Robinhood vs. SoFi: Which Fintech Growth Stock Offers Better Returns by 2025?

Fintech Titans Clash: Robinhood's Crypto Surge Battles SoFi's Banking Ambitions

Robinhood's Crypto Gambit Pays Off

Zero-commission trading meets crypto explosion—Robinhood's user base skyrockets as digital asset volumes hit record highs. The platform's seamless integration of stocks and cryptocurrencies creates a gateway for millennial and Gen Z investors diving headfirst into decentralized finance.

SoFi's All-in-One Banking Play

Student loans, investing, and now full-service banking—SoFi builds an ecosystem that traditional banks still can't match. Their charter acquisition unlocks cheaper funding while cross-selling products creates sticky customers who rarely leave the platform.

The Growth Metrics That Matter

User acquisition costs tell the real story: Robinhood burns through marketing dollars while SoFi's organic growth through financial services creates sustainable momentum. Both chase the same prize—the $20 trillion in assets millennials will inherit by 2030.

Regulatory Headwinds or Tailwinds?

SEC crackdowns on payment for order flow could cripple Robinhood's model overnight. Meanwhile, SoFi's banking charter provides stability—though they still face the eternal struggle of making student loans seem exciting to investors.

Verdict: Different Bets, Different Timelines

Robinhood offers explosive but volatile growth tied to crypto cycles—SoFi delivers slower but steadier expansion through traditional finance with a tech twist. Choose your poison: quick riches or gradual domination. Because let's be honest—both still lose money, but in finance, that's just called 'investing in growth.'

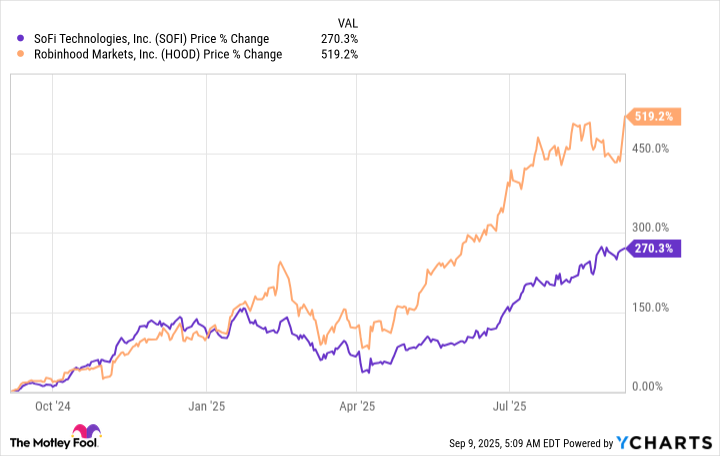

SOFI data by YCharts

But what happens next? Let's see which of these is the better growth stock today.

Disrupting finance in different ways

Robinhood gained fame, or maybe infamy, as the platform retail investors used to bid up stock prices when asubgroup called wallstreetbets set out to squeeze short investors a few years ago. It also raised eyebrows for the way it makes money; it doesn't charge investors for trades, but it uses a payment for order FLOW model, which means market makers pay Robinhood to get trades routed to their firms. It also makes money from interest on cash balances, and more recently, from its Gold accounts, which require a $50 annual or $5 monthly fee.

Although there had been concern over its marketing tactics, which encourage retail investors who may not be experienced or knowledgeable, it seems to have moved past most of these controversies. It offers a newly diverse financial app that's constantly expanding, and in addition to trading, it now offers credit cards and some banking services, and it has added many capabilities to its trading platform, including cryptocurrency.

SoFi is more of a standard bank, although it's all digital, and it's dedicated to providing easy-to-use services for its student and young professional Core clientele. It also aims to be extraordinary, offering exclusive exchange-traded funds (ETFs) among its investing tools and access to private equity funds.

Lending is its main segment, but it has also expanded to offering a wide array of fee-based financial services outside of lending that are growing much faster than the loan segment. It also had a risky reputation when it first became a public company, since it was fairly young and unprofitable.

Growth, profits, and opportunities

Both of these companies are growing rapidly, and they're both profitable. Let's see how their recent performance Stacks up against each other.

| Robinhood | $989 million | 45% | $386 million | 105% | 26.5 million | 10% |

| SoFi | $855 million | 43% | $97 million | 459% | 11.7 million | 34% |

Data source: Robinhood and SoFi quarterly earnings. All growth is year over year for the 2025 second quarter.

Robinhood Gold members increased 76% during the past year to 3.5 million in the quarter. Not only is that a rich source of recurring revenue, but these engaged customers also spend more time trading and generating service-based revenue for Robinhood.

Robinhood is still a fairly small platform in terms of what it offers, but it plans to launch many new services, like digital wallets, in the coming months, as well as enter new markets. There's a long growth runway, and it looks like it's just getting started.

SoFi is focusing on its cross-selling and upselling strategy while attracting new customers. The financial services segment is leading the way, and revenue more than doubled during the past two quarters year over year. It recently added cryptocurrency trading to its platform as well, and it's launching a new blockchain-based global remittance (wire transfer) service on its app. It envisions becoming a top-10 U.S. bank, and it's on the way.

Valuation and expectations

Although based on second-quarter performance you might think these two companies' stock price movements WOULD be similar, the market is prizing Robinhood's growth much more than SoFi's. Granted, this is just one snapshot, and during the past year, Robinhood's revenue growth was higher than SoFi's.

SoFi is still a smaller company, which means it might have more opportunity, but both of these companies have a huge growth runway as they change the way people manage their finances.

The market might see Robinhood's greater disruptive qualities as a more compelling feature right now. That's also its greatest risk, though. SoFi is different, but it still retains the look of a regular bank, while Robinhood's platform is built for riskier financial activities.

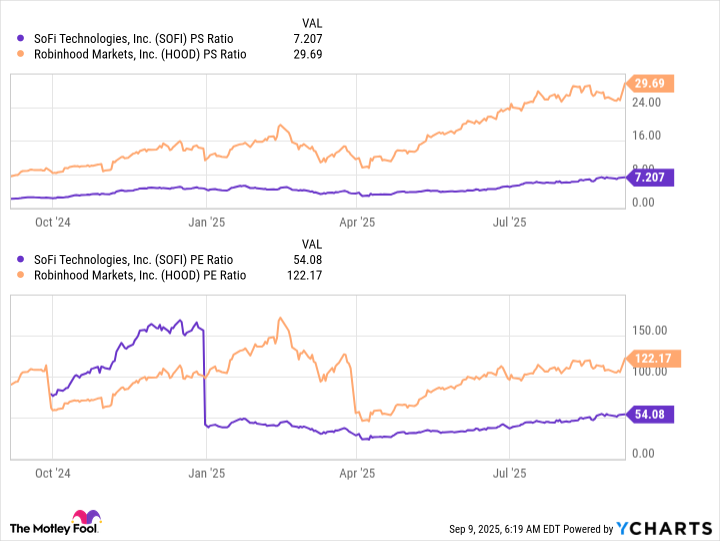

This also shows up in the stocks' valuations.

SOFI PS Ratio data by YCharts

SoFi stock isn't cheap, but it's much cheaper than Robinhood stock.

Investors might see Robinhood's astronomical ascent over the past year and automatically think it must be worth owning. I can't tell you whether its future growth is already priced into the stock, but it's trading at a hefty premium that leaves little room for error.

If you have some appetite for risk but are essentially a long-term player, SoFi looks like the right stock for you. I think that applies to most individual investors. However, investors who can tolerate a lot of risk might find Robinhood attractive today.