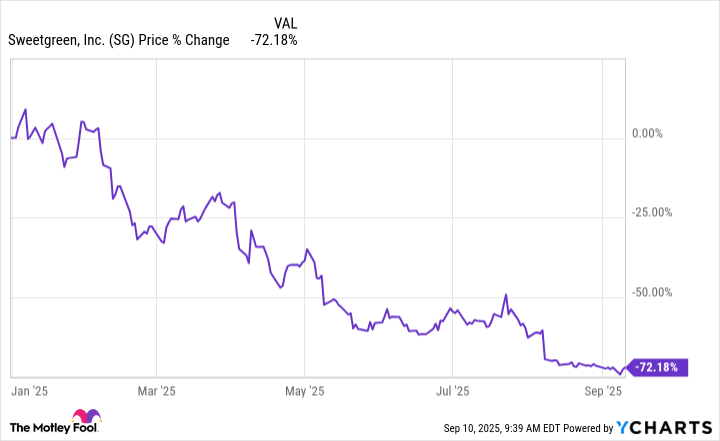

Sweetgreen Stock: Beaten Down Now, But Primed for a 10x Surge

Wall Street's latest casualty just became its most compelling rebound story.

The Salad Chain That's Eating Wall Street's Lunch

Sweetgreen's stock got crushed—we're talking bargain-bin levels. But here's the twist: this isn't another pandemic-flash-in-the-pan story crashing back to earth. The fundamentals? Still fresh. The model? Actually scalable. And the valuation? Let's just say the market's throwing a fire sale on something that still tastes premium.

Why This Isn't Just Another Broken IPO

Forget the hype-cycle hangover. This company's got unit economics that could make legacy restaurants blush—if they weren't so busy counting empty tables. Digital-native ordering, subscription loyalty that actually works, and a supply chain that doesn't collapse at the first sign of inflation. They built the infrastructure while everyone else was still debating third-party delivery fees.

The 10x Math That Doesn't Require Fantasy Projections

No crystal ball needed here. Current prices assume stagnation—but same-store sales keep climbing even as competitors coupon themselves into oblivion. Expansion plans aren't about blanketing strip malls; they're surgical strikes in high-density urban corridors where people actually care about what they eat. And that's before we talk about the automation tech that'll eventually make labor costs look… quaint.

Wall Street's busy downgrading the stock while quietly accumulating positions—a classic move from the 'panic now, profit later' playbook. Sometimes the best investments are the ones everyone's too scared to touch. Even if you think salads are boring, making 10x returns never is.

SG data by YCharts

However, if you can look past the immediate challenges the company faces, there is a path to Sweetgreen becoming a 10-bagger from here. After all, the company currently has a market cap of just $1 billion, but $10 billion looks like an achievable milestone, especially for a company that was valued at close to $5 billion not long ago. By comparison, similar restaurant growth stocks andcurrently carry market caps of $10.7 billion and $7.6 billion, respectively.

Let's take a look at a few reasons why the stock could 10x.

Many of its challenges look short term

Sweetgreen's results have been weak in the first half of 2025, but that was partly due to difficult comparisons with its 2024 results and the impact of events like the California wildfires, as Los Angeles is a major market for the company and where it's headquartered. In the second quarter, for example, comparable sales fell by 7.6% year over year, but that lapped an increase of 9.3% in the quarter a year ago, so comps were still up on a two-year basis.

The company is also transitioning its loyalty program, and has shut down its Sweetpass subscription program. Overall, management said the transition to SG Rewards created a 250 basis-point headwind to same-store sales in the second quarter, though that impact should be temporary.

Additionally, there has been a broad slowdown across the restaurant industry, seemingly due to consumer concerns about tariffs, inflation, a slowing job market, and a potential recession., for example, reported declines in comparable sales in the first two quarters of the year, and Cava's growth slowed substantially.

None of these challenges appears to be long term or structural. In fact, Sweetgreen management expects same-store sales will improve in the second half of 2025 as its year-over-year comparisons get easier. Its guidance calls for flattish comps in the second half of the year, which may still be underwhelming but WOULD still be a clear improvement from the first half.

Image source: Getty Images.

Its restaurants are still popular

Sweetgreen's average unit volumes (i.e., average sales per restaurant) slipped from $2.9 million to $2.8 million in the second quarter, but that's still much better than a lot of established restaurant chains and puts it on par with industry leaders like Chipotle.

To reinvigorate growth, management is working to improve the chain's value proposition. Among the moves management pointed to in Q2, Sweetgreen increased its chicken and tofu portions by 25%, updated its chicken and salmon recipes, and made changes designed to improve customers' price perception. Management also said it has seen a favorable response to the chain's summer menu, which should bode well for its third-quarter results.

There's still a long runway for growth

Sweetgreen is the leading fast-casual salad chain, but it's still small -- as of the end of the second quarter, it had around 260 locations. However, it's growing its footprint quickly. Management expects to open a total of 40 new locations this year, and over the longer term aims to grow the chain to at least 1,000 stores.

As its strong average unit volumes indicate, there's a lot of demand for Sweetgreen's product, and plenty of WHITE space for it to expand into in the U.S. and even potentially internationally.

The Infinite Kitchen could be a game-changer

The biggest differentiator Sweetgreen has could be its Infinite Kitchen, a robotic system that automates the bulk of work involved in making salads. That allows the chain to expedite orders and increase throughput while reducing labor costs.

Management continues to be pleased with the impact of the Infinite Kitchen and is retrofitting more of its existing stores to add it. The system will also be installed in 20 of the 40 stores it plans to open this year. While the Infinite Kitchen increases the upfront costs of opening new Sweetgreen locations and is likely contributing to the company's recent losses, it should pay off over the long term, both financially and operationally.

Overall, there's still an attractive opportunity in front of Sweetgreen. The company has proven there's demand for its offerings, but it needs to execute on its new loyalty program, keep prices reasonable, and roll out the Infinite Kitchen more widely. If it can do those things successfully, this growth stock will have a TON of upside, and a 10x return for those who invest now could become a reality.