Where Will TSMC Stock Be in 1 Year? The Semiconductor Giant’s Next Move Revealed

TSMC's stock trajectory faces a critical inflection point as global chip demand reshapes the semiconductor landscape.

AI Boom or Supply Chain Gloom?

Nvidia's insatiable appetite for advanced chips keeps TSMC's fabs humming at near-full capacity—but geopolitical tensions and inventory corrections loom like storm clouds over Hsinchu. The company's 3nm yield improvements could either catapult margins or become another capital-intensive nightmare for shareholders.

Geopolitical Chess Game

Washington's export restrictions and China's semiconductor ambitions force TSMC into a high-stakes balancing act. Arizona fab expansion costs balloon while Taiwanese operations face perpetual earthquake risks. Because nothing says stable investment like betting on fault lines and trade wars.

Valuation Versus Reality

Analysts keep parroting price targets like broken records—ignoring that semiconductor cycles make cryptocurrency volatility look predictable. The stock either rides the AI wave to new heights or gets crushed by the next inventory correction. Place your bets, but maybe keep some antacids handy.

Image source: Getty Images.

TSMC's biggest catalyst is likely to get stronger in 2026

TSMC's revenue in the first eight months of 2025 increased by 37% from the same period last year. TSMC management forecasted revenue growth of 30% for the year, but its performance so far suggests that it will exceed that mark. That should set TSMC stock up for a strong finish to 2025.

TSMC will likely carry this momentum into 2026 thanks to strong prospects for its largest business segment. Roughly 60% of TSMC's revenue came from the high-performance computing (HPC) segment in the previous quarter. That's not surprising, as TSMC fabricates chips for,,, and. These companies are the dominant players in the graphics processing unit (GPU) and custom AI processor markets, the two main types of chips that power AI data centers.

All these companies have been growing at a tremendous pace in recent quarters, and they are likely to sustain that momentum in 2026 as well. Broadcom's AI revenue, for instance, is expected to double next year. The company has brought a new customer for its AI chips on board, and it finished the previous quarter with a massive backlog of $110 billion.

Marvell, on the other hand, projects a substantial increase in the number of customers for its custom AI processors. Nvidia and AMD should also see a significant boom in demand for their chips in 2026 because all the major cloud computing companies are short of data center capacity.

, for instance, just announced that its remaining performance obligations (RPO) in the previous quarter jumped a stunning 359% year over year to a whopping $455 billion. Management added that it expects "to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars" in the next few months.

Similarly,management remarked on its August earnings conference call that it saw "capacity constraints despite significant capacity coming online." That's because the demand for Microsoft's AI data centers is ahead of supply despite efforts to ramp up capacity. Bloomberg estimates that the major tech companies are likely to increase their capital spending by $33 billion next year to $369 billion as they add more AI capacity.

Actual growth could be much higher than that, as big tech companies are expected to hike their capital spending in 2025 owing to the AI-fueled demand for data center capacity. And a look at the massive backlogs reported by cloud computing giants of late indicates that the trend could continue in 2026. These cloud computing companies will have to purchase more GPUs and custom AI processors as they build out more data centers. This bodes well for TSMC because of its relationship with the top AI chip designers.

How much upside is in store for investors in the next year?

TSMC's 12-month median stock price target of $278 (as per 45 analysts covering the stock) points toward a potential jump of 11% from current levels. What's worth noting is that 96% of the analysts covering TSMC suggest buying it right now. But then, don't be surprised to see TSMC's stock jumping higher than analysts' expectations in the coming year.

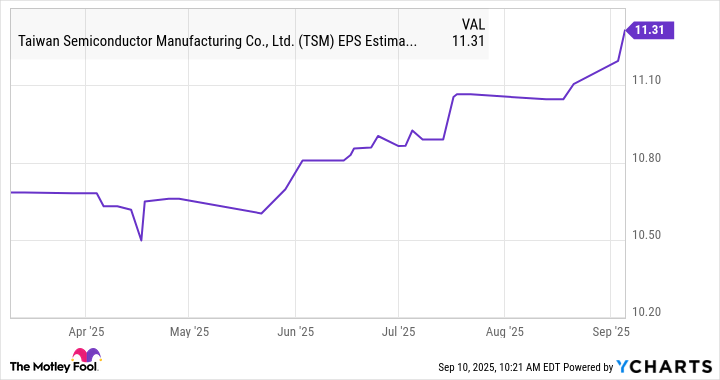

Its 2026 earnings are expected to land at $11.31 per share. However, that forecast has moved up significantly of late.

Data by YCharts.

More upward revisions to TSMC's 2026 forecast cannot be ruled out on the back of potentially stronger spending on AI chips next year. Assuming TSMC manages to increase its earnings to $12.00 per share and trades at 29 times earnings after a year (in line with the tech-ladenindex's forward earnings multiple), its stock price could hit $348.

That WOULD be a 36% jump from current levels. With TSMC trading at just 22 times forward earnings right now, investors would do well to buy this AI stock hand over fist as it has the potential to rise impressively in the coming year.