Oracle’s Meteoric Rise: Could It Really Become the Next Nvidia?

Oracle's blockchain pivot sends shockwaves through tech investing circles—could this enterprise giant actually challenge Nvidia's dominance?

From Databases to Digital Gold

Oracle's aggressive push into blockchain infrastructure mirrors Nvidia's early bet on AI chips. The company's leveraging its existing enterprise relationships to deploy decentralized oracle networks at scale.

The Numbers Don't Lie

While specific figures remain proprietary, Oracle's recent partnerships with major financial institutions suggest adoption rates that could rival Nvidia's initial AI breakthrough years. Traditional enterprise clients are suddenly talking blockchain—and Oracle's positioned as their default gateway.

The Cynical Take

Wall Street's already pricing this like another Nvidia—because nothing gets financiers hotter than finding 'the next something' rather than actually understanding the technology. But this time, the enterprise adoption metrics might actually justify the hype.

Image source: Getty Images.

What Nvidia and Oracle have in common

First, it's important to note that Nvidia and Oracle have a lot in common. Both have been around for decades and progressively developed their technologies over time -- and neither started out as an AI company. Nvidia launched in 1993, and in its early days mainly sold its graphics processing units (GPUs) -- the chips today known for driving AI -- to the video gaming market. Oracle got its start even further back, in 1977, setting itself on the path to become a database management giant.

Both companies also still have a co-founder heavily involved today: Jensen Huang is the chief executive officer of Nvidia, and Larry Ellison is chief technology officer of Oracle. This is positive because founders generally have a particular attachment and commitment to their companies.

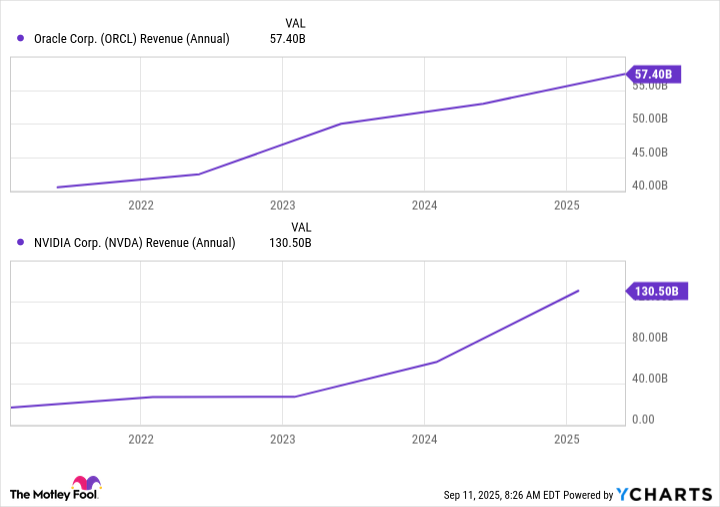

Finally, both Nvidia and Oracle saw the AI opportunity early and identified a way to benefit from this hot technology. Nvidia focused the design of its GPUs on serving the AI market, and Oracle put resources into developing its cloud infrastructure business and pairing the power of AI with the strength of its database platform. These moves have helped revenue take off over the past few years.

ORCL Revenue (Annual) data by YCharts

A 35% one-day gain

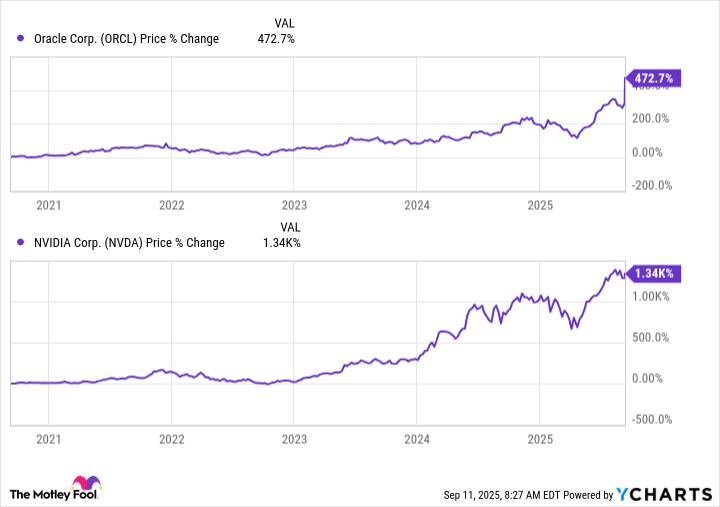

Stock performance has followed -- and Oracle stock popped 35% in one trading session this week after the company announced its growth forecast.

ORCL data by YCharts

Now, let's consider our question: Could Oracle become the next Nvidia? By this, I mean becoming the key destination for AI and seeing its share price skyrocket in the years to come.

As I showed above, both companies have some key similarities -- elements that aren't just fun trivia but actually have helped Nvidia and Oracle build strong businesses. They both clearly have been on board early in this AI revolution -- Nvidia saw a bigger gain in the early days as GPUs have been the first tool needed in AI development and that continues to be the case, suggesting Nvidia's gains are far from over.

As for Oracle, the company now may be heading for its days in the limelight as AI infrastructure capacity becomes critical. The forecast that drove Oracle's gain this week is this one: The company expects cloud infrastructure revenue to grow from $18 billion in this fiscal year to $144 billion in just four years. And in the coming months, Oracle expects to sign on a bunch of multibillion-dollar customers.

A trillion-dollar prediction

Nvidia says AI infrastructure spending might climb to $4 trillion over the coming five years -- and in recent quarters, companies fromtohave increased their capital spending forecasts to invest in AI growth. All of this supports the idea that Oracle's revenue could soar from now and throughout this AI boom.

Of course, Oracle faces competition from other cloud providers, as Nvidia faces competition from other chip designers. But Oracle, thanks to the pairing of its database strengths with AI and its ecosystem of related services, may, like Nvidia, stand out from the crowd. As for stock performance potential, if Oracle shares tripled from today's level, the company's market cap WOULD reach about $2.7 trillion -- that's still less than certain tech giants in the trillion-dollar club.

Meanwhile, trading at 48 times forward earnings estimates, Oracle is more expensive than Nvidia, which trades at 39 times forward earnings. But this isn't a shockingly high level for a tech stock, and it's important to note that this metric only incorporates earnings estimates for the coming year -- it doesn't account for growth farther down the road.

All of this suggests that Oracle, thanks to its solid business built over time and its position in the AI market, could become the next Nvidia -- and deliver explosive gains to investors over the long run.