Healthcare Stocks Set for Q4 Rebound: 2 Companies Primed for Major Comeback After Brutal Summer Slump

Wall Street's prescription for healthcare stocks just got a bitter taste—but these two players are brewing up a recovery cocktail.

The Summer Bloodbath

Healthcare sectors took a beating worse than a meme stock after bad news. Investor confidence evaporated faster than a shitcoin rally, leaving portfolios looking anemic.

The Comeback Candidates

First up: a biotech firm that's been quietly stacking research wins while the market wasn't looking. Their pipeline's deeper than Bitcoin's correction cycles—and potentially more profitable.

Second contender: a medtech company that's been cutting costs like a DeFi protocol slashing gas fees. They've streamlined operations so efficiently they make high-frequency traders look sluggish.

These aren't your grandfather's blue chips—they're positioned to bounce harder than crypto after a 50% dip. Because nothing makes money like buying when there's blood in the streets... even if that blood is from paper-handed institutional investors.

Image source: Getty Images.

1. Novo Nordisk

Novo Nordisk's shares dropped recently after the company reported second-quarter financial results that fell short of analyst projections, but its issues predate this episode. Over the past 18 months, the Denmark-based drugmaker has faced clinical setbacks and has been falling behind its biggest competitor in the diabetes and weight loss markets:.

However, the sell-off may have gone a bit too far. Novo Nordisk is trading at 13 times forward earnings estimates, lower than the healthcare industry's average of 16.6. And this is for a company that tends to grow its revenue and earnings faster than similarly sized peers.

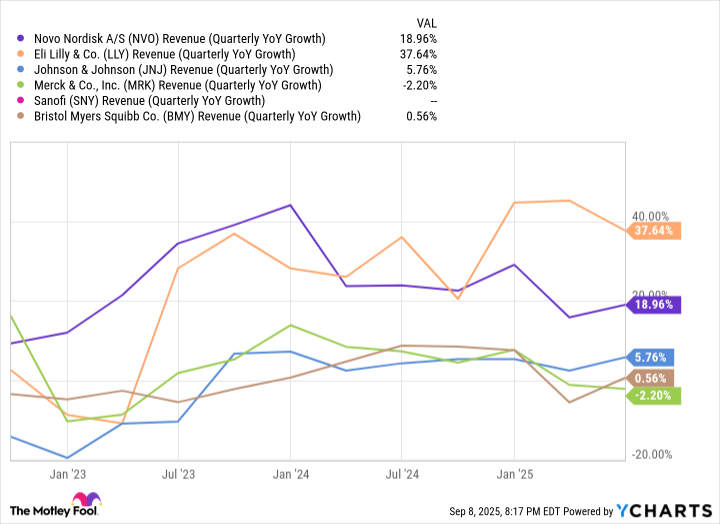

NVO Revenue (Quarterly YoY Growth) data by YCharts

Aside from Eli Lilly, Novo Nordisk has outperformed other pharmaceutical giants in the top-line growth category in recent years and continues to do so.

Furthermore, recent clinical and regulatory developments should also help it recover. Wegovy was approved to treat metabolic dysfunction-associated steatohepatitis (MASH), becoming only the second medicine to receive approval in the U.S. for this indication, and the first in the GLP-1 category. An oral version of Wegovy could also soon receive approval for weight management.

Novo Nordisk's amycretin, a next-generation GLP-1 medicine, is currently in phase 3 studies, with both oral and injectable formulations. And the company's CagriSema, which reported solid phase 3 data that fell short of market expectations, should still go on to be a success. According to some projections, it could generate $15.2 billion in revenue by 2030.

Lastly, Novo Nordisk has enhanced its pipeline over the past year through licensing deals and acquisitions. At least some of its pipeline programs should yield positive results. The company's shares look attractive at current levels, given its still excellent prospects in what may be the fastest-growing therapeutic area in the industry.

2. Viking Therapeutics

Viking Therapeutics is a mid-cap biotech also developing weight management medicine. Although VK2735 performed well in mid-stage studies last year, sending the stock soaring, the company's stock has been declining since then. Recently, an oral version of VK2735 failed phase 2 studies. Or at least, that's what the market reaction might suggest. There is more to the story, though. Yes, oral VK2735 had high rates of discontinuation due to gastrointestinal-related adverse reactions; however, there are ways to mitigate this.

The highest dose of the medicine had the highest discontinuation rates, but it also resulted in an average weight loss of 12.2% in just 13 weeks. By comparison, Eli Lilly's orforglipron induced a mean 12.4% weight loss in a similar patient population in 72 weeks.

Lower doses of Viking's oral VK2735 still look commercially viable if measured against orforglipron over 72 weeks. Even the medicine's highest dose is still in play. The company could achieve lower rates of adverse reactions by slowly increasing the dosage.

In other words, the market may have overreacted, creating an attractive entry point for opportunistic investors. That's especially the case once you look at the rest of the company's pipeline: an ongoing phase 3 study for subcutaneous VK2735 and an investigational therapy for MASH, VK2809, which could soon enter late-stage clinical trials.

Viking Therapeutics is a clinical-stage biotech. That makes the stock somewhat risky. But the company might have substantial upside potential. Investors with an above-average tolerance for risk should strongly consider the stock.