Should You Buy Archer Aviation While It’s Below $10?

Flying cars meet Wall Street—and the runway's looking bumpy. Archer Aviation's stock dips under ten bucks, leaving investors wondering if this is the ultimate buying opportunity or just another overhyped tech play crashing back to earth.

The Electric Vertical Takeoff Gamble

eVTOL stocks aren't for the faint of heart. They combine regulatory hurdles, massive R&D burns, and that special flavor of optimism usually reserved for crypto traders after their third espresso. Archer's sub-$10 price tag might look tempting—until you remember most aviation startups have a failure rate that'd make a hedge fund blush.

Sky-High Potential, Grounded Reality

Every analyst with a pilot's license will tell you the urban air mobility market could be worth billions. But between now and profitability? That's a longer journey than a cross-country flight with multiple layovers. The company's burning cash faster than a rocket booster, and profitability remains somewhere over the horizon—literally and figuratively.

The Verdict: Boarding Pass or Bail Out?

Buying Archer under $10 is either a genius move or financial suicide—with the outcome depending entirely on whether flying taxis become the next Uber or the next Segway. One thing's certain: if you're investing here, you'd better have a stomach for turbulence and a portfolio that can survive a crash landing. After all, nothing says 'modern portfolio theory' like betting on fictional vehicles from Blade Runner.

Archer's Midnight aircraft could revolutionize transportation

Archer Aviation develops electric vertical takeoff and landing aircraft, with its Midnight aircraft as its flagship product. With this eVTOL technology, Archer aims to provide direct-to-consumer aerial ride-sharing services. Think of, but zooming around the city in an electric-powered drone-like vehicle.

The company's Midnight aircraft is built on its proprietary 12-tilt-6 distributed electric propulsion platform. It can seat four pilots, take off vertically from a helicopter pad, and its lithium-ion-battery-powered motor is quiet, making it ideal for urban transportation.

This technology is promising for urban transportation, enabling people to travel quickly to and from airports. Additionally, military applications of this eVTOL technology could be a significant source of growth. With its low thermal and acoustic signatures, the aircraft could be great for reconnaissance, rescue, and other military missions.

What's next for Archer Aviation

Archer is currently producing six Midnight aircraft, with three already in final assembly, which will incorporate a four-blade rear propeller. When complete, it will have eight total Midnight aircraft in its fleet.

It aims to build up to 10 Midnight aircraft in 2025 to support ongoing certification-related testing and deployments with key partners. The primary focus for 2025 is on manufacturing piloted, type-design aircraft for testing and early commercial deployment, with plans to ramp up production to two aircraft per month by the end of 2025 at its Covington, Georgia, facility.

The eVTOL company is on track to obtain commercial authority from the General Civil Aviation Authority (GCAA) in the United Arab Emirates (UAE) sometime this year. This will enable it to conduct exhibition flights, which simulate actual passenger routes, eventually leading to full commercial flights in the region by the end of this year or early next year.

Turning to the U.S., the government has begun to lay the groundwork for air taxi deployments to begin in the next few years, as it looks to validate Midnight's performance, safety, and scalability in real-world conditions. Archer is currently in phase four of the Federal Aviation Authority's (FAA) type certification process, having completed Midnight's airworthiness criteria in May 2024. A key step remaining is the resolution of the industrywide flight test policy, which Archer anticipates will happen soon.

Image source: Archer Aviation.

By 2026, Archer's goal is to scale production and delivery rates for both U.S. and international customers to achieve a positive gross margin per aircraft. By 2027, the company aims to achieve a positive operating margin, targeting a gross margin of approximately 50% per aircraft. By 2028, the goal is to reach full manufacturing facility capacity of 650 aircraft per year, with a 20% or greater operating margin.

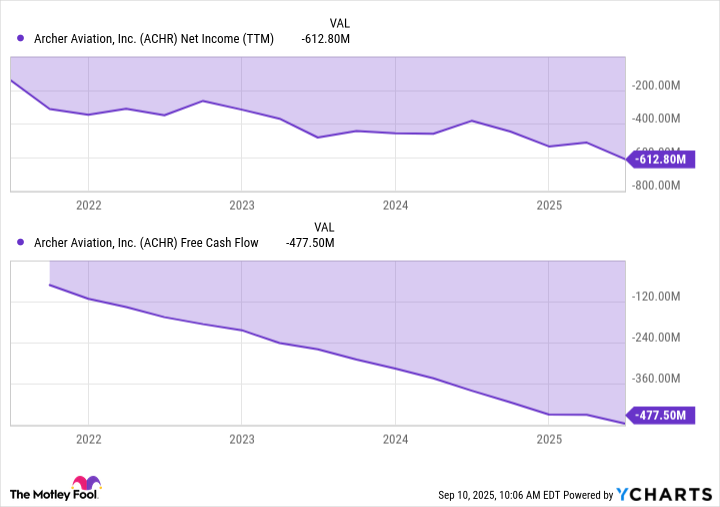

Watch its cash situation

Archer's financial situation is something investors want to monitor closely. Currently, at the end of the second quarter, Archer has $1.7 billion in cash and cash equivalents. This is a positive sign, as it marks the fourth consecutive quarter where the company has increased its cash balance.

Archer needs capital because of the capital-intensive nature of its business. The company lost $206 million in the second quarter and is still pre-revenue at this stage. In the meantime, it will continue to burn cash for operational, research, and development costs as it works toward certification and scales up its manufacturing capabilities.

ACHR Net Income (TTM) data by YCharts

Is Archer Aviation a buy?

Archer is developing innovative technology that could revolutionize urban transportation as we know it. With that said, the company is in its early stages, as aircraft undergo rigorous testing before rolling out in the UAE sometime late this year or early next year, and in the U.S. after that.

As an early-stage company, it is incurring losses, and profitability remains far off for the company. This makes it vulnerable to any delays or impacts on the timeline of approval, commercial operations, and ramping up of manufacturing capacity.

Right now, Archer is a high-risk, high-reward stock if it can establish a foothold and build out the future of urban air mobility. As such, it's best suited for investors with a long-term horizon who are willing to ride out fluctuations as the company works to make urban air transportation a reality.