BigBear.ai vs. Palantir: The Next AI Titan in Finance?

AI analytics firms are rewriting the rules of financial intelligence—and BigBear.ai just entered the ring swinging.

Palantir’s shadow looms large, but this newcomer’s leveraging blockchain-grade data parsing to crack markets wide open.

BigBear’s tech stack mirrors Palantir’s early days: predictive modeling, real-time data fusion, and a hunger for institutional contracts.

They’re not just analyzing data—they’re predicting volatility, tracking dark pool movements, and flagging regulatory risks before they hit headlines.

While Wall Street still bets on legacy systems, crypto-native traders are already layering AI insights into their algos. The edge? Speed. Precision. Ruthless efficiency.

One hedge fund’s ‘secret sauce’ is another’s compliance nightmare. But in a world drowning in data, those who parse fastest win biggest—even if it means outsmarting their own algorithms.

Just remember: in finance, every AI ‘breakthrough’ eventually becomes another fee on your statement.

Image source: Getty Images.

BigBear.ai's margins leave a lot to be desired

As mentioned, BigBear.ai is focused on government contracts. Its biggest one is for the U.S. Army's Global Force Information Management-Objective Environment (GFIM-OE). This platform will utilize AI to ensure that the U.S. Army has the proper information to train, equip, resource, and ensure proper headcount in whatever the current mission is.

Another area where BigBear.ai is developing a solution is airport screenings. Its software has been deployed at multiple airports in the U.S. and around the world to expedite processing for international travelers.

However, neither of these two contracts has anything in common, which raises the first issue with comparing BigBear.ai to Palantir. Palantir has a base product that it markets to government and commercial clients. Then, this product is adapted to the various use cases a client may have. BigBear.ai is building each solution from the ground up, which isn't an efficient approach.

This increases the cost to build the product, which is reflected in the gross margins.

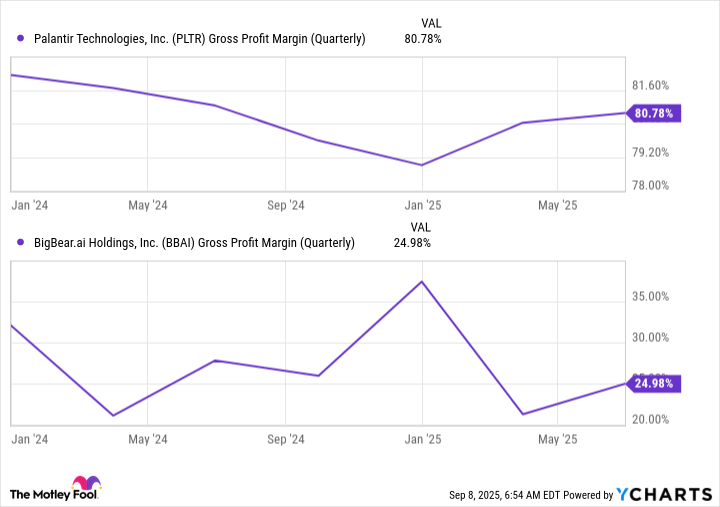

Data by YCharts.

Palantir's margins have stayed steadily in the 80% range, while BigBear.ai's have bounced between 20% and 35%. This isn't a good sign for investors, and it limits the profitability that BigBear.ai could have if it achieves full profitability.

This is a major red flag for me, but the next comparison also raises an issue.

BigBear.ai's lack of growth is a huge red flag

We're in the golden age of AI spending, so companies associated with AI should be delivering incredible growth. Palantir's growth rate has been accelerating over the past few years, and the company delivered companywide growth of 48% in Q2, with government revenue increasing by 49%. However, BigBear.ai's results were nowhere NEAR this good.

In Q2, BigBear.ai's revenue actually fell 18% year over year, due to disruptions caused by efficiency-focused initiatives in the U.S. government. While this may be true for BigBear.ai's contracts, it's clearly not true government-wide, as Palantir is seeing massive growth in the areas it's pursuing.

This is potentially another massive red flag, as BigBear.ai should be growing at warp speed, considering the market conditions and its relatively small size (its Q2 revenue was merely $32.5 million).

Considering BigBear.ai's lack of growth and inability to deliver strong gross margins, the odds of BigBear.ai becoming the next Palantir are slim. There are also far better AI investment options available, and investors should consider those first before purchasing BigBear.ai shares. If you're unsure about which AI stocks to pick, there are also several promising AI ETFs available that allow investors to capitalize on the general rise of AI, rather than just one company.

There are multiple better investment options available than BigBear.ai, and investors shouldn't waste time picking a long shot like BigBear.ai when there are far better, surefire bets available.