If You’d Dropped $10K on Arista Networks (ANET) Stock a Decade Ago, Here’s What You’d Be Sitting On Today

Tech Investment Goldmine: How Arista Networks Defied Conventional Wisdom

While Wall Street analysts were busy overcomparing price-to-earnings ratios, Arista was quietly building the backbone of the cloud revolution—and minting fortunes for early believers.

The Numbers Don't Lie

That hypothetical $10,000 investment would've ballooned into a staggering sum that'd make most traditional finance returns look downright pedestrian. We're talking multiples that outperform every major index—without the soul-crushing fees of actively managed funds.

Disrupting More Than Just Networks

Arista didn't just challenge Cisco's dominance—it exposed how legacy infrastructure players were sleeping at the wheel while cloud computing exploded. Their architecture became the silent engine powering everything from hyperscale data centers to the AI boom Wall Street now desperately chases.

The Real Lesson? Timing Beats Timing

While fund managers were rebalancing quarterly, Arista shareholders enjoyed the rarest thing in finance: a decade of technological execution without desperate pivots or dilution. Proof that sometimes the smartest trade is finding innovators—then getting out of their way.

First fueled by cloud computing, and then artificial intelligence

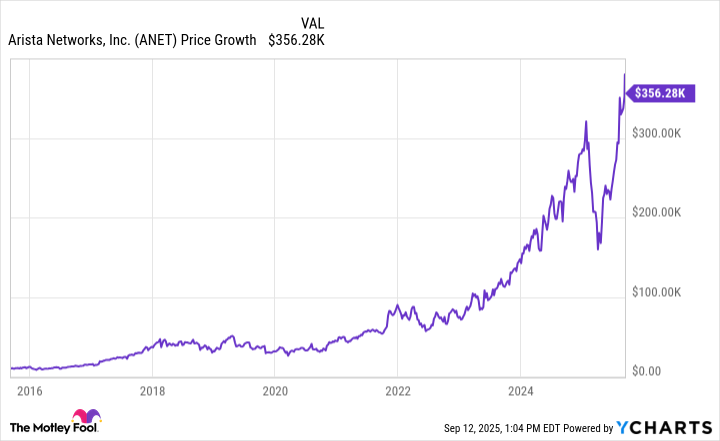

What WOULD a $10,000 investment in Arista Networks back in mid-September 2015 be worth today? The graphic below shows its growth. With an average annualized return of about 42% per year, this position would now be worth $356,280.

Data by YCharts

Most of this gain would have been realized in just the past three years, driven by the rapid growth of artificial intelligence data centers that require high-performance networking solutions. Even prior to that, however, Arista was well equipped to capitalize on an expanding cloud computing market.

A repeat is unlikely, but...

Can ANET do the same again over the course of the coming 10 years? Never say never. But it seems unlikely.

The size of this gain is largely rooted in the sheer newness of AI, which forced the hurried purchase of any and all solutions capable of making artificial data centers function as needed. However, this explosive phase of the movement is now in the rear-view mirror.

Don't dismiss this stock's remaining upside potential, though. While the mathematical pace of AI's relative growth will almost certainly slow from here, Global Market Insights still expects the worldwide artificial intelligence hardware market to grow at an average annual rate of 18% through 2034. The flexibility of its software-based networking solutions leaves Arista Networks well-positioned to capture at least its fair share of this growth.