. The math works if AI adoption accelerates faster than skeptics predict. Though let's be honest: if it misses, some hedge fund manager will still collect a bonus for 'strategic vision.'

Bottom line: bet against human ingenuity at your own peril.

Image source: Getty Images.

Driving crucial AI tasks

This company has taken the tech world by storm in recent years, becoming the world's No. 1 AI chip designer. I'm talking about(NVDA 0.43%). Chips are key, as they drive the most crucial of AI tasks, and this tech giant's graphics processing units (GPUs) -- or AI chips -- are the most powerful on the planet. And customers aiming to win in AI have taken notice. They've scrambled to gain access to as many Nvidia GPUs as possible to run their projects, resulting in enormous revenue growth for Nvidia.

The best illustration of this is to compare Nvidia's annual revenue of $27 billion just two years ago with the latest full year, during which revenue climbed to more than $130 billion.

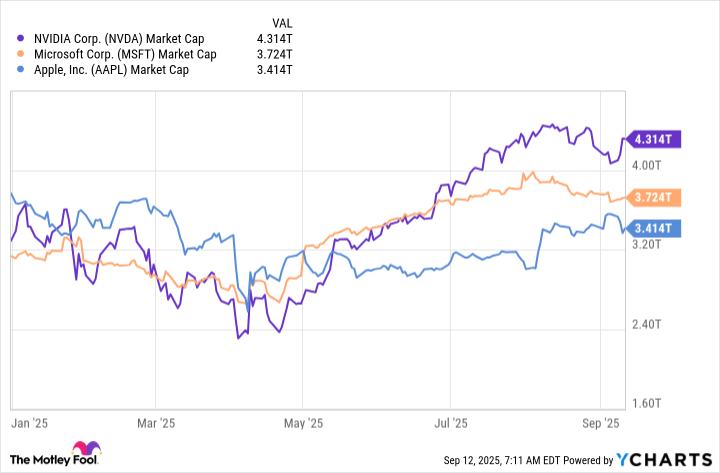

Investors have recognized this, with Nvidia stock soaring more than 1,100% over the past three years. This helped the company reach the major market cap milestone of $4 trillion a couple of months ago. It became the first to reach this level, securing its spot as the world's biggest company. In fact, it's continued to progress to $4.3 trillion, and giantsandremain under the $4 trillion mark, at least for now.

NVDA Market Cap data by YCharts.

Why do I think Nvidia could reach $10 trillion from here? The company predicts that AI infrastructure spending may increase to as much as $4 trillion by the end of the decade. Nvidia, as a supplier of the most sought-after chips and related products, may garner a great deal of this business. In the past, the company has taken about 25% of data center spending -- that could imply $1 trillion in revenue for Nvidia. As Nvidia's revenue has climbed in the past, so has its share price and market value. And that's likely to happen again.

The path to $10 trillion

Now, let's consider how Nvidia could make it to the $10 trillion level in five years. To maintain its current price-to-sales ratio of 26, Nvidia WOULD have to generate sales of about $380 billion in 2030. Analysts expect Nvidia to bring in $200 billion in sales this year, implying a compound annual growth rate of about 14% over the coming five years. This is clearly achievable considering Nvidia's track record of revenue growth, forecasts for AI spending ahead, and leadership position in the market.

Even if Nvidia's growth slows from current levels -- revenue climbed 56% in the latest quarter -- and AI spending comes in somewhat lower than today's projections, Nvidia remains well positioned to meet my market value prediction.

Does this mean anything in particular for you as an investor? As Nvidia grows in market value, it's a reflection of the company's strength, but a growing market cap isn't the reason to buy a particular stock. Instead, look to Nvidia's revenue patterns, demand for its chips, and innovation plans. These offer us a great reason to get in on this top AI stock.